Follow the money: questions over deposed Bangladeshi elite’s £400m UK property empire.

17/01/2025

30 NOV 2024 - An investigation by the Observer, in partnership with campaign group Transparency International, reveals Bangladeshi power players accused of corruption have amassed a portfolio of British real estate worth almost £400m – and possibly much more. Now, Transparency International says, the UK faces the “first test” of its ambition to make London the anti-corruption capital of the world.

Bangladeshi authorities believe a handful of powerful families and businesses linked to HASINA’S AWAMI LEAGUE PARTY acquired billions of pounds by illicit means, including huge loans from state-owned banks that have never been repaid.

Investigators believe these funds may have been siphoned out of Bangladesh using the hundi system of money transfer, which is popular in South Asia.

According to investigators and the new regime, the destination for some of that money has been the UK, a familiar home for illicit funds.

Dhaka’s interim government has enlisted help tracking down about £13 billion in assets, following a global paper trail they believe leads to hiding places, including London property.

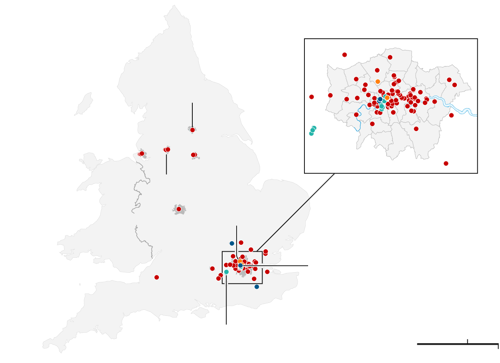

The network of about 350 properties ranges from modest flats to mansions in gated communities. Their owners include UK and offshore companies owned by some of Bangladesh’s wealthiest and most influential businesspeople and two ex-ministers of the Hasina regime. The owners claim the allegations are politically motivated attacks by the new regime.

The findings raise questions about the rules governing a phalanx of British firms—including major banks, law firms, and estate agents—that earned handsome fees for their services on multimillion-pound property transactions.

They have prompted concern among MPs and campaigners about the progress of efforts to combat Britain’s reputation as a magnet for dirty money, particularly whether rules on background checks and identifying sources of clients’ funds are sufficiently robust.

UNDER SCRUTINY FOR THEIR ALLEGED INVOLVEMENT IN FINANCIAL IRREGULARITIES

All individuals and families ARE under scrutiny for their alleged involvement in financial irregularities and property acquisitions abroad.

- Nazrul Mazumder: Chairman of Nassa Group, a major conglomerate in Bangladesh

- Salman F Rahman: Former private sector adviser to Sheikh Hasina and vice-chairman of BEXIMCO GROUP. He and his family are implicated in owning high-value properties in London

- Ahmed Shahryar: Related to Salman F Rahman, involved in managing key divisions of their family business

- Sobhan Family: Ahmed Akbar Sobhan, chairman of Bashundhara Group, and his family are also linked to significant property holdings in the UK.

- Chowdhury Family: Saifuzzaman Chowdhury, former land minister, and his family own numerous properties in the UK.

SALMAN F RAHMAN, CO-FOUNDER AND VICE CHAIR OF BEXIMCO,

- Days after Sheikh Hasina [former prime minister] fled Bangladesh, Salman F Rahman was arrested while also allegedly attempting to escape, this time by boat on Dhaka’s network of waterways. Rahman was Hasina’s adviser on private industry and investment. Many in Bangladesh saw him as the most influential figure in the regime.

- He now faces allegations of money laundering by the Dhaka-based Criminal Investigation Department (CID), a specialist investigative unit. The Bangladesh Financial Intelligence Unit (BFIU), part of the central bank, has frozen his bank accounts and those of family members.

- Rahman is the co-founder and vice chair of BEXIMCO, one of Bangladesh’s largest conglomerates, with sprawling interests in everything from garment manufacturing to pharmaceuticals.

- Since the Awami League came to power, benefits that BEXIMCO is reported to have enjoyed include the refinancing of vast loans from state-owned banks. It even held a national monopoly on distributing the Oxford-AstraZeneca Covid vaccine to a nation of more than 170 million people.

- Now, however, its financial affairs – including around £1bn of allegedly unpaid loans – are under investigation by the National Board of Revenue, the country’s tax authority.

- Bangladesh’s central bank has appointed a custodian to oversee its finances.

BEXIMCO IS A FAMILY AFFAIR. - RAHMAN’S SON, AHMED SHAYAN, AND HIS NEPHEW, AHMED SHAHRYAR

- According to LinkedIn and company publications, Rahman’s son, Ahmed Shayan, and his nephew, Ahmed Shahryar, have held the position of chief executive officer or run key divisions.

- The duo are under investigation by the CID, while Ahmed Shayan’s assets in the country have been frozen.

- Authorities tracing that money has alighted on Grosvenor Square, in London’s Mayfair district, among the largest and most prestigious of the capital’s 18th-century garden plazas.

- Members of the Rahman family own – or hold stakes in – seven luxury apartments there, most via companies based in offshore jurisdictions.

- One, bought for £26.75m in March 2022, is owned by Ahmed Shayan Rahman via a British Virgin Islands company. He also owns another flat in the square that cost £35.5m.

- Offshore companies controlled by his cousin, Ahmed Sharyar, own four more properties worth a combined £23m in the same square and nearby.

LAND MINISTER SAIFUZZAMAN CHOWDHURY

- But at least one other Awami League figure, the former land minister Saifuzzaman Chowdhury, is under scrutiny.

- The BFIU has frozen his bank accounts, while a court has ordered the seizure of immovable assets he and his family members owned.

