Guernsey and other risky jurisdictions highlighted in the OFSI SANCTION threat assessment

14/02/2025

Yesterday [13 Feb], The Office of Financial Sanctions Implementation (OFSI) released a threat assessment on financial services.

The OFSI states in the assessment, from 2023, that while links to BVI, THE REPUBLIC OF CYPRUS, and SWITZERLAND remained prevalent, there was an increase in reports involving:-

- The Isle of Man,

- Türkiye,

- The UAE, and

- Guernsey

The following offers some highlights from the OFSI SANCTION threat assessment.

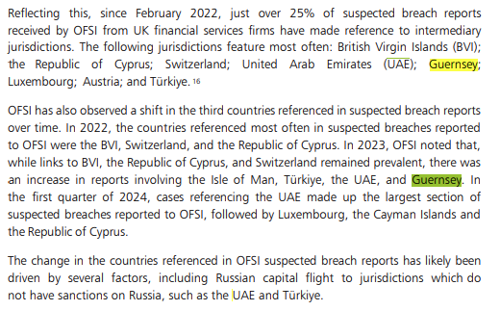

INTERMEDIARY JURISDICTIONS

- Suspected breaches of UK financial sanctions prohibitions by Russian DPs often involve INTERMEDIARY JURISDICTIONS.

- Individual Russian DPs have traditionally structured their interests, including the ownership and control of assets, through a small number of favoured intermediary jurisdictions.

- While some INTERMEDIARY JURISDICTIONS offer greater secrecy through legal and financial systems,

- INTERMEDIARY JURISDICTIONS that do not offer secrecy have historically also been attractive to Russian investors for commercial reasons due to their services and products and/or links to major markets.

THE REPORT SHOWS:-

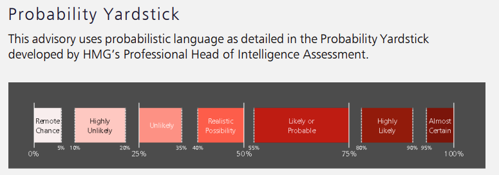

KEY JUDGEMENTS OUTLINED IN THE ASSESSMENT:

- Some UK financial services firms, including non-banks, have likely not disclosed all suspected breaches to OFSI.

- ALMOST CERTAIN that Russian DESIGNATED PERSONS [DPs] have turned to new professional and non-professional enablers to breach financial sanctions. OFSI has observed significantly increased enabler activity since 2023.

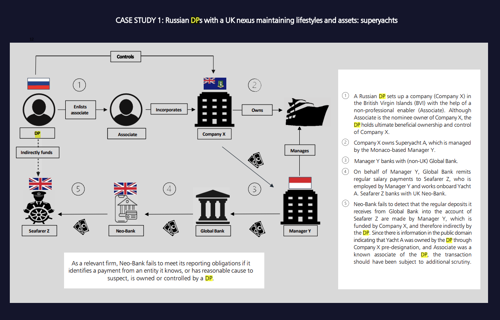

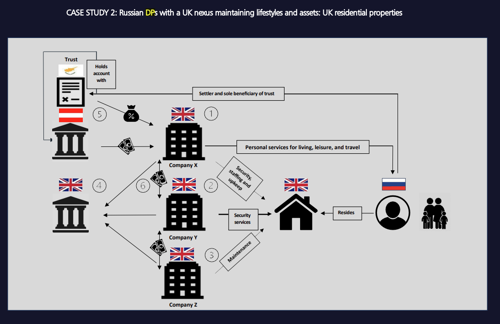

- It is HIGHLY LIKELY that enablers have made payments through NBPSPs relating to maintaining Russian DPs’ lifestyles and assets, including superyachts and UK residential properties.

- It is LIKELY a tiny number of enablers have attempted to front for Russian DPs and claim ownership of frozen assets.

- Enablers have often used alternative payment methods, particularly Cryptoassets, to breach UK financial sanctions prohibitions on Russia.

- Most non-compliance by UK financial services firms has likely occurred due to several common issues, including improperly maintaining frozen assets and breaches of licence conditions.

KEY JUDGEMENTS YARDSTICK

RED FLAGS

- There are some red flags referenced against Russian risk

4 Maintaining lifestyles and assets:

- A new individual or entity making payments to meet an obligation previously met by a Russian DP

- Individuals associated with Russian DPs, including family members and professional enablers, receiving funds of significant value without adequate explanation

- Frequent payments between companies owned or controlled by a DP

- Attempts to deposit large sums of cash without adequate explanation

- Cryptoasset to fiat transactions (or vice versa) involving a Russian DP’s family members or associates

- A family member of a DP is an additional cardholder on a purchasing card and regularly uses the card for personal expenses and overseas travel

5 Fronting

- Individuals with limited profiles in the public domain, including those with little relevant professional experience

- Inconsistencies in name spellings or transliterations, particularly those stemming from Cyrillic spellings

- Recently acquired non-Russian citizenships, including from countries which offer golden visa schemes

- Frequent or unexplained changes of name or declared location of operation

Country risk

- Throughout its analysis of suspected breach reports, OFSI has observed increased instances of specific activities in certain countries, which could indicate UK financial sanctions breaches.

- These activities are particularly relevant to financial services firms operating in or transacting with firms in these countries.

- While the activities described below do not always signify suspected breaches in and of themselves, they are linked with illicit sanctions activity in that jurisdiction. They should, therefore, trigger increased due diligence.

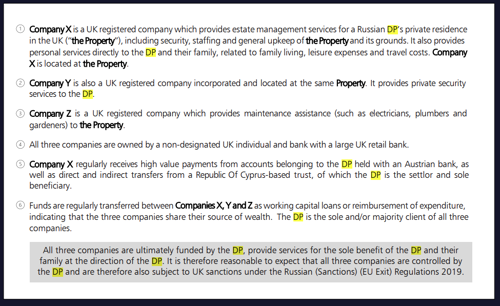

CASE STUDIES

Here is the link

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.