EUR 500 billion crime:- How carousel VAT fraud works and how you can stop it

22/09/2025

Carousel fraud (also known as Missing Trader Intra-Community or MTIC fraud) exploits the EU’s VAT system. Fraudsters create chains of companies trading goods (often electronics) across EU borders. VAT is collected from customers but never remitted to tax authorities.

The same goods are frequently “carouseled” through multiple companies, each time generating fraudulent VAT refund claims.

In fact, in 2010, Europol announced an estimated EUR 500 billion loss attributed to VAT fraud on cross-border trading of carbon emission allowances.

Scale and Structure of the Fraud

- Operation Admiral is the largest VAT carousel fraud ever investigated in the EU, with estimated damages now at €2.9 billion.

- The scheme involved over 400 companies across at least 16 EU countries. The companies acted as legitimate suppliers of electronic goods, selling over €1.48 billion worth of devices via online marketplaces.

- While end customers paid VAT, the selling companies disappeared without paying the tax to the authorities.

- Other companies in the chain then claimed VAT refunds, compounding the losses.

- The proceeds were laundered through offshore accounts and used to fund other criminal activities, including drug trafficking and cybercrime.

- The investigation uncovered links to Russian organised crime, with evidence of assets being injected into the operation in exchange for payments and influence over management

Explanation

- VAT carousel fraud is a complex scheme used by organised criminal networks to fraudulently cash in on Government VAT revenues.

- In its most basic form, referred to as the missing trader fraud, it exploits the VAT Directive mechanism that governs cross-border intra-community transactions in goods and not only.

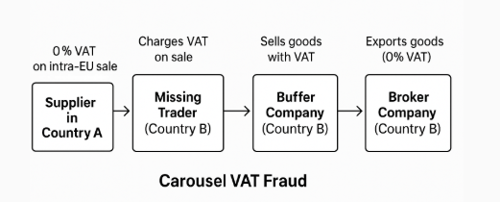

Here is a simple scheme

Here’s a step-by-step explanation of how the above carousel VAT fraud works, using a simplified example involving four entities across two EU countries:

🧩 Step-by-Step Breakdown

- Supplier (Country A)

- A legitimate company sells goods (e.g., smartphones) to a company in another EU country.

- No VAT is charged because intra-EU exports are zero-rated under EU VAT rules.

- Missing Trader (Country B)

- This company receives the goods and sells them domestically with VAT.

- However, it does not pay the VAT to the tax authority.

- After a few transactions, it disappears—hence the name “missing trader.”

- Buffer Company (Country B)

- A legitimate-looking company buys the goods from the missing trader.

- It pays VAT and sells the goods onward, also charging VAT.

- This company helps conceal the fraud by creating a layer between the missing trader and the final buyer.

- Broker Company (Country B)

- The broker buys the goods and exports them back to Country A or another EU country.

- Since exports are zero-rated, the broker claims a VAT refund from the tax authority.

- The refund is based on the VAT it paid to the buffer company.

🔁 The Carousel Effect

- The goods are re-imported and re-exported multiple times through different shell companies.

- Each cycle generates fraudulent VAT refund claims.

- The same goods may circulate dozens of times, creating a carousel of transactions.

💰 Outcome for Fraudsters

- They collect VAT from customers.

- They don’t remit VAT to the government.

- They claim refunds on VAT they never actually paid.

- The result: massive losses to national and EU budgets.

Carousel VAT Fraud Compliance Checklist

Here’s a compliance checklist to help detect and prevent involvement in carousel VAT fraud (missing trader fraud), based on best practices and regulatory guidance :

- Know Your Customer (KYC) & Supplier Due Diligence

- Verify the identity, VAT registration, and trading history of all customers and suppliers.

- Check for newly established companies with little or no trading history.

- Investigate businesses operating from residential addresses, serviced offices, or short-term leases.

- Be cautious with companies recently acquired by new owners with no relevant industry experience.

- Transaction & Product Red Flags

- High-value, low-bulk goods (e.g., mobile phones, computer chips) are frequently targeted.

- Unusual payment instructions (e.g., to third parties or offshore accounts).

- Requests to pay less than the full invoice price or to split payments.

- Transactions involving unsecured loads or suspiciously favourable terms.

- Spontaneous offers of high-profit, low-risk deals from unknown parties.

- Commercial Substance & Market Knowledge

- Ensure your contacts have genuine knowledge of the market and products.

- Assess the commercial viability of deals—if it seems “too good to be true,” investigate further.

- Confirm that goods or services are as described and originate from legitimate sources.

- Documentation & Audit Trail

- Maintain clear, accurate, and timely records for all transactions.

- Ensure all invoices, credit notes, and supporting documents are genuine and issued promptly.

- Keep a robust audit trail for VAT treatment and reporting.

- Ongoing Monitoring & Controls

- Regularly review and update due diligence procedures.

- Monitor for changes in trading patterns, such as sudden increases in volume or value.

- Use automated systems for VAT calculations and reporting where possible.

- Conduct periodic internal audits of VAT compliance controls.

- Reporting & Escalation

- Train staff to recognise red flags and report suspicious activity.

- Establish clear escalation procedures for potential fraud cases.

- Seek legal or professional advice if you suspect involvement in a fraudulent scheme.

Additional Resources:

- HMRC Guidance: How to spot missing trader VAT fraud (PDF)[5] = https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/947102/Missing_trader_fraud_2020.pdf

- European Commission: VAT Carousel Fraud https://taxation-customs.ec.europa.eu/taxation/vat/fight-against-vat-fraud/vat-carousel-fraud_en

- VAT Carousel Fraud | Zampa Partners https://zampapartners.com/insights/vat-carousel-fraud

- VAT Carousel Fraud | MTIC Fraud | VAT Fraud | DBT & Partners https://www.dbtandpartners.co.uk/fraud/carousel-fraud-detection/

- How to spot missing trader VAT fraud - GOV.UK https://www.gov.uk/government/publications/vat-missing-trader-fraud

- VAT compliance controls: new guidance from HMRC - ICAEW https://www.icaew.com/insights/tax-news/2025/feb-2025/vat-compliance-controls-new-guidance-from-hmrc

- VAT Carousel Fraud - European Commission - Taxation and Customs Union https://taxation-customs.ec.europa.eu/taxation/vat/fight-against-vat-fraud/vat-carousel-fraud_en

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.