A Guernsey bank account linked to a $2 billion tax evasion case and Robert Brockman, a billionaire (now deceased)

06/05/2025

In 2020, A US federal grand jury returned a 39-count indictment charging Brockman with tax evasion, wire fraud, money laundering, and other offences.

Brockman allegedly concealed over $2 billion in income from the IRS in the most significant individual tax evasion case in U.S. history.

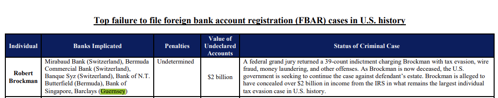

In a March 29, 2023, report published about CREDIT SUISSE'S ROLE IN U.S. TAX EVASION SCHEMES, a list of the Top failure to file foreign bank account registration (FBAR) cases in U.S. history is published – the list includes the following:-

- Mirabaud Bank (Switzerland), Bermuda

- Commercial Bank (Switzerland),

- Banque Syz (Switzerland),

- Bank of N.T.

- Butterfield (Bermuda),

- Bank of Singapore, and

- Barclays (Guernsey)

The report highlights that Brockman is now deceased, and the U.S. government seeks to continue the case against the defendant’s estate.

AUG 2022 - Robert Brockman, billionaire charged in $2 billion tax evasion case, dies at 81

- A trial was set for February, even though Brockman’s attorneys had argued he had dementia and was incompetent to stand trial. He had pleaded not guilty.

- Billionaire Robert Brockman, who was indicted in 2020 in what has been called the largest ever tax evasion case against an individual in the U.S.,

- https://www.justice.gov/archives/opa/pr/ceo-multibillion-dollar-software-company-indicted-decades-long-tax-evasion-and-wire-fraud

Robert Brockman, billionaire charged in $2 billion tax evasion case, dies at 81

- His attorneys had been arguing in court that he had dementia and was incompetent to stand trial. But a judge in May ruled him competent and set a February trial date.

- Brockman, a Florida native and Houston resident whose fortune Forbes has estimated at $4.7 billion, was the former CEO of Reynolds & Reynolds, an Ohio-based software company that provides business solutions.

- In October 2020, the government charged him in a 39-count indictment, evading taxes on $2 billion in gains, wire fraud, money laundering, and other offences. He pleaded not guilty.

- The alleged scheme to conceal the billions in income from the IRS spanned decades, the Justice Department said in its indictment announcement.

- David L. Anderson, the U.S. attorney for the Northern District of California, said that the "allegation of a $2 billion tax fraud is the largest ever tax charge against an individual" in the U.S.

- Keneally, a longtime tax specialist who was Brockman’s lead lawyer, was the assistant attorney general in charge of the Justice Department's tax division from 2012 to 2014.

- According to court records, the wealthiest Black citizen in the U.S., Robert Smith, Brockman's former business associate, was to be a key witness against him. Smith avoided charges by admitting to evading taxes, paying $139 million in taxes and penalties, and agreeing to cooperate.

- At issue in the criminal case against Brockman was the allegation that he avoided taxes through an offshore charitable trust that prosecutors said he secretly controlled — and which he said was independent.

- Prosecutors said he used ill-got gains to buy a Colorado fishing lodge, a private jet and a 200-foot yacht, among other things.

- The government filed paperwork last year to seize the 100-acre fishing retreat in the Rockies, The Aspen Times reported then.

- It was not immediately clear how Brockman’s death would affect the government’s ability to recover the taxes it says are owed.

SOURCE

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.