FCA speeds up crypto approvals in response to critics – but its still only 45%

22/09/2025

IT'S BEEN REPORTED THAT Since the start of April, the FCA has hit 45 per cent of crypto approval applications.

This 45-acceptance rate is sharply higher than in the previous five years, when the regulator was widely criticised for being too slow to approve applications and only giving the green light to less than 15 per cent of applications it received. However, the push to make it quicker and easier for crypto companies to secure UK regulatory approval has failed to prevent a sharp drop in the number of applications.

Crypto asset providers that registered in the year to April completed the process in just over five months on average, compared with an average of 17 months for those approved two years earlier, the watchdog said in response to a freedom of information request by law firm Reed Smith.

Since the start of April, the Financial Conduct Authority

- Has approved the crypto registrations of five companies, including US investment group BlackRock and UK-based bank Standard Chartered,

- while six others were rejected, refused or withdrawn, according to data the watchdog gave to the Financial Times.

Numbers

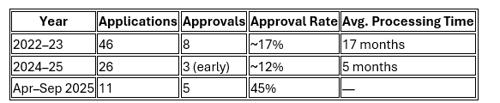

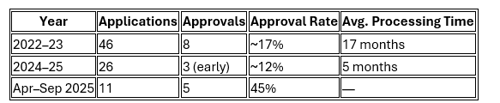

- The number of applications from crypto groups fell from 46 in the year to April 2023 to 26 in the year to April 2025.

- The number of approvals also declined from eight in 2022-23 to only three in 2024-25 — although this has rebounded in the past six months.

Although the FCA has added 55 companies to its register, it has been widely viewed as overly cautious about the risks in crypto markets and too slow to allow them to be part of mainstream finance.

Eu/us

- Both the EU and the US have been quicker to regulate the sector and to allow exchange-traded funds in crypto assets such as bitcoin to be sold to retail investors.

- George Osborne, the former Tory chancellor who is now an adviser to US crypto exchange Coinbase, wrote in the FT last month: “On crypto and stablecoins, as on too many other things, the hard truth is this: we’re being completely left behind. It’s time to catch up.”

- The FCA recently started offering preapproval meetings with a case officer to help companies prepare for what was expected of them in the registration process. It has also organised roundtables, webinars and other events to help companies with registration.

- As of today, any firms wanting to carry out cryptoasset activities in the UK have had to register under the scheme since the start of 2020 by showing they comply with the FCA’s rules to combat financial crime, including money laundering and terrorist financing.

- However, the UK’s plans to launch a complete regulatory framework may have contributed to the decline in applications by persuading companies thinking of registering with the FCA to hold off until the wider rules are in place.

CONCISE, UP-TO-DATE OVERVIEW OF THE FCA’S CRYPTO REGISTRATION LANDSCAPE AND REGULATORY DEVELOPMENTS

Here’s a concise, up-to-date overview of the FCA’s crypto registration landscape and regulatory developments

- Recent FCA Crypto Registration Trends (2024–2025)

- Higher Approval Rate: Since April 2025, the FCA has approved crypto registrations for five companies—including BlackRock and Standard Chartered—while six others were rejected, refused, or withdrawn. This marks a 45% acceptance rate, a significant increase from the previous five years, when the rate was below 15%.

- Fewer Applications: Despite the higher approval rate, the number of applications has dropped sharply—from 46 in the year to April 2023 to just 26 in the year to April 2025. Approvals also fell from eight in 2022–23 to only three in 2024–25, though there’s been a rebound in the past six months.

- Faster Processing: The average time to complete registration has dropped from 17 months (two years ago) to just over five months for firms registering in the year to April 2025.

- Why the Drop in Applications?

- Regulatory Uncertainty: The UK’s plans to launch a complete crypto regulatory framework (expected in 2026) may have led some firms to delay applications, waiting for more straightforward, more comprehensive rules.

- Stringent Standards: Historically, the FCA has been seen as slow and overly cautious, with a high rejection/withdrawal rate due to strict anti-money laundering (AML) and financial crime controls.

- Upcoming UK Crypto Regulatory Framework

- Full Regulation by 2026: The FCA is preparing a tailored, sector-specific regulatory framework for crypto, set to take effect in 2026. This will not simply apply traditional banking rules to crypto, but will focus on areas unique to digital assets—such as cybersecurity, operational resilience, and technology risks.

- Balanced Approach: The FCA aims to balance innovation and consumer protection, with requirements adapted to the realities of crypto markets. Some traditional requirements (like cooling-off periods and specific product oversight) may be relaxed, while rules around security and operational resilience will be strengthened.

- FCA Support for Applicants

- Pre-Application Meetings: The FCA now offers free pre-application meetings with a case officer for crypto, payments, and wholesale firms considering registration or authorisation. These meetings help firms understand expectations, clarify requirements, and prepare stronger applications. The FCA also organises roundtables, webinars, and industry events to support applicants.

- Guidance and Feedback: Firms are encouraged to engage early, use FCA guidance, and take advantage of practical examples and feedback to improve application quality.

- International Context

- Global Competition: The UK is under pressure to speed up and clarify its crypto rules, especially as the US and EU have moved faster to regulate the sector and allow products like crypto ETFs for retail investors.

- Industry Voices: High-profile figures, such as former Chancellor George Osborne (now an adviser to Coinbase), have publicly called for the UK to “catch up” and not be left behind in the global digital asset race.

Summary Table: FCA Crypto Registration (2020–2025)

Sources:

- FCA Crypto Registration Support https://www.fca.org.uk/firms/authorisation/pre-application-support-service

- FCA to Fully Regulate Crypto by 2026 https://coinpedia.org/news/uks-fca-sets-2026-deadline-to-fully-regulate-crypto-with-new-rules/

- Blockonomi: FCA Approval Rates https://blockonomi.com/only-4-out-of-35-crypto-companies-gain-uk-fca-approval-in-past-year/

- https://www.ft.com/content/c146250f-9821-44f3-ad21-4a3edf843e65

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.