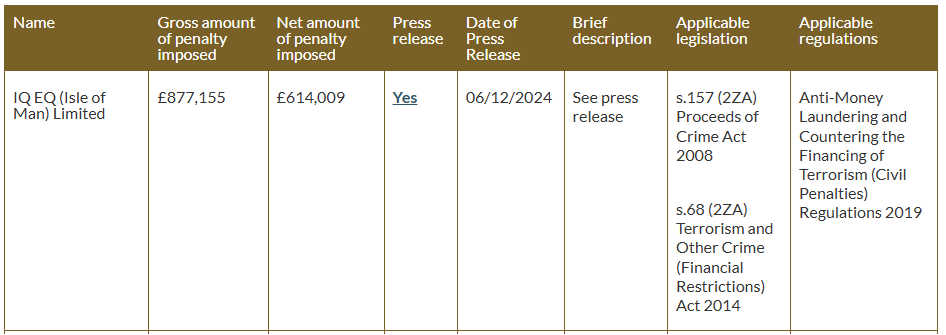

Isle of Man fine IQEQ (Isle of Man) Limited 877k

09/12/2024

PUBLIC STATEMENT CONCERNING THE IMPOSITION OF A CIVIL PENALTY ON IQ EQ (ISLE OF MAN) LIMITED (‘IQ EQ IOM’)

Published on: 06 December 2024

1.Action

1.1 The Isle of Man Financial Services Authority (the “Authority”) makes this public statement in accordance with powers conferred on it under section 13 of the Financial Services Act 2008 (the “Act”) and other Applicable Legislation[1].

1.2 The making of such public statement supports the Authority’s regulatory objectives of, among other things, securing an appropriate degree of protection for customers of persons carrying on a regulated activity, reducing financial crime and maintaining confidence in the Isle of Man’s financial services industry.

1.3 An investigation by the Authority in respect of IQ EQ IOM (Class 3 (11) (12) – Services to Collective Investment Schemes, Class 4 – Corporate Services and Class 5 – Trust Services) identified a number of historic regulatory failings in relation to the Financial Services Rule Book (the “Rule Book”) and Anti-Money Laundering and Countering the Financing of Terrorism Code 2019 (the “Code”). In light of the same, the Authority has determined that it would be reasonable and proportionate, in all the circumstances, that IQ EQ IOM be required to pay a discretionary civil penalty. This penalty is £614,009, which includes a discount of 30% to reflect IQ EQ IOM’s cooperation during this process and the mitigating factors set out in this statement (the “Civil Penalty”).

1.4 The penalty reflects the fact that:

1.4.1 The contraventions identified are attributable to deficiencies in the procedures, systems and controls as required by the Code;

1.4.2 IQ EQ IOM co-operated fully with the Authority and agreed settlement at an early stage, through the Authority’s EDMP; and

1.4.3 the presence of mitigating factors, such as the significant evolution of IQ EQ IOM’s risk framework and the improvements it has made in line with its regulatory obligations.

1.5 Civil Penalties issued by the Authority are calculated as a percentage of the relevant company’s income in accordance with the Regulation IQ EQ IOM is one of the largest trust and corporate services providers in the Isle of Man and that is reflected in its relevant income, and therefore size of civil penalty. The absolute amount of the Civil Penalty relative to the absolute amount of other civil penalties that have been imposed by the Authority previously is not necessarily indicative of the relative seriousness of the contraventions identified in each matter – the level of a civil penalty is determined each time on the facts of a particular matter and regard is had by the Authority to the level and the percentage of civil penalties imposed in other matters.

2. Background

2.1 IQ EQ IOM has been licensed with the Authority to undertake the regulated activities of Class 3 (11) (12) – Services to Collective Investment Schemes, Class 4 – Corporate Services and Class 5 – Trust Services, since 2001.

2.2 In April 2021, the Authority conducted a supervisory inspection in respect of the Class 3 licence of IQ EQ IOM in accordance with its statutory powers under Schedule 2 to the Act (the “Inspection”). The Inspection, based on a sample of files, identified contraventions of the Code and breaches of the Rule Book.

2.3 Upon identification and consideration of the contraventions, IQ EQ IOM appointed a third-party professional firm to review certain aspects of the IQ EQ IOM control framework including its governance framework. The costs associated with the appointment of the third-party professional firm were borne fully by IQ EQ IOM.

2.4 At the time of this review, IQ EQ IOM had already self-identified various areas for improvement and had commenced a programme of enhancements, implementing new policies, control frameworks and procedures. The outcome of the Inspection, reporting professional’s views and IQ-EQ IOM’s own self-identified findings will be collectively referred to as the “Relevant Findings”.

2.5 IQ EQ IOM has engaged promptly and positively with the Authority throughout this matter in a timely and constructive manner. IQ EQ IOM has also undertaken a comprehensive programme of enhancements following the Relevant Findings, involving commitment both financially and in terms of time, which has resulted in important changes and enhancements to IQ EQ IOM’s control environment.

