ASK MAT: Compliance and Control Testing protocols – as CO, I’m not familiar with the difference; could you help?

26/09/2025

ASK MAT: Compliance and Control Testing protocols – as CO, I’m not familiar with the difference; could you help?

MAT SAYS:

- Thank you for such a great question, and there are two essential pillars of a robust risk and governance framework: Compliance Testing and Control Testing.

- While they may sound similar, they serve distinct purposes and are often misused or confused with each other.

- Unfortunately, many firms place more emphasis on compliance testing because of regulatory risk rather than considering control effectiveness issues

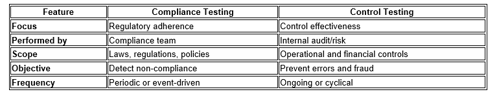

Key Differences at a Glance

I'll aim below to clarify the differences, highlight their importance, and explore how financial institutions can leverage both to strengthen their compliance posture.

What Is Compliance Testing?

Compliance Testing is the process of evaluating whether a financial institution adheres to applicable laws, regulations, and internal policies. The compliance function typically conducts it and focuses on regulatory requirements such as:

- Treating customers fairly

- Solvency rules

- AML/CTF/CPF - Know Your Customer (KYC)

- Data privacy regulations

- Cyber regs

- ETC. ETC

Key Objectives:

- Ensure regulatory obligations are met

- Identify gaps in adherence to laws and policies

- Assure regulators and senior management

- Support remediation and continuous improvement

Example:

Testing whether customer disclosures required under REG Z OR CODE Y were provided accurately and on time across a sample of customer files.

WHAT IS CONTROL TESTING?

Control Testing, on the other hand, assesses the design and operating effectiveness of internal controls that support business processes and risk mitigation. It is often performed by internal audit or risk management teams and focuses on whether controls are functioning as intended.

Key Objectives:

- Validate the effectiveness of controls in preventing or detecting errors, fraud, or non-compliance

- Support financial reporting accuracy

- Strengthen operational resilience

- Assure risk management frameworks

Example:

Testing whether system access controls are correctly configured to prevent unauthorised access to sensitive financial data.

Why Both Matter in Financial Services

In regulated financial services companies, both testing types are critical:

- Compliance Testing ensures the institution is not exposed to regulatory penalties or reputational damage.

- Control Testing ensures that the systems and processes in place are robust enough to prevent issues before they occur.

Together, they form a complementary framework that supports the "three lines of defence" model—business units, risk/compliance, and internal audit.

The Rise of Automation and Continuous Monitoring

With increasing regulatory complexity and resource constraints, many institutions are turning to automated testing platforms to address these challenges.

Technologies like Control Test Automation (CTA) enable real-time monitoring of controls and compliance across entire data populations—not just samples[1].

This shift allows for:

- Continuous assurance

- Reduced manual effort

- Faster identification of issues

- Enhanced audit trails

Best Practices for Implementation

- Define Clear Ownership: Ensure roles and responsibilities are well-defined across compliance, risk, and audit functions.

- Integrate Testing into Governance: Align testing outcomes with enterprise risk management and board reporting.

- Leverage Technology: Use automation to scale testing and improve accuracy.

- Focus on High-Risk Areas: Prioritise testing where regulatory or operational risk is highest.

- Document and Remediate: Maintain thorough records and ensure timely remediation of findings.

Conclusion

In a world of increasing regulatory scrutiny, financial institutions must go beyond checkbox compliance. By understanding and effectively deploying both Compliance Testing and Control Testing, firms can build a resilient, transparent, and trustworthy operation that not only meets regulatory expectations but also drives long-term value.

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.