Coinbase Global's fines reach $181 million after the Central Bank of Ireland issued a €21.5 million fine

07/11/2025

Coinbase, one of the world’s largest cryptocurrency exchanges, has faced mounting regulatory scrutiny over the past few years. From anti-money laundering (AML) failures to securities violations, the company has paid over $181 million in fines globally.

Overview

The Central Bank of Ireland has imposed a €21.5 million fine (approximately $24.7 million) on Coinbase Europe Limited, the European arm of the U.S.-based crypto exchange, for failures in its transaction monitoring system between 2021 and 2022. The penalty follows technical lapses that left gaps in anti-money laundering (AML) compliance.

What Happened?

According to Cointelegraph: [cointelegraph.com]

- Cause of Failure: Three coding errors in Coinbase’s monitoring system affected five of its 21 compliance scenarios. These errors prevented the proper screening of specific crypto addresses separated by special characters.

- Impact: The system only partially monitored transactions for suspicious activity during the period.

- Discovery & Fix: Coinbase detected the issue through internal testing, fixed it within weeks, and reviewed all affected transactions.

Key Figures

- Fine Amount: €21.5 million ($24.7 million)

- Affected Transactions: 185,000 flagged transactions reviewed

- Suspicious Transaction Reports Filed: 2,700 reports totalling $15 million

- Total Value of Transactions During Period: Over $202 billion (31% of Coinbase Europe’s transactions)

- Average Annual Revenue Basis for Fine: Estimated $480 million in Ireland between 2021 and 2024

Regulatory Context

As a registered Virtual Asset Service Provider (VASP) in Ireland, Coinbase is required to maintain robust systems to detect and report potential money-laundering risks under Irish AML laws.

Coinbase’s Response

Coinbase stated that it has enhanced oversight and compliance testing to prevent similar issues. Updates include:

- Stricter pre-deployment reviews

- Expanded scenario testing

- Continuous improvements to detect evolving high-risk activity

The company emphasised its commitment to AML compliance:

“Coinbase recognises the importance of effective AML procedures and takes our obligations under AML legislation and regulatory guidance very seriously.” (Source). [cointelegraph.com]

Previous fines

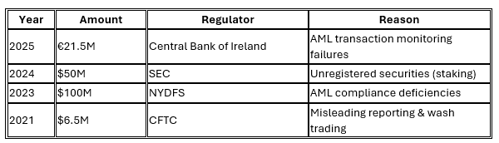

It seems that Coinbase has been in trouble before

Known Fines Against Coinbase

- €21.5 million fine by the Central Bank of Ireland (2025)

- Reason: Failure to monitor over 30 million transactions worth €176 billion between April 2021 and March 2025 due to coding errors in its transaction monitoring system.

- Details: Initial fine was €30.66 million, reduced by 30% under Ireland’s settlement process.

- Source: France24. [france24.com]

- $100 million fine by the New York Department of Financial Services (NYDFS) (January 2023)

- Reason: Weaknesses in Coinbase’s compliance program, including failures in transaction monitoring and customer due diligence.

- Details: NYDFS cited “significant failures” in AML compliance and required Coinbase to invest $50 million in compliance improvements.

- Source: Reuters. [finance.yahoo.com]

- $6.5 million fine by the U.S. Commodity Futures Trading Commission (CFTC) (March 2021)

- Reason: Allegations of misleading reporting and wash trading on Coinbase’s GDAX platform between 2015 and 2018.

- Source: CFTC Press Release. [finance.yahoo.com]

- $50 million penalty by the Securities and Exchange Commission (SEC) (2024) (related to staking services)

- Reason: Operating an unregistered securities offering through its staking-as-a-service program.

- Source: SEC Announcement. [finance.yahoo.com]

Further Reading

https://cointelegraph.com/news/coinbase-settles-with-ireland-over-monitoring-errors

https://finance.yahoo.com/news/coinbase-just-got-fined-21-155825363.html?guccounter=1

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.