Briefing: Sudan Conflict, UAE Involvement – beware sanction and Terrorist Financing Risks

24/12/2025

Key facts

- Sudan’s civil war has escalated into one of the worst humanitarian crises in recent years.

- The Rapid Support Forces (RSF), a paramilitary group descended from the Janjaweed militias, are implicated in atrocities and systemic violence.

- Investigations by The Sentry reveal that the United Arab Emirates (UAE) has provided mercenaries, weapons, and financial support to RSF, fuelling the conflict

- The Rapid Support Forces, a paramilitary group that grew out of the Janjaweed militias that terrorised Darfur in the 2000s, are once again waging a campaign of genocidal violence

Two landmark reports from The Sentry

- This year, in a pair of landmark reports, The Sentry

- Exposed how the United Arab Emirates is directly complicit in fuelling this war.

- Investigations revealed how the UAE has provided mercenaries, materiel, and financial support to the RSF, enabling a cycle of violence that continues to devastate communities across Sudan.

Read the Two landmark reports from The Sentry

1. “The RSF’s Business Network in the UAE” (October 2025)

🔍 Key Findings:

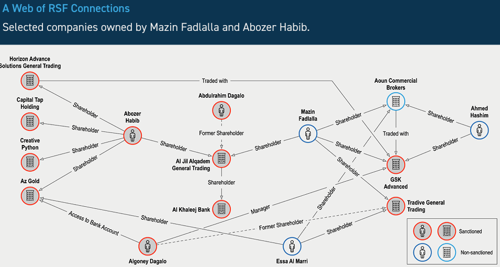

- A network of UAE-based companies, including jewellers, interior designers, consultancy, and gold-trading firms, was established by businesspeople linked to the RSF. [thesentry.org]

- Mazin Fadlalla, a core figure, purchased hundreds of Toyota pickup trucks (“technicals”) for RSF military use and actively participated in the RSF gold smuggling chain: mining in Darfur → export to UAE → sale on global markets. [thesentry.org], [thesentry.org]

- These companies served as mechanisms to convert smuggled gold into hard currency.

- Policy recommendation: Authorities across the EU, UK, and U.S. should investigate and consider sanctions targeting Fadlalla and his associated firms. [thesentry.org]

🔗 Read the full report here:

- The RSF’s Business Network in the UAE [thesentry.org]

- https://thesentry.org/reports/sudan-rsf-business-network-in-the-uae/

- https://thesentry.org/wp-content/uploads/2025/09/SudanRSF-TheSentry-Oct2025.pdf

2. “Sudan Mercenaries Linked to Business Partner of Top UAE Bureaucrat” (November 2025)

🔍 Key Findings:

- A UAE businessman, Mohamed Hamdan Alzaabi, whose company Global Security Services Group (GSSG) recruited and deployed Colombian mercenaries (“Desert Wolves”) to support the RSF in El Fasher. [thesentry.org], [thesentry.org]

- GSSG is co-owned or operated by Ahmed Mohamed Al-Humairi, the Secretary‑General of the UAE Presidential Court, akin to a chief of staff, revealing high-level governmental links. [thesentry.org], [thesentry.org]

- Mercenary recruitment and financial flows were facilitated through extensive offshore networks: Colombia → Panama → UAE → Sudan, including evidence of child soldier training and deployment. [thesentry.org], [thesentry.org]

- Policy recommendation: The Sentry urges sanctions by the U.S., EU, and UK against Alzaabi, GSSG, Al-Humairi's stakeholders, and their associated firms, also urging enhanced due diligence by financial institutions. [thesentry.org], [thesentry.org]

🔗 Full report available here:

- Sudan Mercenaries Linked to Business Partner of Top UAE Bureaucrat [thesentry.org]

- https://thesentry.org/reports/sudan-mercenaries-rsf-uae-bureaucrat/

- https://thesentry.org/wp-content/uploads/2025/11/Sudan-RSF-UAE-TheSentry-Nov2025-2.pdf

Report Summary

- These investigations reveal a coordinated UAE-backed ecosystem enabling the RSF to sustain its war efforts through logistical, financial, and military support beyond mere arms provisioning, highlighting serious cross-border terrorist financing, sanctions evasion, and money laundering risks.

Key Compliance Risks for Jersey Firms

- Terrorist Financing Exposure:

- RSF’s activities may qualify as terrorism under international definitions.

