ASK MAT: As a Jersey-JFSC-supervised person, do I need to complete criminal background checks (DBS) checks before 31 May 2026, or can I delay them to a later date?

12/01/2026

ASK MAT: As a Jersey-JFSC-supervised person, I understand that the JFSC has approved new rules on criminal background checks (DBS), effective 31 May 2026. My question is: do I need to complete the checks before 31 May 2026, or can I delay them to a later date?

MAT SAYS

- You do not need to complete DBS/criminal record checks for all existing individuals before 31 May 2026.

- A transitional period from 27 November 2025 to 31 May 2026 allows time to update policies and begin checks.

- From 31 May 2026,

- EXISTING senior management (PP/KP)

- Adopts a RISK-BASED APPROACH for existing

- Principal persons (PPs) and

- Key persons (KPs),

- NEW PP/KP APPOINTMENTS

- Checks are mandatory without delay for

- New appointments,

- Role changes, or

- Trigger events.

- Document all decisions to ensure defensibility.

Detailed Practical and Regulatory Position

- Below is the practical and regulatory position under the JFSC’s confirmed criminal background check (DBS/criminal record certificate) regime, effective 31 May 2026.

- This addresses your question precisely: checks for existing roles do not need to be completed by that date, but they cannot be indefinitely deferred without justification.

Short Answer (Headline)

- You do not have to complete DBS/criminal record checks for all existing individuals before 31 May 2026.

- However:

- From 31 May 2026 onward, you must demonstrate that you are taking “reasonable steps” to ensure all PPs and KPs are fit and proper, including criminal background screening where appropriate.

- For new appointments, new roles, or defined trigger events after 31 May 2026, the check is mandatory at that point and cannot be deferred.

- In short:

- There is a transitional, risk-based approach for existing roles, but no blanket “indefinite deferral.”

- The regime explicitly does not apply retrospectively.

What Comes into Force on 31 May 2026

- The JFSC has confirmed that:

- The enhanced criminal background check requirements form part of the updated AML/CFT/CPF Handbook, effective 31 May 2026.

- The regime applies to PPs and KPs of Jersey-supervised persons, across all relevant sectors.

- After industry feedback, the JFSC removed the originally proposed blanket 3-year rolling refresh requirement and instead placed responsibility on firms to manage checks on a risk-based basis.

- A transitional period runs from 27 November 2025 to 31 May 2026, during which firms should update policies and procedures and begin obtaining checks as needed, without a strict pre-effective-date obligation for existing roles.

Existing PPs and KPs as at 31 May 2026

- If an individual already holds a PP or KP role on 31 May 2026, and already has JFSC “no objection”:

- You are not required to retrospectively obtain a DBS automatically on day one.

- Instead, the JFSC expects that:

- You assess whether obtaining a criminal record certificate is a reasonable step in ensuring that the person remains fit and proper.

- This must be done using a risk-based approach.

- The decision (to obtain now, later, or not at all) must be documented and defensible.

- So, checks may be delayed beyond 31 May 2026 for existing role-holders, if you can explain the timing.

- Typical risk factors that would push you towards doing the check sooner rather than later include:

- Control or significant influence over assets, clients, or trust structures.

- MLRO / MLCO / compliance officer roles.

- Higher-risk business lines or clients.

- Prior regulatory findings or governance weaknesses.

- New information calling fitness and propriety into question.

- Entity size/complexity or non-compliance history.

Situations Where Delay Is Not Permitted

- From 31 May 2026 onward, criminal background checks must be obtained without delay where any of the following occur:

-

- New PPs or KPs appointed after 31 May 2026. A Basic DBS or foreign equivalent is mandatory and must be:

- Recent (generally within 6 months).

- Covering all relevant jurisdictions.

- New PPs or KPs appointed after 31 May 2026. A Basic DBS or foreign equivalent is mandatory and must be:

-

- Existing individual applying for a new or additional PP/KP role, even if already approved in another capacity:

- A fresh criminal record certificate may be required, depending on the date of the last check.

- Defined / Trigger Events: Examples include:

- Change of control.

- Promotion to a more influential role.

- Material concerns about conduct or integrity. In these cases, deferral would not be defensible.

- Existing individual applying for a new or additional PP/KP role, even if already approved in another capacity:

What the JFSC Will Expect to See in Practice

- From 31 May 2026 onwards, supervisors are likely to focus on governance and evidence, not a single cut-off date.

- You should be able to evidence:

- Updated policies and procedures covering criminal background checks.

- A documented risk-based assessment of existing PPs/KPs.

- A forward plan identifying:

- Who will be checked?

- When.

- Why that timing is appropriate.

- Clear rules that no new PP/KP appointment proceeds without a check.

- This expectation is explicitly reflected in JFSC feedback and industry updates.

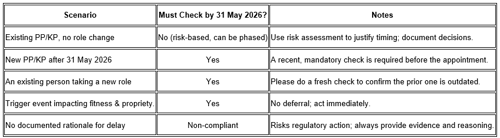

Practical Compliance Scenarios

Bottom Line

- You do not need to complete all criminal background checks by 31 May 2026.

- But from that date onward, you must be able to show that you are actively managing them with no open-ended or undocumented delays.

- Leverage the transitional period (27 November 2025 to 31 May 2026) to prepare policies and assessments proactively.

References

All sources cited in the document are listed below for verification:

- Consultation on enhancements to criminal background checks Issued:29 January 2025 https://www.jerseyfsc.org/industry/consultations/consultation-on-enhancements-to-criminal-background-checks/

- Jersey Financial Services Commission (JFSC) Feedback Paper on Enhancements to Criminal Background Checks: https://www.jerseyfsc.org/media/0rpnaady/feedback-on-enhancements-to-criminal-background-checks.pdf

- JFSC Implementation Date Announcement for AML/CFT/CPF Handbook Enhancements: https://www.jerseyfsc.org/news-and-events/implementation-date-for-amlcftcpf-handbook-enhancements/

- https://www.comsuregroup.com/news/jfsc-feedback-and-follow-on-consultation-handbook-enhancements-and-criminal-background-checks/

- https://www.comsuregroup.com/news/details-about-jfsc-consultation-on-enhancements-to-criminal-background-checks/

This updated document is self-contained, accurate as of January 2026.

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.