JERSEY LOW-RISK AML NOW IN THE LAW = Director [less TCB directors], the COOP, and Crown & Anchor

04/09/2024

Proceeds of Crime (Low-Risk Financial Services Business) (Jersey) Order 2024 comes into effect on September 10th.

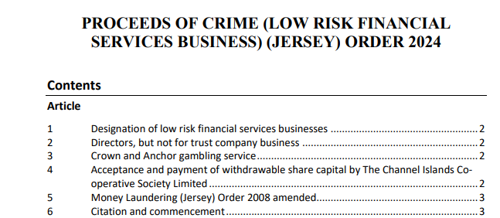

The Proceeds of Crime (Low-Risk Financial Services Business) (Jersey) Order 2024 is a recent legislative measure by the Jersey government that designates certain financial services activities as low-risk in terms of money laundering and terrorist financing. This order is part of Jersey’s efforts to align its financial regulations with international standards while ensuring that stringent anti-money laundering requirements do not unduly burden low-risk activities.

This order was made on September 3, 2024, and will come into force on September 10, 2024 - https://www.jerseylaw.je/laws/enacted/Pages/RO-050-2024.aspx

KEY POINTS OF THE ORDER:

The designation of Low-Risk Financial Services Businesses now includes Certain activities, such as:-

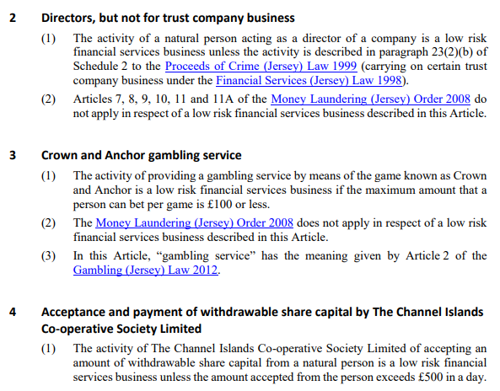

- acting as a director of a company (excluding trust company business)

- providing Crown and Anchor gambling services with a maximum bet of £100.00

- Channel Islands Co-operative Society: Activities involving accepting and paying withdrawable share capital by The Channel Islands Co-operative Society Limited, provided the amounts do not exceed £500 daily.

Please have a look below for more details.

ACTING AS A DIRECTOR OF A COMPANY (EXCLUDING TRUST COMPANY BUSINESS)

- You are now exempt from the following for those acting as a company director (excluding trust company business).

Proceeds of Crime (Low-Risk Financial Services Business) (Jersey) Order 2024 comes into effect on September 10th.

Money Laundering (Jersey) Order 2008 – 1 September 2023

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.