FCA enforcement data shows a sharp increase in s.166 retail & consumer protection reviews.

13/09/2024

A combination of the FCA's data-led approach and the consumer duty's self-reporting requirements probably means s.166 will increase. FCA-regulated firms (and their insurers) are well advised to ensure that the scope of any such review is properly focussed on the issues, that any subsequent past business review is limited to addressing foreseeable harm, and that redress is only paid if legal liability is established.

These matters are explored in the following two parts.

- PART 1- info from a blog post by David Allinson, Partner at Reynolds Porter Chamberlain LLP.

- PART 2 – A reminder about the FCAs Consumer Duty initiative

PART 1

David Allinson says:- Use the (en)force(ment) - FCA enforcement data shows a sharp increase in s.166 reviews.

The FCA has published its annual report and accounts for 2023 / 2024. This voluminous document is 170 pages long.

David Allinson's blog focuses on some exciting data in an appendix concerning using s.166 of FSMA.

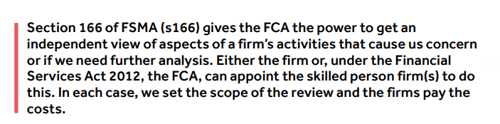

- s.166 of the Financial Services and Markets Act 2000 ("FSMA") gives the FCA the power to obtain a report from a skilled person on any aspect of a regulated firm's business.

- This is often a precursor to a past business review.

Firms are particularly keen to avoid s.166 as they will be required to pay the skilled person's costs, which can be substantial.

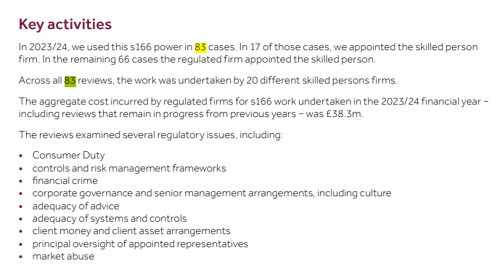

The FCA's annual report for 2023/24 shows that:-

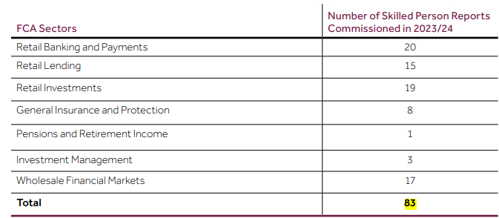

- A total of 83 skilled person reviews were commissioned in the 2023/24 year.

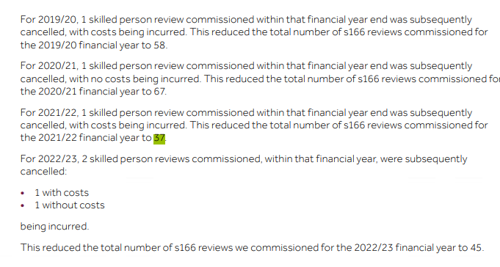

To put this in context:-

- 45 such reviews were commissioned in 2022/23 and

- Only 37 in 2022/23 (net of those commissioned and then cancelled).

It's perhaps no surprise that this increase matches up with

- The advent of the Consumer Duty – the FCA's data confirms that this was one of the issues that was examined via s.166,

They don’t specify how many of the 83 reviews commissioned were concerned about this. However:-

- 20 reviews concerned retail banking,

- 15 concerned retail lending and

- 19 concerned retail investments,

So, 54 were in the retail finance space. Deductive reasoning indicates that a proportion of these will indeed have been concerned with Consumer Duty, which could have been the reason for the increase.

I mentioned earlier that firms are generally keen to avoid the costs of such a review. To put this in context,

- The aggregate cost incurred by firms for s.166 work in the year was £38.3 million.

- This averages out to £460,000 per review (although this comparison is somewhat flawed as it includes sums incurred on s.166s that were live from previous years).

A combination of the FCA's data-led approach and the consumer duty's self-reporting requirements probably means that this trend will continue. FCA-regulated firms (and their insurers) are well advised to ensure that the scope of any such review is properly focussed on the issues, that any subsequent past business review is limited to addressing foreseeable harm, and that redress is only paid if legal liability is established.

PART 2

The FCA's Consumer Duty sets higher consumer protection standards across financial services, requiring firms to prioritise their customers' needs.

Implementation Timeline

- 31 July 2023: Rules came into force for open products and services.

- 31 July 2024: Rules will apply to closed products and services

The FCA expects firms to deliver good customer outcomes proactively, with a strong focus on culture, governance, and continuous improvement.

Here are the key components:

Consumer Principle

At the core of the Consumer Duty is a new Consumer Principle, which mandates firms to "act to deliver good outcomes for retail customers.

Cross-Cutting Rules

The Duty includes three cross-cutting rules:

- Acting in good faith towards customers.

- Avoid causing foreseeable harm to customers.

- Enabling and supporting customers to pursue their financial objectives

Consumer Outcomes

The Duty outlines four prescribed outcomes that firms must achieve:

- Products and Services: Ensuring products and services are fit for purpose and meet customers' needs.

- Price and Value: Providing fair value for customers.

- Consumer Understanding: Ensuring customers understand the products and services they are using.

- Consumer Support: Offering adequate support to customers throughout their relationship with the firm

SOURCES

Blog Source

- 09 September 2024. Published by David Allinson, Partner

- https://www.rpc.co.uk/thinking/professional-and-financial-risks/use-the-enforcement/

FCA consumer duty Source:

- Consumer Duty — A Different Approach to Financial Services ... - Kroll. https://bing.com/search?q=FCA+rules+and+approach+to+Consumer+Duty.

- Consumer Duty | FCA - Financial Conduct Authority. https://www.fca.org.uk/firms/consumer-duty.

- Consumer Duty implementation: good practice and areas for improvement - FCA. https://www.fca.org.uk/publications/good-and-poor-practice/consumer-duty-implementation-good-practice-and-areas-improvement.

- Consumer Duty — A Different Approach to Financial Services ... - Kroll. https://www.kroll.com/en/insights/publications/financial-compliance-regulation/consumer-duty-different-approach-financial-services-regulation.

- CONSUMER DUTY: FCA ISSUES FINAL RULES AND GUIDANCE. - Clifford Chance. https://www.cliffordchance.com/content/dam/cliffordchance/briefings/2022/09/consumer-duty-fca-issues-final-rules-guidance.pdf.

- FCA finalises Consumer Duty rules | Deloitte UK. https://www.deloitte.com/uk/en/Industries/financial-services/blogs/fca-finalises-consumer-duty-rules.html.

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.