IFCs linked TO Pig Butchering Scams being indited by the SEC Charges - 3 Individuals, 5 Companies charged

01/10/2024

17 SEPT 2024 –

- The U.S. Securities and Exchange Commission (SEC) announced its first-ever enforcement actions targeting "pig butchering" scams—fraudulent schemes where scammers build personal relationships with victims through social media platforms to gain their trust, before defrauding them via fake cryptocurrency trading platforms.

- The SEC filed charges against five entities and three individuals involved in two scams connected to the platforms

- NanoBit = https://www.sec.gov/files/litigation/complaints/2024/comp-pr2024-134-nanobit.pdf

- CoinW6. = https://www.sec.gov/files/litigation/complaints/2024/comp-pr2024-134-coinw6.pdf

- Together, these scams defrauded investors out of nearly $3.2 million.

- The complaints in both cases are in-depth descriptions of scammers luring victims, through romantic overtures, to send cryptocurrency.

TRM LABS [TRM] - https://www.trmlabs.com/

- TRM have analysed these cases and in the summaries below it is noted that along with the US, a number of VASPS were in Malta and Seychelles were implicated. Also monies ended up in Hong Kong bank accounts

In the case of NanoBit,

- In the case of NanoBit, scammers impersonated financial professionals in WhatsApp groups between October 2023 and June 2024, luring victims into investing in what was presented as a legitimate crypto asset trading platform. They falsely claimed that their affiliate, NanobitUS Securities, was an SEC-registered broker, giving the operation an air of legitimacy.

- Instead, the NanoBit platform was completely fraudulent, with funds being misappropriated and wired to bank accounts in Hong Kong. The defendants, including NanoBit Limited, are accused of violating antifraud provisions under federal securities laws.

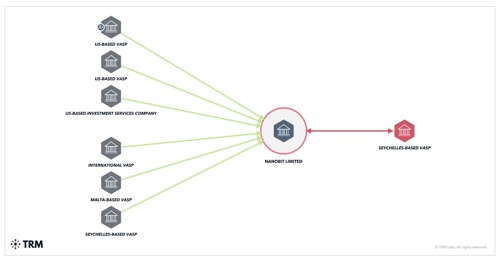

- The SEC complaint shows, as visualized in the TRM graph below, that the NanoBit funds were transferred to a "transmitter" or aggregation address, which contained crypto likely obtained through other fraudulent activities.

- These fraudulent activities extended beyond NanoBit, implicating a web of fraudulent transactions that spanned multiple crypto addresses.

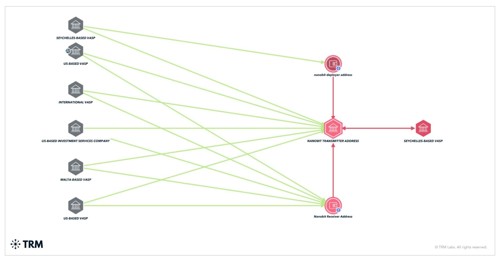

- According to the SEC complaint, and visualized in TRM graph visualizer below, the NanoBit Receiver Address and NanoBit Deployer Address received hundreds of thousands of dollars of victims’ funds; which were then moved to the “Transmitter Address” “with crypto assets likely obtained through other fraudulent activities.”

- As of September 2024, the “transmitter” address has received about USD 9 million worth of cryptocurrency likely from multiple fraud schemes.

CoinW6

- Similarly, CoinW6 ran a relationship-driven scam, where perpetrators posed as young professionals on LinkedIn and Instagram. Between July 2022 and December 2023, they built romantic relationships with victims through WhatsApp.

- After establishing trust, they convinced investors to open accounts on a fake CoinW6 trading platform, promising daily returns of up to 3% from crypto asset products such as staking, mining, and yield farming. In reality, these investments were entirely fictitious, with victim funds being siphoned off by the scammers. When victims attempted to withdraw funds, they were met with demands for additional payments or faced blackmail threats regarding compromising romantic communications.

Summary thought

- These cases, which underscore the risks of relationship-based investment frauds, signal a growing threat to retail investors in the crypto space.

- According to TRM Labs, scams and fraud accounted for about one-third of all crypto-related crime in the previous year, totalling $12.5 billion in losses.

Source

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.