Jersey JEPs Part 2 - An overzealous regulator that bullies and terrifies?

04/10/2024

The JEP has launched a multi-day series [starting October 3rd] speaking to people who have been caught in the regulator’s crosshairs.

- Day 1- https://www.comsuregroup.com/news/jep-investigation-who-is-watching-the-watchdog/

- Day 1 https://www.comsuregroup.com/news/the-first-of-a-multi-part-series-by-jep-investigations-into-the-jersey-financial-services-commission/

The JEP IS investigating and asking whether the JFSC should be more accountable and what it could be doing to support the industry.

Day 2 - October 4th – the second part is published as follows

BACK in 2020, Jersey’s Royal Court issued a rare reversal of sanctions by the JFSC against SWM Ltd, a wealth management firm. It was the culmination of a six-year battle by the company against the Island’s financial regulator. But it was a Pyrrhic victory.

The JFSC had required SWM to commission a report by Grant Thornton into investment advice given to investors several years earlier, and when the report came back and suggested that the advice had been unsuitable, the regulator told the company it had to send it to all of its clients. Rather than doing so, SWM decided to take the JFSC to court.

Despite winning the case, SWM could not get professional indemnity insurance and was forced to close its doors. The JFSC has never admitted fault in the case of SWM, and indeed in a statement issued after the judgment it claimed that the court had upheld the majority of its findings, which included that the firm had inadequate processes for due diligence and had failed to handle complaints.

In the statement, the JFSC said that “despite the findings of the Royal Court, the JFSC continues to believe that it was, and remains, reasonable and [acting] in the best interests of investors”.

One of the regulator’s other criticisms was that the firm had failed to maintain adequate insurance. That last charge highlighted the Catch-22 when it comes to dealing with the JFSC: a firm that is under investigation is duty bound to inform its insurers of the investigation, which often withdraw or suspend cover until the matter is resolved.

SWM did not have insurance because they were under investigation, then when the investigation ended – and the court judgment went in their favour – they were criticised for not being insured.

“It did begin to feel like a war,” said Olaf Blakeley, who represented SWM.

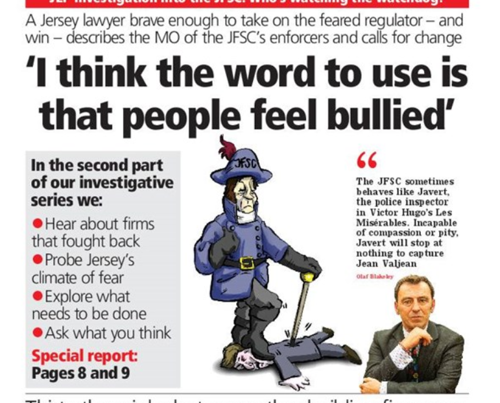

Advocate Blakeley, a Jersey lawyer who has represented a number of people and companies in legal battles with the regulator, compared the JFSC to sometimes behaving like Javert, the police inspector in Victor Hugo’s Les Misérables. Incapable of compassion or pity, Javert will stop at nothing to capture Jean Valjean.

“You had two sides that were absolutely convinced they were right and were willing to fight until the end,” he recalled.

It wasn’t the first time that Advocate Blakeley had taken the regulator to court and won. He also successfully overturned JFSC sanctions on the director of a financial advisory firm, Jeremy Leslie-Smith, who had been investigated and subsequently sanctioned by the JFSC despite being acquitted of fraud in Jersey’s Royal Court.

The JFSC never admitted fault in the case of Mr Leslie-Smith, who subsequently left the Island.

Mr Leslie-Smith did not respond to a request for comment, but Advocate Blakeley said that, for the JFSC, the case had “become an obsession”. Even when he was able to show direct evidence that he could not have committed the offence the JFSC had accused him of, the regulator’s enforcement division refused to drop the case against him.

“There is a dogged, sometimes irrational and unreasonable zealousness that causes the problems. I think the word to use is that people feel bullied. And so what then happens is there becomes an impasse. You just give in or it is pistols at dawn.”

Despite Advocate Blakeley’s battles with the JFSC, he is keen to point out that he has no axe to grind against the regulator – or against regulation in general. Enforcement is an essential part of policing the finance industry, which is always going to face the issue of bad actors. The problem is that it has often picked the wrong targets.

“I accept that the enforcement division have a difficult job. The people who are fraudsters – who have no intention of following best practice – are slippery fish,” he said.