3. Relevant Findings

The key relevant findings confirmed were that IQ EQ IOM, in respect of the period from 2021 – 2022:

- had historic instances of non-compliance with a number of Code requirements – IQ EQ IOM was contravening certain aspects of paragraphs 4, 5, 13, 15, 30, 33 (and, in respect of the Class 3 review only, paragraph 8, 10, 12, 16) of the Code; and

- had historic issues of non-compliance with Rule Book requirements in relation to maintaining appropriate internal and operational controls, systems, policies and procedures – IQ EQ IOM was breaching certain aspects of rules 8.3(2), 8.6, 8.23(1) of the Rule Book; and

- had historic issues of non-compliance relating to the conduct of business under the Rule Book (specifically in relation to its Class 3 business) – IQ EQ IOM was breaching certain aspects of rules 6.54, 6.60, 6.63.

The corporate governance structure and compliance framework in place was not appropriate for the size, scale and complexity of the business during the material time.

4. Statement

4.1 The Authority is satisfied that the imposition of the Civil Penalty on IQ EQ IOM, in conjunction with other ancillary measures taken, reflects the nature of the historic non-compliance identified. The Authority is satisfied that the directors and Board members of IQ EQ IOM, at this time, recognise and acknowledge the historic failings of IQ EQ IOM.

4.2 In accordance with the EDMP, IQ EQ IOM entered into settlement discussions at an early stage with the Authority and, having acknowledged the historic findings, sought to finalise and remediate matters expeditiously.

5. Cooperation and Remediation

5.1 The Authority is satisfied that IQ EQ IOM and the directors of IQ EQ IOM cooperated fully and engaged positively with the Authority’s EDMP.

5.2 The directors and Board members of IQ EQ IOM acknowledge the historic contraventions and breaches identified.

5.3 As at the date of the settlement agreement made between IQ EQ IOM and the Authority (the “Settlement Agreement”), IQ EQ IOM has implemented new procedures, has engaged additional personnel at board and officer level (including two new independent non-executive directors, a new Managing Director and a new Risk & Compliance Director, as well as significant investment in the Risk & Compliance function) and has committed to providing the Authority with additional periodic reporting.

5.4 At the time of the Relevant Findings, IQ EQ IOM had already self-identified and commenced a programme of enhancement and remediation, implementing new policies, control frameworks and procedures. When viewed collectively, the Authority is satisfied that IQ EQ IOM has sought to address the historic failings which have resulted in the imposition of the Civil Penalty.

5.5 At the date of the Settlement Agreement, IQ EQ IOM remains actively engaged with the Authority to ensure compliance with its regulatory obligations.

6. Key Learning Points for Industry

6.1 Compliance with the Code is a legal requirement; all firms undertaking business in the regulated sector have an obligation to conduct their affairs in a manner that adequately mitigates the risks faced by it in order to ensure that the Isle of Man retains its reputation as a responsible, and well regulated, international financial centre.

6.2 The Authority requires that businesses have appropriate expertise, experience and sophistication within their resources and within their anti-money laundering and countering the financing of terrorism (“AML / CFT”) framework and controls, taking into account the nature of their clients. This includes ensuring its officers and staff should be adequately trained and qualified and be considered by the Board of the regulated entity, individually and collectively, to have the appropriate degree of expertise and sophistication to mitigate associated risks.

6.3 Any weaknesses in the design, implementation and operation of AML/CFT controls, can expose a licenceholder to AML / CFT risk. The AML/CFT risks faced by trust and corporate service providers is recognised in the Isle of Man Government’s National Risk Assessment 2020 which applies an overall risk rating of Medium/High risk of being used for ML to the sector. Persons in this sector will be required by the Authority to have and to maintain a very robust control environment at all times.

6.4 A regulated entity’s risk management arrangements, including in respect of AML / CFT, should extend to understanding the investment and operational activities of its clients even when providing only a limited range of services to any particular client.

6.5 All stages of the client relationship, from new client take-on, on-going monitoring of new and long-standing relationships to exiting the relationship, should pervade the same approach, attitude and culture so as to reduce AML / CFT risks.

6.6 Mitigating risk to the greatest degree possible requires both a set of well-documented procedures and policies and a risk based mind-set across the business. This risk-based mind-set should be reflected operationally and demonstrated through absolute adherence to the Code and the Rule Book. Continuous compliance improvement, fostered through regular staff training and vigilant monitoring, will strengthen the organisation's overall risk management.

6.7 Those providing services to exempt schemes under a Class 3 licence must ensure that the schemes meet the criteria of an exempt scheme at all times, not just at establishment.

6.8 Active engagement and cooperation with the Authority provides the best possible opportunity to resolve matters in a timely and constructive manner and, where appropriate, to minimise the likelihood of the Authority taking further action in relation to instances of non-compliance with the Code.

[1] under regulation 5(7) of the Anti-Money Laundering and Countering the Financing of Terrorism (Civil Penalties) Regulations 2019 (the “Regulations”)

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.