Is proliferation financing a money laundering offence, a terrorist offence, or a standalone offence?

23/09/2024

Part 1 - Introduction

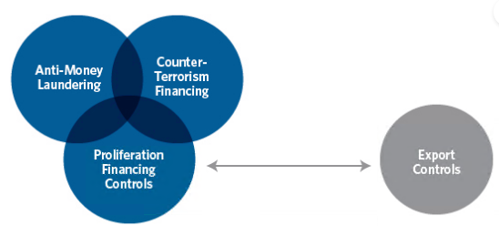

In Jersey, the Jersey Financial Services Commission [JFSC] says Proliferation financing [PF] can be described as both:-

- A distinct financial crime risk and

- Sanctions risk.

Royal United Services Institute for Defence and Security Studies [RUSI] says:

- Unlike other financial crime risks, such as money laundering and terrorist financing, proliferation finance tends to be directed by state actors, such as North Korea and Iran.

The JFSC does, however, say:-

- PF may share many CHARACTERISTICS with other forms of financial crime, such as Money laundering and/or Terrorist financing.

- Since PF networks may derive funds from criminal activity and/or legitimately sourced funds, transactions related to PF may use the international financial system under the umbrella of legitimate business and may not exhibit the same CHARACTERISTICS as Money laundering and/or Terrorist financing.

- Predicate offences and criminal actors are relevant considerations for PF. Still, the complex nature of PF means that the range of possible threats is broader than when considering Money laundering or Terrorist financing in isolation.

- PF threats are typically posed by proliferation networks, created by those targeted by UNSCR-designated sanctions to disguise their activities, including those acting on their behalf or at their direction. As a result, their financing needs and methods may not necessarily be the same as those of other criminal actors.

Therefore,

- PF shares similarities with money laundering and terrorist financing, distinct and addressed separately under international regulations.

PF, however, is considered a stand-alone offence. It involves providing FUNDS OR FINANCIAL SERVICES for the development, acquisition, or spread of weapons of mass destruction, including chemical, biological, radiological, or nuclear weapons

To assist in understanding similar CHARACTERISTICS, the JFSC has made up a comparison table to assist in highlighting these characteristics [see the end of this post]

Part 2 – what laws

In Jersey, the laws criminalising proliferation financing are primarily governed by the:-

- Sanctions and Asset-Freezing (Jersey) Law 2019 and

- Sanctions and Asset-Freezing (Implementation of External Sanctions) (Jersey) Order 2021

These laws implement sanctions related to the prevention and disruption of the financing of weapons of mass destruction (WMD)

- United Nations Security Council resolutions

- United Nations Security Council Resolutions (UNSCR) concerning the prevention, suppression, and disruption of the proliferation of weapons of mass destruction (WMD) (Proliferation) and Proliferation financing (PF).

- UNSCRs require countries to freeze without delay the funds or other assets of, and to ensure that no funds and other assets are made available, directly or indirectly, to or for the benefit of, any person or entity designated by, or under the authority of, the United Nations Security Council (UNSC) under Chapter VII of the Charter of the United Nations.

- UK autonomous sanctions

- Under the Sanctions and Anti-Money Laundering Act 2018 (SAMLA), the UK has implemented several specific sanctions to deter proliferation financing, particularly targeting countries like North Korea and Iran, as well as the proliferation of chemical, biological, radiological, and nuclear (CBRN) weapons.

- Here are some key regulations:

- North Korea (Sanctions) (EU Exit) Regulations 2019: These regulations impose financial, trade, and immigration sanctions to prevent North Korea's nuclear and other WMD program development.

- Iran (Sanctions) (Nuclear) (EU Exit) Regulations 2019: These regulations target Iran's nuclear program by imposing asset freezes, trade restrictions, and prohibitions on financial services.

- Chemical Weapons (Sanctions) (EU Exit) Regulations 2019: These regulations impose sanctions on individuals and entities involved in the use and proliferation of chemical weapons.

- Counter-Terrorism (Sanctions) (EU Exit) Regulations 2019: While primarily focused on counterterrorism, these regulations also address financing proliferation activities.

- These regulations are part of the UK's broader strategy to prevent the financing and support of activities related to the proliferation of WMD.

- These sanctions regulations ensure that any financial support for the proliferation of WMD, including nuclear, biological, and chemical weapons, is strictly prohibited.

Part 3 - Export controls and proliferation financing.

Export controls and proliferation financing are closely linked in efforts to prevent the spread of weapons of mass destruction (WMD).

Export controls and proliferation financing - Here's how they correlate:

- Export Controls:

- These regulations govern the export of goods, technologies, and services that could be used for military purposes or in developing WMDs.

- They aim to prevent sensitive items from falling into the wrong hands.

- Proliferation Financing:

- This refers to the financial support for the proliferation of WMDs, including funding activities related to the development, acquisition, and delivery of such weapons.

Correlation:

- Detection and Prevention:

- Effective export controls help identify and restrict the transfer of dual-use goods (items that can be used for civilian and military purposes), which are crucial in preventing proliferation financing.

- By controlling the export of these goods, authorities can disrupt the supply chains that might be financed for proliferation purposes.

- Regulatory Frameworks:

-

- Export controls and proliferation financing measures are part of broader national and international security regulatory frameworks.

- They often involve similar stakeholders, including governments, financial institutions, and international bodies.

3. Information Sharing:

-

- Export control authorities and financial institutions can better share information to detect and prevent proliferation financing.

- financial institutions can flag suspicious transactions that might indicate attempts to finance the acquisition of controlled goods.

4. Legal and Enforcement Measures:

-

- Countries with robust export control systems are generally better equipped to combat proliferation financing.

- Weak export controls can lead to gaps that proliferation networks exploit to finance their activities.

By integrating export controls with measures to combat proliferation financing, countries can enhance their overall capacity to prevent the spread of WMDs.

CLOSE - PF vs Money laundering and Terrorist financing

The JFSC provides detailed guidance on these laws and their implementation.

JFSC has made up a characteristic comparison table.

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.