Briefing on Mauritius AML Updates from 2023-25

06/10/2025

Mauritius has continued to enhance its Anti-Money Laundering (AML), Countering the Financing of Terrorism (CFT), and Countering Proliferation Financing (CPF) framework since 2023, aligning with international standards set by the Financial Action Task Force (FATF). Key developments include:

- The establishment of the Financial Crimes Commission (FCC) through the Financial Crimes Commission Act 2023,

- Further refinements via the Anti-Money Laundering and Combating the Financing of Terrorism and Proliferation (Miscellaneous Provisions) Act 2024.

These updates centralise enforcement, improve regulatory oversight, tighten reporting timelines, and expand beneficial ownership transparency across sectors. The reforms build on Mauritius' removal from the FATF grey list in 2021, aiming to maintain its status as a transparent financial hub.

Financial Crimes Commission Act 2023

- Enacted in December 2023 and proclaimed effective from March 29, 2024 (with some exceptions), this Act establishes the FCC as Mauritius' apex body for combating financial crimes, including money laundering, corruption, fraud, and terrorism financing.

- It repeals and integrates functions from prior legislation, such as the Prevention of Corruption Act, the Asset Recovery Act, and the Good Governance and Integrity Reporting Act, creating a unified structure to detect, investigate, prosecute, and recover assets related to financial crimes.

Key Features and Structure:

- Purpose and Scope:

- The FCC addresses "financial crimes" broadly, encompassing corruption (e.g., bribery, conflicts of interest), money laundering (transactions involving crime proceeds), fraud, financing of drug dealing, and ancillary offences like conspiracy.

- It extends jurisdiction to offences committed outside Mauritius if they are linked to the country or involve Mauritians.

- The Act emphasises prevention through education, policy development, and international cooperation.

- Establishment and Governance: The FCC is a body corporate led by a Director-General (appointed for 3-5 years with expertise in law or anti-corruption) and four part-time Commissioners. It includes divisions for Investigation, Asset Recovery and Management, Education and Prevention, and Legal Affairs. Oversight bodies include:

- Operations Review Committee (independent advice on operations).

- Parliamentary Committee (administrative monitoring and annual reporting).

- National Coordination Committee (inter-agency policy coordination, co-chaired by the FCC Director-General).

- Public-Private Partnership Task Force (collaboration with private sector entities like banks and insurers).

- Powers and Functions:

- Investigation: Receive complaints, conduct searches, intercepts, arrests, and use special techniques (e.g., surveillance, controlled deliveries) with judicial approval. Mandatory reporting by public officers on suspicions.

- Asset Recovery: Issue criminal (post-conviction) and civil (balance of probabilities) attachment/confiscation orders for proceeds, instrumentalities, or terrorist property. A Recovered Assets Fund manages proceeds for rewards, compensation, and capacity building.

- Unexplained Wealth: Target disproportionate assets with orders for disclosure, liens, and confiscation.

- Prosecution: Legal Division handles cases; offences carry penalties up to 10 years imprisonment and fines of 20 million rupees. Compounding allowed with DPP consent.

- Protection: Safeguards for informers and witnesses, no liability for good-faith reports.

- Amendments to FIAMLA:

- The Act repeals Part II of the Financial Intelligence and Anti-Money Laundering Act (FIAMLA) 2002,

- updates definitions (e.g., aligning "money laundering" with FCCA provisions), and

- requires the Financial Intelligence Unit (FIU) to disseminate intelligence to the FCC within 48 hours for investigations.

- It also expands FIU duties, such as responding to requests within 21 days (with an option to extend).

This Act represents a significant 2023 update, centralising AML/CFT enforcement, replacing fragmented agencies, and fostering public-private collaboration to mitigate risks.

Anti-Money Laundering and Combating the Financing of Terrorism and Proliferation (Miscellaneous Provisions) Act 2024

Introduced in July 2024, this Act was passed on July 18, assented to, gazetted, and took effect from July 25, 2024. It amends 16 existing laws to strengthen further Mauritius' AML/CFT/CPF regime in line with FATF standards.[5][6][7][8] It builds directly on the 2023 FCC establishment by refining enforcement mechanisms, enhancing transparency, and addressing gaps in supervision and reporting.

Objectives:

Promote accountability, mitigate risks of money laundering and terrorism financing, and ensure regulatory compliance. The Act focuses on timely reporting, risk-based supervision, and the establishment of beneficial ownership registers to prevent the misuse of legal entities.

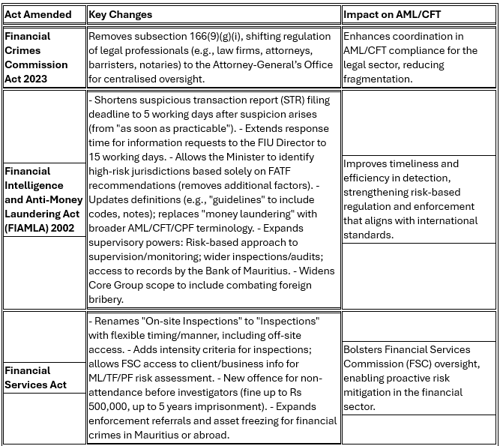

Key Amendments to Related Acts:

These amendments, effective from 2024, directly stem from the 2023 FCC framework by integrating it with broader regulatory tools, such as FIU-FCC intelligence sharing and expanded asset recovery.

Overall Impact and Future Outlook

The 2023-2024 updates have significantly strengthened Mauritius' AML/CFT system by consolidating agencies under the FCC, enhancing reporting, and integrating risk-based approaches. The FIU remains central for intelligence analysis and dissemination, now more integrated with the FCC for swift action

These measures reduce vulnerabilities in sectors like legal services, foundations, and virtual assets, while promoting international cooperation. As of October 2025, ongoing amendments (e.g., via Act No. 1 of 2025) indicate continued evolution, with potential for further FATF-aligned refinements to sustain Mauritius' compliance.

References

- https://mauritiusassembly.govmu.org/Documents/Acts/2023/act232023.pdf

- https://www.mra.mu/download/FCCAct2023.pdf [

- https://mauritiusassembly.govmu.org/Documents/Acts/2024/act142024.pdf

- https://www.mondaq.com/security/anti-money-laundering/1350160/mauritius-strengthens-its-amlcft-framework

- https://www.bom.mu/media/press-communiques/anti-money-laundering-and-combatting-financing-terrorism-and-proliferation-miscellaneous

- https://www.fatf-gafi.org/en/countries/detail/Mauritius.html

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.