HMRC has released its latest report on businesses failing to comply with the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, effective since June 26, 2017.

04/02/2026

Fines Overview

- Number of penalties issued: 369 (includes 335 named businesses, 2 anonymised cases totalling £5,450, and 32 minor penalties under £5,000 totalling £23,297).

- Overall total penalty amount: £1,881,237.

- The penalties cover breaches from April 1, 2025, to September 30, 2025, and focus primarily on registration and compliance issues.

- The total for named penalties is approximately £1,852,490 (calculated from sector breakdowns below).

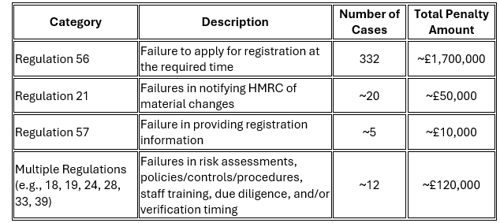

Reasons for Fines (Grouped by Category)

The breaches are dominated by registration failures. Breakdown:

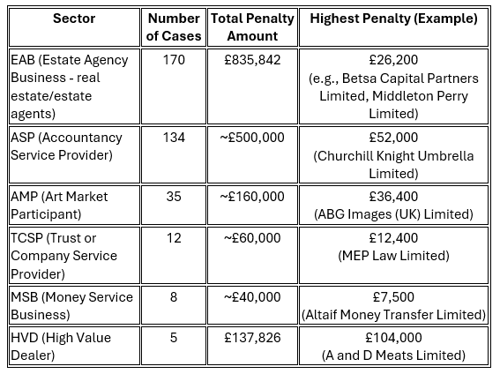

Industry Sectors (In Descending Order)

Sectors abbreviated as per the report:

- EAB: Estate Agency Business

- ASP: Accountancy Service Provider

- AMP: Art Market Participant

- TCSP: Trust or Company Service Provider

- MSB: Money Service Business

- HVD: High Value Dealer

This data is verified against the official HMRC report and recent news coverage. Businesses should review their compliance to avoid similar penalties HMRC notes that published entities may have since corrected issues or changed management.

Source: HMRC Corporate Report (Updated Feb 2, 2026). For the full list, visit the GOV.UK page.

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.