BITCOIN AS A STRATEGIC TREASURY ASSET? IF SO IS IT ON YOUR BALANCE SHEET – SHOULD IT BE?

24/09/2025

Bitcoin is still a polarising asset but ignoring it may no longer be an option.

- It’s now on the balance sheets of pension schemes, public companies, sovereign wealth funds and private companies.

Here’s what you need to know before advising clients or allocating reserves.

- Over 1m bitcoin, worth more than $116bn, now sit on business balance sheets globally.

- While US giants like Strategy and Tesla dominate headlines, others, including Figma, Coinbase, and Block (creators of Square), are following suit.

- Even UK pension funds are getting involved;

- Cartwright recently advised the first UK pension scheme to allocate 3% of its assets to bitcoin.

Holding bitcoin legally, responsibly and advantageously

- Whether you’re advising clients, managing a treasury or setting firmwide policy, understanding the legal, tax and technical implications of holding bitcoin is becoming a core part of the modern financial world.

- Accountants, CFOs and finance leaders have a crucial role to play in shaping how bitcoin is approached, reported and governed.

- With the proper controls, reporting frameworks and board alignment, it’s possible to hold bitcoin not just legally, but responsibly and advantageously.

- With appropriate legal, tax and treasury input, and clearly documented oversight, it is possible to treat bitcoin not just as a speculative asset, but as a responsible and strategic component of treasury policy.

BITCOIN AS A STRATEGIC TREASURY ASSET?

- So, why are UK businesses treating bitcoin as a strategic treasury asset?

- The following article [written by Bitcoin Collective] explores the drivers behind this trend, outlines practical accounting and legal considerations, and equips accountants to guide clients through this evolving landscape.

Why should businesses hold bitcoin?

Several drivers are increasingly pushing UK businesses to explore including bitcoin on their balance sheet.

- Protection against inflation: With prolonged periods of elevated inflation in the UK, cash loses real value. Bitcoin’s capped supply of 21 million coins (with a known issuance schedule) gives it a non-fiat, scarcity-based characteristic that appeals to treasury managers seeking “store of value” assets.

- Diversification of treasury reserves: Traditional treasury assets such as cash (GBP), short-term gilts or deposits are heavily correlated with macro events impacting sterling. Bitcoin adds an uncorrelated asset class, accessible global liquidity and continuous markets (24/7 trading).

- Strategic and competitive advantage: Early movers gain reputational benefits, media attention and may appeal to digitally literate stakeholders (investors, staff, clients) who view bitcoin investment as modern or as evidence of risk-aware innovation.

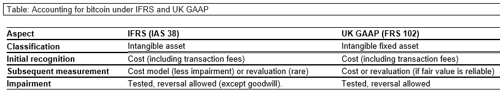

Accounting treatment

Bitcoin’s unique nature means it doesn’t fit neatly into traditional accounting categories.

It’s not

- Cash, a financial instrument (IAS 7/IFRS 9) or

- Inventory (IAS 2) unless it is held for sale in the ordinary course of business.

Here’s how it’s treated under UK accounting standards.

Note on IFRS revaluation model:

- While technically permitted under IAS 38, most auditors consider the revaluation model impractical for bitcoin.

- This is because Bitcoin does not trade on a single, active market that meets IFRS fair value criteria.

- As a result, IFRS reporters almost always use the cost model (cost less impairment).

Legal and compliance considerations

- Regulatory status

Bitcoin is classified as a cryptoasset under UK law, but it is not considered legal tender. As such, its holding and transfer are not restricted, but businesses must understand the implications under the following frameworks.

- Money laundering regulations (MLRs): If engaging in crypto exchange or custody activity (for example, for clients), registration with the Financial Conduct Authority is required.

- Financial promotions regime: As of October 2023, crypto promotions to UK consumers are regulated. However, internal treasury use is generally exempt from this requirement.

- Taxation

- Corporation tax: Any gains realised on the disposal of bitcoin are subject to corporation tax (currently 25% for most companies).

- VAT: Buying bitcoin is VAT-exempt following HMRC guidance and the EU Court of Justice ruling (Hedqvist case).

- Payroll and benefits: If bitcoin is used for remuneration, PAYE and national insurance contributions (NICs) apply based on GBP value at the time of payment. HMRC does not currently accept tax payments in bitcoin.

Balancing risks and rewards

- Before investing in bitcoin, directors must ensure the decision aligns with the company’s articles of association and complies with Section 172 of the Companies Act 2006, promoting the success of the company for the benefit of its members.

- Appropriate due diligence, risk assessments and internal governance reviews should be conducted, particularly around custody, valuation and disclosure.

- Advising clients to hold bitcoin may also raise professional indemnity insurance (PII) considerations for accountants and advisory firms, which should be reviewed on a case-by-case basis.

Holding bitcoin can offer clear advantages, such as:

- Protection against fiat currency debasement

- First-mover advantage and reputational upside

- Potential long-term value appreciation.

But it also comes with material risks, including:

- Price volatility and accounting complexity

- Custody and cybersecurity challenges

- Evolving and uncertain regulatory frameworks.

Boards must weigh these trade-offs carefully.

- With appropriate legal, tax and treasury input, and clearly documented oversight, it is possible to treat bitcoin not just as a speculative asset, but as a responsible and strategic component of treasury policy.

Holding bitcoin legally, responsibly and advantageously

- Bitcoin is still a polarising asset, but ignoring it may no longer be an option.

- Whether you’re advising clients, managing a treasury or setting firmwide policy, understanding the legal, tax and technical implications of holding bitcoin is becoming a core part of the modern financial world.

- Accountants, CFOs and finance leaders have a crucial role to play in shaping how bitcoin is approached, reported and governed.

- With the proper controls, reporting frameworks and board alignment, it’s possible to hold bitcoin not just legally, but responsibly and advantageously.

SOURCE

This article was written by Bitcoin Collective, a UK-based media and education company focused on helping businesses and individuals understand Bitcoin.

If you’d like to learn more, they’re hosting an event in Derby on 21 November titled “Bitcoin: A competitive advantage”, exploring how businesses can use Bitcoin strategically.

https://bitcoincollective.co/bitcoin-a-competitive-advantage/

Use code AW10 for 10% off tickets.

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.