GUERNSEY Sanctions Notice - Russia (Designated Person Asset Reporting) – data submission by 24 November 2023.

01/11/2023

It was announced on November 1st, 2023, that the Policy & Resources Committee (P&R) is carrying out a review of frozen assets linked to persons designated under the Russia (Sanctions) (EU Exit) Regulations 2019 (the Russia regime).

The purpose of the review is to enable P&R to update its records with respect to assets frozen under the “Russia regime”.

It is being carried out using P&R’s information-gathering powers in section 15 of the Sanctions (Bailiwick of Guernsey) Law, 2018.

It is appreciated that some businesses may recently have provided an update on assets frozen under the “Russia regime”. However, this review aims to standardise the information held by P&R as much as possible at a specific time, i.e., 31 October 2023.

In this respect, it is like the annual frozen asset review process that is carried out by HM Treasury’s Office of Financial Sanctions Implementation (OFSI), using HM Treasury’s information-gathering powers in the Sanctions and Anti Money Laundering Act 2018.

As part of that review, OFSI requires all persons who hold or control funds or economic resources belonging to, owned, held, or controlled by a designated person to provide a report to OFSI with the details of these assets, including their value at a particular date.

However, unlike the OFSI review, which covers all financial sanctions regimes implemented in the UK, the P&R review only covers the “Russia regime”.

In addition, the scope of the information required by P&R differs slightly from that required by OFSI, as it takes account of the financial services provided by the Bailiwick.

Businesses that hold or control frozen assets or which have an ongoing connection to frozen assets outside the Bailiwick are therefore requested to complete the attached template.

Businesses THAT DO NOT COME WITHIN ANY of the three Tabs of the template SHOULD NOT PROVIDE a nil return to P&R, AS THIS WILL BE ASSUMED FROM THE ABSENCE OF A RESPONSE.

The template covers three categories of assets.

Tab 1 deals with assets that are located in the Bailiwick, e.g., funds in Bailiwick banks.

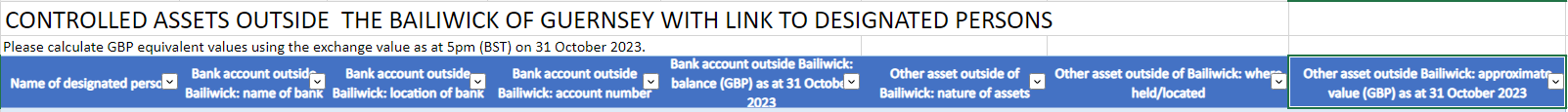

Tab 2 deals with assets that are located outside the Bailiwick that are held or controlled by persons in the Bailiwick, e.g. assets outside the Bailiwick held within a trust structure where the trustee is a Bailiwick financial services business.

Tab 3 deals with assets that are neither located in nor controlled from the Bailiwick, but where there is some ongoing connection to the Bailiwick e.g. where a Bailiwick financial services business provides directors for a company that sits within the same overarching structure as a company that holds assets belonging to a designated person.

The value columns relate to the value of assets as of the close of business on 31 October 2023.

In the case of non-liquid assets (e.g. real property or vehicles), businesses are not expected to commission valuations in order to complete the template. It will be sufficient to provide an approximate value based on information that the business already holds or has easy access to.

It is recognised that businesses that come within Tab 3, may need access to information about the nature or value of the assets. In that situation, an estimate should be provided (and identified as such) or the response should say Unknown if that is not possible.

Businesses THAT DO NOT COME WITHIN ANY of the three Tabs should not provide a nil return to P&R, as this will be assumed from the absence of a response.

This also applies to businesses aware of assets frozen under the Russia regime but do not own, control or have an ongoing connection to those assets. Examples would be

- Businesses that have provided legal or accountancy services to a party who holds the assets of a designated person or that have received a payment from assets linked to a designated person under a licence.

- There is also no need to report any assets that are linked to persons designated by bodies other than the UK (e.g., the EU or OFAC).

If you have a review question, contact P&R at ciara.harnden@gov.gg with the subject line “Russia – Designated Person Asset Reporting”.

The completed template should be sent to sanctions@gov.gg with the subject line “Russia – Designated Person Asset Reporting” by 24 November 2023.

Source

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.