“The problem is when it has been overzealous, and aimed its fire at members of the industry who are neither fraudsters nor people who fall below the standards. There are people who are not fit and proper, but I have represented people who have done nothing wrong.”

Yesterday, the JEP published the start of a multi-day series revealing the findings of a months-long investigation into the regulator’s use of public statements, when an individual or a company is named and shamed on the JFSC website. This newspaper heard from dozens of sources – mostly anonymous, due to fears of retribution – who had been issued with public statements and lost their careers.

One of the most egregious issues with the public statement process in Jersey is that – unlike in other jurisdictions, like Guernsey – individuals have no formal right of appeal other than to the Royal Court, which can be cripplingly expensive. Some who spoke to the JEP said that they had spent months and years begging the JFSC over email to remove their statements from the internet: some had been successful, most had not.

It is this lack of accountability that has led many in the industry to describe the regulator as “a law unto themselves” and as “judge, jury and executioner”.

Unlike the UK’s Financial Conduct Authority, the JFSC is not subject to freedom-of-information requests and has no requirement to disclose anything about either its budget or the measures that it takes and why it takes them.

The JEP has repeatedly requested information that would shine light on the issues raised by those who spoke about their experiences. All have been refused.

In a written response to multiple questions by the JEP following this investigation, the JFSC said it did not comment on individual cases.

In a statement, the regulator said: “The JFSC is scrutinised both locally and internationally, and more recently by MONEYVAL, a permanent monitoring body of the Council of Europe which assessed the Island’s compliance and effectiveness on international standards to counter money laundering and the financing of terrorism.”

It said that the use of public statements was “an essential and effective tool in fighting financial crime and their use in Jersey was recently endorsed by MONEYVAL”, and on enforcement, it said: “We have a demonstrable and public track record of actively pursuing a broad spectrum of appropriate enforcement activities of varying type, scope and entity size.

“Our enforcement team seeks to act firmly but fairly, playing a critical role in investigating and, where appropriate, instigating action against businesses or individuals who do not comply with legal and regulatory requirements. This includes cases of serious regulatory misconduct.”

The regulator’s refusal to accept fault is coupled with a refusal to give advice to companies and individuals that have genuine questions about how they are regulated, said Advocate Blakeley.

“My 100% experience of this is that the JFSC will not provide any regulatory advice – they refuse. You can say, ‘Should I do a) or b)?’ and they tell you, ‘We’re not here to give advice’.”

As a result, industry practitioners are reluctant to come to the JFSC with questions, lest they inadvertently provoke an investigation that could then cripple them financially. This is a key challenge for the JFSC, says Advocate Blakeley, because if firms and individuals are unwilling to engage with the regulator, there is more chance that serious issues arise.

“In a workplace, if you have the image of being a fair boss who deals with issues in a reasonable way, they are more likely to own up. But if they think the result could be massive sanctions or blackballing, they will hide their mistakes,” he said.

“And when they hide their mistakes, that’s when the danger starts.”

Few, if any, of those who spoke to the JEP over the past several months had an issue with the role of regulation and regulator in the finance industry – indeed, a number spoke positively of dealings with the UK’s Financial Conduct Authority. By contrast, experiences with the JFSC have been resolutely negative. And that, says Advocate Blakeley, surely says a lot.

The climate of fear in the Island surrounding the JFSC and the widespread criticism by the industry of its actions is not normal, said Advocate Blakeley.

“Lots of people complain about the JFSC, and not just those who have been driven out of town. There are people who are still working in the industry and who are terrified of going on the record, because they believe that if they do, there will be reprisals,” said the advocate.

“Now, that should never happen. If I was a regulator, I would really want to be liked by the people I regulate. Obviously not by the fraudsters and criminals, but by the industry at large.”

‘‘ There is a dogged, sometimes irrational and unreasonable zealousness that causes the problems. I think the word to use is that people feel bullied. And so what then happens is there becomes an impasse. You just give in or it is pistols at dawn

Advocate Olaf Blakeley

‘‘ The problem is when it has been overzealous, and aimed its fire at members of the industry who are neither fraudsters nor people who fall below the standards. There are people who are not fit and proper, but I have represented people who have done nothing wrong

Advocate Olaf Blakeley

Tomorrow

- We demand action to make the JFSC more open and accountable

What do you think?

- Contact Orlando Crowcroft in confidence at Orlando@allisland.media

- Take part in our survey: jerseyeveningpost.com/JFSCfeedback/ or scan the QR code below

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.