Jersey low risk directors - don’t forget there is still AML work to do.

05/09/2024

Following the news about The Proceeds of Crime (Low-Risk Financial Services Business) (Jersey) Order 2024 - made on September 3, 2024, and in force on September 10, 2024 - we found out that:-

- Low risk Directors, [but not for trust company business] do not need to apply Articles 7, 8, 9, 10, 11 and 11A of the Money Laundering (Jersey) Order 2008

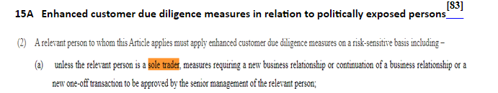

Along with these exemptions If you are a Jersey Sole trader director, you can apply.

Also, a Jersey Sole trader directors, you should also consider what the JFSC rules say.

The JFSC says:-

- Governance =

- a sole trader, “the board” will be the sole trader.

- Training =

- In the case of a supervised person who is a sole trader, that person must be aware of the enactments in Jersey relating to money laundering, the financing of terrorism, or the financing of proliferation and the AML/CFT/CPF Codes of Practice.

- In the case of a supervised person who is a sole trader, that person must be able to recognise and be aware of their obligations surrounding:

- Transactions carried out by, or on behalf of, a person who is, or appears to be, engaged in money laundering, the financing of terrorism, or the financing of proliferation.

- Other conduct that indicates a person is, or appears to be, engaged in money laundering, the financing of terrorism, or the financing of proliferation.

- A supervised person who is a sole trader may demonstrate that they are aware of relevant enactments and are able to recognise and are aware of their obligations surrounding transactions and other conduct where they have received formal training or through self-study.

In addition other rules to consider and apply appropriately are found here

- Section 1 - Introduction - tracked changes 4 September 2023

- Section 2 – Corporate governance - tracked changes 4 September 2023

- Section 3 - Identification measures - overview - tracked changes 4 September 2023

- Section 4 - Identification measures - finding out identity and obtaining evidence - tracked changes 4 September 2023

- Section 5 – Identification measures – reliance on obliged persons- tracked changes 4 September 2023

- Section 6 – Ongoing monitoring - tracked changes 4 September 2023

- Section 7 – Enhanced and simplified CDD measures - tracked changes 4 September 2023

- Section 8 – Reporting money laundering and terrorist financing activity- tracked changes 4 September 2023

- Section 9 - Screening, awareness and training of employees - tracked changes 4 September 2023

- Section 10 - Record keeping - tracked changes 4 September 2023

The above outlines what is required in the Money Laundering (Jersey) Order 2008 as follows.

Source https://www.jerseylaw.je/laws/current/Pages/08.780.30.aspx

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.