IN 2024, Europe's cross-border illicit flows are estimated to be $194.9 billion.

02/04/2025

The latest report from Nasdaq Verafin, titled Financial Crime Insights: Europe, reveals the staggering scale of financial crime across Europe.

Cross-border transactions have tripled over the last decade, indicating a significant increase in the exchange of funds between countries within an increasingly complex global financial system. In this highly interconnected environment, criminals are exploiting cross-border transactions to circulate funds for international criminal organisations and money laundering networks, moving the proceeds of drug trafficking and fraud and facilitating terrorist and proliferation financing.

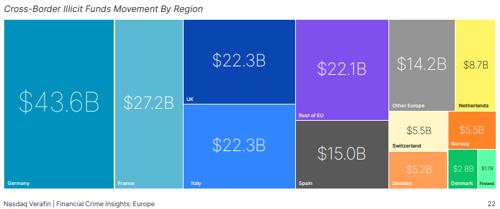

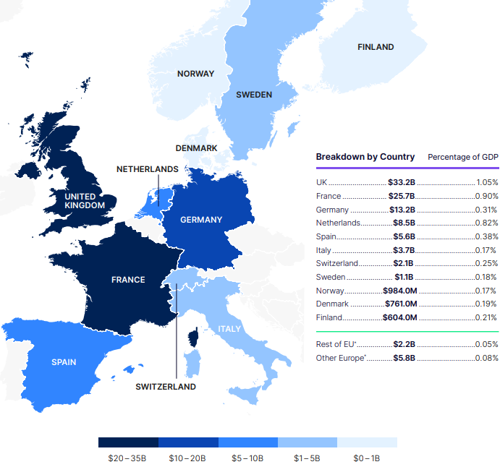

THE Nasdaq Verafin report reveals that the scale of cross-border illicit funds movement is a significant risk to the European financial system. Europe's cross-border illicit flows are estimated to be $194.9 billion, representing more than a quarter of the region's total money laundering activity.

Germany, France, Italy, and the UK represented more than half of all cross-border illicit funds.

Criminals are moving illicit funds across borders to obscure the source or destination of the funds, making the recovery of funds more challenging. International illicit activity undermines the integrity of the financial system in both sending and receiving countries, underscoring the need for the global financial system to prioritise financial crime risk in cross-border transactions.

Moving forward, the adoption of the ISO 20022 international payments standard by fast and instant payments systems, including in the UK and EU, will facilitate greater interoperability of cross-border across the financial industry, and the G20 is aligned on a Roadmap for Cross-Border Payments, endeavouring to improve the speed, transparency and cost of these transactions to promote economic growth and international trade.

As Europe prioritises innovation in the payments space, making cross-border payments faster and more accessible than ever, these vectors can be exploited by money mules and threat actors unless the industry works together to prioritise effective fraud prevention and AML/CFT measures to address the international nature of financial crime threats in cross-border payments.

THE X9 Financial Crime Threats of Greatest Concern in the EU

The latest report from Nasdaq Verafin, titled Financial Crime Insights: Europe, reveals the staggering scale of financial crime across Europe.

As criminals continually adapt their tactics to evade detection, financial institutions are implementing stronger fraud controls and more stringent AML/CFT compliance programs to manage and mitigate the evolving risks of financial crime.

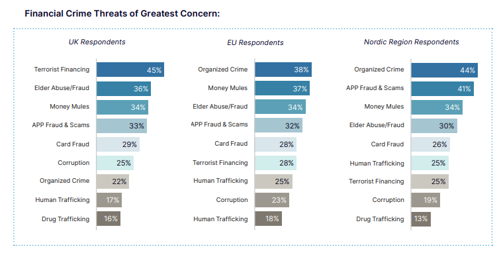

Nasdaq Verafin data reveals that a range of financial crime trends are threatening financial institutions, their customers and the financial system. Of most concern to survey respondents across Europe overall were money mules, APP fraud and scams, terrorist financing, and elder fraud.

From a regional perspective, the ranking of these threats varied among UK, EU, and Nordic respondents.

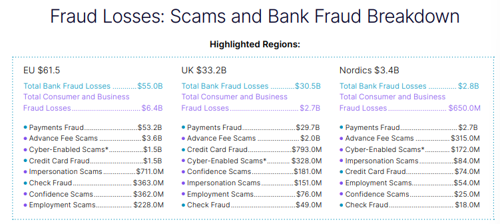

$103.6 Billion in Fraud Losses Across Europe

The latest report from Nasdaq Verafin, titled Financial Crime Insights: Europe, reveals the staggering scale of financial crime across Europe.

Losses to consumers and businesses originating from impersonation, confidence, advance fee, employment, and cyber-enabled scams, as well as bank fraud losses from payments, check and credit card fraud.

In 2023, $750 billion, or 2.3% of the EU's GDP, was laundered through the EU.

The latest report from Nasdaq Verafin, titled Financial Crime Insights: Europe, reveals the staggering scale of financial crime across Europe.

The Financial Crime Insights:

- In 2023, an estimated $750 billion in illicit funds flowed through the continent's financial system, equivalent to 2.3% of the continent's GDP.

- Europe report also reveals that $3.1 trillion was laundered globally in 2023. Remarkably, nearly a quarter of that total is linked to Europe, despite the region accounting for less than 10% of the world’s population.

The estimated EU breakdown includes the following:

- $178 billion from drug trafficking

- $82 billion from human trafficking

- $2.7 billion from terrorist financing

- $487 billion from other illicit activity (including organised crime, fraud, and corruption)

The report highlights several key points:

- Cross-border transactions: More than a quarter of the laundered funds, approximately $194.9 billion, were moved across borders.

- Fraud losses: Europe faced $103.6 billion in losses due to various scams and bank fraud scenarios.

- Economic and societal impacts: Financial crimes such as elder abuse, human trafficking, drug trafficking, and terrorist financing have serious repercussions on Europe's economy and communities.

The report emphasises the urgent need for:

- Enhanced public-private collaboration

- Coordinated cross-border responses

- Advanced technology to detect and prevent financial crime

References

- https://finance.yahoo.com/news/nasdaq-verafin-report-finds-750-060000878.html

- https://verafin.com/financial-crime-insights-europe/?src=pressrelease

https://www.nasdaq.com/global-financial-crime-report?src=pressrelease?src=pressrelease

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.