- Funds linked to RSF or its supporters could enter the financial system via trade finance, correspondent banking, or investment flows.

- Sanctions Risk:

- The EU, UK, and U.S. have imposed sanctions on individuals and entities tied to Sudanese armed groups.

- UAE-based intermediaries or shell companies could be used to mask beneficial ownership.

- UK Sanctions Regime on Sudan

- The UK enforces financial and trade sanctions under the Sudan (Sanctions) (EU Exit) Regulations 2020, maintaining key UN and historical EU measures, including comprehensive arms embargoes, travel bans, asset freezes, and restrictions related to goods that may be used for repression or conflict. [gov.uk], [legislation.gov.uk]

- Official UK guidance clarifies the prohibitions and licensing requirements, such as licensing for humanitarian exceptions; non-compliance could result in enforcement actions by OFSI (Office of Financial Sanctions Implementation). [gov.uk], [govwire.co.uk]

- Targeted Sanctions on RSF Commanders

- On 12 December 2025, the UK imposed sanctions (asset freezes and travel bans) on four senior commanders of the Rapid Support Forces (RSF), including Deputy Leader Abdul Rahim Hamdan Dagalo, for their roles in mass killings, systematic sexual violence, and attacks on civilians in El-Fasher. [gov.uk], [aa.com.tr], [aol.com]

- These sanctions highlight that dealings direct or indirect with RSF-linked individuals or entities are strictly prohibited under UK law.

- Terrorist Financing & AML Risks

- Material Support to RSF

- The RSF is recognised internationally as engaging in atrocities and targeted violence, reflecting characteristics of extremist or terrorist activity. Financial support, whether through trade, services, or finance, could violate UK anti-terrorism financing laws.

- High-Risk Channels via UAE or Third Parties

- Reports suggest the RSF have received backing through UAE-linked intermediaries, raising risks of using international trade, commodity transactions, or correspondent banking to obfuscate financing. [ilkha.com], [politico.eu]

- Any financial flows routed through such channels require heightened due diligence.

- Trade-Based Money Laundering (TBML)

- Arms embargoes and trade restrictions increase the risk of crypto-transfer through dual-use goods, commodities (e.g. gold, mineral exports), which are vulnerable to financing RSF and potentially misused for TF.

- High-Risk Jurisdictions & PEPs:

- Sudan and conflict-affected regions are high-risk jurisdictions under FATF guidance.

- UAE’s involvement raises concerns about regional PEPs and politically exposed networks.

- Red Flags for Jersey Firms:

- Payments routed through the UAE or Sudan with opaque structures.

- Use of trade in gold, arms, or humanitarian aid channels as cover for illicit flows.

- Sudden large transfers involving NGOs or charities operating in conflict zones.

- UK AML/CFT Regulatory Alignment

- Under UK Money Laundering Regulations, firms must:

- Apply Enhanced Due Diligence (EDD) for high-risk jurisdictions like Sudan and associated intermediaries.

- Monitor for sanctions breaches and patterns suggestive of terrorist linkages.

- Report any suspicious activity to the relevant authorities promptly.

- Implications for Jersey Compliance

- Robust sanctions screening: Ensure RSF persons, UAE-linked facilitators, or Sudan-linked firms are flagged and blocked.

- EDD on Sudan/UAE clients: Include structured risk assessments, source of funds, transactional monitoring, and ownership transparency.

- Transaction scrutiny: Watch for trade in gold, arms, or dual-use goods, especially if disadvantageous to known risk indicators.

- Clear escalation protocols: Early SAR filings for financial activity pointing to RSF or TF.

RECOMMENDED ACTIONS

- Enhanced Due Diligence (EDD): Apply EDD for clients with links to Sudan, UAE, or sectors like arms, logistics, or humanitarian aid.

- Sanctions Screening: Regularly update screening tools for RSF-related names and entities.

- Transaction Monitoring: Flag unusual patterns, especially involving high-risk jurisdictions or commodities (gold, oil).

- Suspicious Activity Reporting: File SARs promptly if indicators of terrorist financing or sanctions evasion appear.

RISK MATRIX FOR TERRORIST FINANCING LINKED TO SUDAN/UAE?

Summary:Dealing with Sudan-related clients or transactions poses high sanctions and TF risks under UK law. The UK's robust sanctions framework, including recent RSF designations, and AML/CFT obligations demand stringent due diligence, oversight, and proactive compliance measures.

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.