ASK MAT: Is it correct that in Jersey, eSARs to the JFIU ARE NOT just about money laundering?

18/08/2025

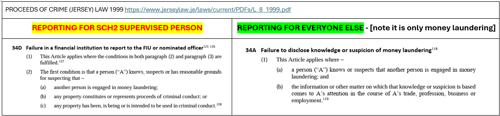

Yes, you're absolutely right (IF YOU ARE A SUPERVISED PERSON) eSARs (electronic Suspicious Activity Reports) under Article 34D of the Proceeds of Crime (Jersey) Law 1999 are not limited to money laundering.

However, If you are not a supervised person, then Article 34A of the Proceeds of Crime (Jersey) Law 1999 applies to you, and it still imposes a legal obligation to report suspicious activity, but with a slightly different scope and context compared to Article 34D.

I HAVE OUTLINED THESE MATCHES BELOW AND INCLUDED A CASE STUDY AND A CHECK SHEET.

Scope of Article 34D eSARs - Under Article 34D, a person (typically in a supervised business) must file a SAR when they have:

- Knowledge, suspicion, or reasonable grounds for suspicion that:

- Another person is engaged in money laundering, terrorist financing,

- “Money laundering” means –

- Conduct which is an offence under any provision of Articles 30 and 31 of this Law or of Articles 15 and 16 of the Terrorism (Jersey) Law 2002; or

- Conduct outside Jersey which, if occurring in Jersey, would be an offence specified in sub-paragraph (a);

Or Property constitutes or represents

- The proceeds of criminal conduct, or

- Terrorist property

This means the reporting obligation covers:

- Money laundering & Financing of terrorism

- Possession or handling of criminal property, even if not linked to laundering

- Any criminal conduct that results in proceeds (e.g., fraud, corruption, tax evasion)

Key Implications

- The law is designed to capture a wide range of criminal activity, not just financial crimes.

- Filing an eSAR provides legal protection to the reporting party from committing a money laundering offence, provided the report is made in good faith and in accordance with the law.

- The reporting obligation applies to employees and supervised persons in the course of their business.

PLEASE NOTE,

- if you are not a supervised person, then Article 34A of the Proceeds of Crime (Jersey) Law 1999 applies to you and it still imposes a legal obligation to report suspicious activity, but with a slightly different scope and context compared to Article 34D.

Article 34A – Duty to Disclose: Non-Supervised Persons

- Under Article 34A, any person (not just those in regulated or supervised businesses) commits an offence if they:

- Know or suspect, or have reasonable grounds to suspect, that another person is engaged in money laundering, and

- Fail to disclose that knowledge or suspicion to a police officer as soon as is reasonably practicable.

- This applies outside the context of a business relationship, meaning it could be triggered by personal knowledge or observations.

Summary

- Yes, Article 34A applies to non-supervised persons.

- It creates a criminal offence for failing to report money laundering suspicions.

- The reporting must be made to a police officer, not the FIU.

- The scope is narrower than Article 34D, which includes broader criminal conduct and applies to supervised businesses.

Key Differences from Article 34D

Article 34D(2)(b)(c)

You will see below that in (b) and (c) there is an offence of Failure in a financial institution to report to the FIU or nominated, where a person (“A”) knows, suspects or has reasonable grounds for suspecting that –

- (b) - any property constitutes or represents proceeds of criminal conduct; or

- (c) - any property has been, is being or is intended to be used in criminal conduct.

The above is not the money laundering offence (found in 34(2)(a)) -34(2) (b) and (c) are broader offences.

Key Insights

- Article 34D(2)(b) applies when property is suspected to be DERIVED FROM criminal conduct, such as fraud, theft, or corruption.

- Article 34D(2)(c) applies when property is suspected to be USED IN criminal conduct, such as funding bribery, terrorism, or illegal trade.

I have included a case study below that shows the type of situation that may be caught.

Case study

- Background

- A lawyer is reviewing a client arrangement of a Jersey-based trust company, Channel Fiduciary Ltd

- The arrangement is a corporate structure for Channel Fiduciary Ltd client, GlobalTech Holdings, a multinational with operations in West Africa.

- The lawyer notes that a director of GlobalTech Holdings based in Nigeria had requested and received a payment of $250,000 from the Jersey-administered account to a local consultancy firm in Nigeria, citing “facilitation services” for a government contract.

- The lawyer notes the following Red Flags

- The consultancy firm has no online presence, no verifiable track record, and shares a registered address with a known politically exposed person (PEP).

- The payment is described vaguely and lacks a formal contract or invoice.

- Internal emails suggest the payment is intended to “smooth the process” of securing a government tender.

- iSAR

- The payment may constitute a bribe, which is a criminal offence under Jersey law and international anti-corruption conventions.

- The lawyers raise an internal Suspicious Activity Report (SAR) to the lawyers' MLRO, noting:

- eSAR

- The funds, if used for bribery, would be used in criminal conduct (Article 34D(2)(c)).

- If the funds were previously obtained through corrupt means, they may represent proceeds of criminal conduct (Article 34D(2)(b)).

- Another person is engaged in money laundering

- The lawyers MLRO reviews the iSAR and the red flags and considers the following reasons to report to the JFIU

- Also, the MLRO records the following suspension

- By recording the suspicious under 34D(2)(b), THE MLRO is also suspicious of Channel Fiduciary Ltd, GlobalTech Holdings (and the director) and the Nigerian consultancy business under Article 34D(2)(a).

SUSPICIOUS ACTIVITY REPORTING CHECKLIST – JERSEY

- Here’s a checklist to help you determine when and how to report under Article 34A (for non-supervised persons) and Article 34D (for supervised persons) of the Proceeds of Crime (Jersey) Law 1999:

Step 1: Are You a Supervised Person?

- Yes → Proceed to Article 34D

- No → Proceed to Article 34A

Article 34A – For Non-Supervised Persons

🔍 When to Report:

- You know, suspect, or have reasonable grounds to suspect that:

- Someone is engaged in money laundering

🛑 You Must:

- Disclose the information to a police officer

- Do so as soon as is reasonably practicable

✅ You’re Protected If:

- You report in good faith

- You make the report promptly

📗 Article 34D – For Supervised Persons

🔍 When to Report:

- You know, suspect, or have reasonable grounds to suspect that:

- A person is engaged in money laundering

- Property is criminal property

- Property is terrorist property

🛑 You Must:

- File an eSAR (electronic Suspicious Activity Report)

- Submit it to the Financial Intelligence Unit (FIU) via the SAR online portal

- Do so as soon as is reasonably practicable

✅ You’re Protected If:

- You report in good faith

- You follow internal procedures (if applicable)

🧠 Tips for Both Articles

- Document your suspicion clearly and factually

- Do not tip off the subject of the report

- Seek legal or compliance advice if unsure

- Use internal reporting channels if you're in a business with a Money Laundering Reporting Officer (MLRO)

Thank you for your question

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.