Crypto Queen - Follow the money - Fenero described the payment as a "loan for CryptoReal."

16/09/2024

Ruja Ignatova, the crypto-queen, claimed to have invented a cryptocurrency, OneCoin and took in more than $4 billion from investors worldwide. But the currency was fake, and the operation was a pyramid scheme, U.S. authorities say.

In March 2019, the U.S. Justice Department charged Ignatova with conspiracy to commit wire fraud, securities fraud, and money laundering. Ignatova is a fugitive, and her whereabouts are unknown.

In an email obtained by prosecutors,

- Ignatova described her thoughts on an “exit strategy” for OneCoin. The first option: “Take the money and run and blame someone else for this ...”

FinCEN Files reveal:-

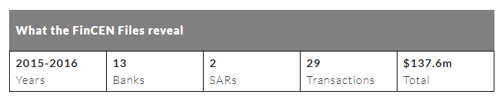

In February 2017, the Bank of New York Mellon reported more than $137 million in suspicious payments by a network of OneCoin-associated companies. The bank wrote that the companies appeared to be engaged in “layering” — a technique used to disguise the source of illicit funds by routing it through multiple transactions.

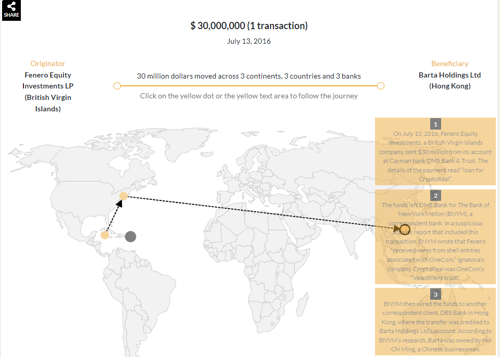

Buzzfeed shared the FinCEN files with the International Consortium of Investigative Journalists (ICIJ), which showed one particular transaction in 2016 where Fenero Equity Investments, a British Virgin Islands-based company, wired approximately $30 million from its account at DMS Bank & Trust, a Cayman-based bank, to BNY Mellon.

Fenero described the payment as a "loan for CryptoReal" – an investment trust set up by OneCoin founder Ruja Ignatova, who has not been seen since late 2017.

In a SAR filed at the time, BNY Mellon's compliance team said Fenero often received wires from shell entities linked to OneCoin. It sent the money to Hong Kong's DBS Bank, which was credited to a local company called Barta Holdings.

Emails seized by U.S. authorities last year show Mark Scott, the New York attorney convicted last year of laundering $400 million for OneCoin, arranged the $30 million loan from Fenero to allegedly purchase an oilfield from Barta Holdings. https://www.coindesk.com/markets/2019/11/22/jury-convicts-crypto-ponzi-scheme-onecoins-lawyer-on-fraud-charges/

Special agent Kurt Hafer, attached to the New York Attorney's office, said

- "I believe that Scott arranged the $30 million purported 'loan' from Fenero to Barta to launder OneCoin Ltd. proceeds to CC-2 [OneCoin's co-founder],"

Further, the seized emails show that the loan was never repaid and that one of the OneCoin co-founders spent $10 million of the amount sent to Barta Holdings.

A BNY Mellon spokesperson told ICIJ the bank fully complied with existing financial regulations and took its role in protecting the integrity of the global financial system seriously. By law, they said, the bank could not comment on specific SARs. Likewise, DMS Bank said it took its legal responsibilities for helping to combat fraud and money laundering "extremely seriously."

Source

https://projects.icij.org/investigations/fincen-files/confidential-clients/#/en/ruja-ignatova/

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.