- He is subject to a travel ban, and Dhaka’s Anti-Corruption Commission is investigating allegations that he illegally acquired hundreds of millions of dollars.

- Investigators want to know how he and his family acquired a vast UK property portfolio of more than 300 titles for at least £160m, according to the UK’s Land Registry.

- Reporters for Al Jazeera spotted Chowdhury outside one, a £14m London mansion, last month, but he has not responded to the Observer's requests for comment by email and letter.

SOBHAN FAMILY, HEADED BY PATRIARCH AHMED AKBAR, KNOWN AS SHAH ALAM.

- But it is not just former ministers who have amassed an impressive portfolio of British property. So, too, did some of the business figures who flourished under the Awami League’s reign.

- With its tree-lined private roads and professional security guards, Wentworth – built around the golf course of the same name – is the perfect bolthole for a privacy-conscious multimillionaire. The prestigious Surrey estate is home to several members of the Sobhan family, headed by patriarch Ahmed Akbar, known as Shah Alam.

- Members of the family own two vast properties here, acquired for a combined £13m and owned via companies registered in the British Virgin Islands,

- Golden Oak Venture Limited and

- Kaliakra Holdings Limited.

- A third, a French-style mansion owned by one of Shah Alam’s sons, appeared to be under construction when the Observer visited.

- The development is owned via an ISLE OF MAN COMPANY called Cessnock Limited. A contractor working on the project emphasises its core value – “discretion”.

- The Siobhan family’s wealth comes from the Bashundhara Group, a conglomerate with interests spanning real estate, shipping, media and sport.

- The family were first investigated over corruption allegations in 2008 but later cleared.

- The fall of the Hasina regime has triggered a fresh probe, including scrutiny of the alleged failure to repay state loans.

- On 21 October, a Dhaka court issued a travel ban against six members of the Sobhan family, including Shah Alam, while the BFIU has frozen their bank accounts.

- Dhaka authorities are believed to scrutinise the family assets, including property, which is expected to be a focus for a new asset recovery taskforce.

- They believe that despite strict currency controls that prevent citizens from transferring more than $12,000 out of the country, billions have been diverted abroad, including through hubs such as Singapore and Dubai.

- Two family properties raise questions about the role of those financial centres as staging posts for money pouring into UK property.

- One £10m mansion on a gated estate in London’s Kensington is owned by Shah Alam’s son and the vice chairman of Bashundhara Group, Safwan Sobhan, through Austino Limited.

- Austino is registered in the British Virgin Islands. Still, a Land Registry file documenting the purchase of the house directs correspondence to Atro International, a construction materials business based in Dubai.

- A similar arrangement relates to a £5.6m Chelsea waterfront property owned by Safwan’s brother, part of a portfolio amassed for £28m.

- The apartment was purchased by Red Pine Trading, which is based in the British Virgin Islands but addresses it as a Singapore tower.

NAZRUL MAZUMDER

- NAZRUL MAZUMDER, the founder and chairman of another Bangladeshi conglomerate, Nassa Group, is under investigation by the Dhaka CID for alleged money laundering, while the BFIU has frozen his assets.

- Bangladeshi authorities are expected to examine how Mazumder and his family funded the acquisition of five luxury properties in Kensington, southwest London, bought for a combined £38m.

- Local inquiries by the Observer indicate that most properties have been rented out, ensuring a steady income for Mazumder, as he faces charges in his home country.

- Sources close to Mazumder indicated that he rejected any suggestion that the properties were purchased with funds acquired illicitly and would contest allegations against him in Bangladesh.

THE DEALS

- NAZRUL MAZUMDER and a company in which he is a shareholder have borrowed from the British branch of Swiss bank UBS and Coutts. This private bank also serves the royal family to fund his family’s Kensington properties.

- SALMAN F RAHMAN’S son bought his £26.75m Grosvenor Square pad using a mortgage provided by the UK branch of Credit Suisse, with the assistance of law firm Charles Russell Speechlys.

- SALMAN F RAHMAN and his cousin, AHMED SHAHRYAR, bought properties with a Barclays mortgage.

- Another London law firm, Jaswal Johnston, has frequently worked on property deals for RAHMAN FAMILY MEMBERS.

- Members of the SOBHAN FAMILY have benefited from the advice of Orbis London, the UK outpost of a real estate adviser with offices in Liechtenstein, Singapore and Switzerland.

- CHOWDHURY’S vast portfolio was acquired and managed with assistance from MovingCity, the estate agent, law firm Charles Douglas, and lender Market Financial Solutions.

THE ENABLERS COMMENTS.

- Barclays, Coutts, Charles Russell Speechlys and UBS, which owns Credit Suisse, declined to comment.

- Orbis London did not return requests for comment.

- Market Financial Solutions, Charles Douglas Solicitors and Jaswal Johnston all said

- They complied with all relevant money-laundering regulations, including strict due diligence checks on customers’ sources of wealth.

- MovingCity said

- It had “always conducted detailed and extensive due diligence checks in strict compliance with applicable regulations and industry practice”.

- “At all material times, MovingCity has understood that the funds used by Mr Chowdhury to purchase UK property originated from legitimate businesses in the UAE, US and UK,”

SOURCE

- https://www.theguardian.com/business/2024/nov/30/money-trail-questions-over-deposed-bangladeshi-elites-400m-uk-property-empire?CMP=Share_AndroidApp_Other

- Hasina’s allies have properties worth Tk 6,000cr in the UK. https://www.thedailystar.net/news/bangladesh/news/hasinas-allies-have-properties-worth-tk-6000cr-uk-3765891.

- Hasina’s associates Salman, Sobhan, Nazrul and Javed spent millions in .... https://www.themirrorasia.net/miscellaneous/2024/12/01/3635.

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.