Jersey’s three significant legal and regulatory changes in 2022 and 2023 and one failure in 2024.

03/03/2025

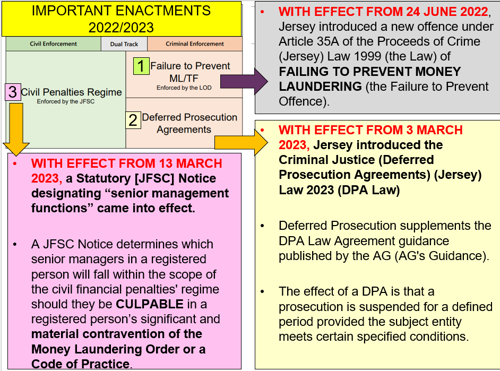

In Jersey, between 2022 and 2023, there were three significant legal and regulatory changes. These were as follows:-

- WITH EFFECT FROM 24 JUNE 2022, Jersey introduced a new offence under Article 35A of the Proceeds of Crime (Jersey) Law 1999 (the Law) of FAILING TO PREVENT MONEY LAUNDERING (the Failure to Prevent Offence).

- WITH EFFECT FROM 3 MARCH 2023, Jersey introduced the Criminal Justice (Deferred Prosecution Agreements) (Jersey) Law 2023 (DPA Law). Deferred Prosecution supplements the DPA Law Agreement guidance published by the AG (AG's Guidance). The effect of a DPA is that a prosecution is suspended for a defined period, provided the subject entity meets certain specified conditions.

- WITH EFFECT FROM 13 MARCH 2023, a Statutory [JFSC] Notice designating “senior management functions” came into effect. A JFSC Notice determines which senior managers in a registered person will fall within the scope of the civil financial penalties' regime should they be CULPABLE in a registered person’s significant and material contravention of the Money Laundering Order or a Code of Practice.

These updates reflect Jersey’s ongoing commitment to maintaining a robust financial regulatory environment.

The "Failure to Prevent" offence increases corporate accountability, DPAs provide a flexible enforcement mechanism, and the JFSC notice reinforces personal responsibility among senior managers. Affected entities should promptly align their compliance frameworks with these changes to mitigate risks and ensure adherence to Jersey’s evolving standards. [MORE INFO ON THESE ARE BELOW]

WHO HAS FAILED THE ABOVE

- NO FAILS—Failure to Prevent Money Laundering: No prosecutions or fines were confirmed, possibly due to enforcement priorities or evidential challenges.

- NO FAILS—Senior Management Functions: No fines or prosecutions were recorded against individuals, though the regime is active and could be used later.

- X1 FAIL = DEFERRED PROSECUTION AGREEMENTS: ONE INSTANCE—, THE FIRST UNDER THE NEW LAW.

OVERALL ASSESSMENT

- Given the short timeframe since these laws took effect (less than two years for the 2023 updates), enforcement may still ramp up. The Afex DPA is the only concrete outcome so far.

MORE INFO:- Briefing: Key Legislative Updates in Jersey – Financial Crime and Regulatory Enforcement (2022–2023)

This briefing outlines three significant updates to Jersey’s legal and regulatory framework concerning financial crime and compliance, effective between 2022 and 2023. These changes strengthen Jersey’s anti-money laundering (AML) regime, enhance prosecutorial flexibility, and increase accountability for senior managers in regulated entities.

1. Introduction of the "Failure to Prevent Money Laundering" Offence

Effective Date: 24 June 2022

Legislation: Article 35A of the Proceeds of Crime (Jersey) Law 1999

Overview: Jersey has introduced a new corporate offence, "Failing to Prevent Money Laundering" under Article 35A. This provision targets entities that fail to implement adequate systems and controls to prevent money laundering activities within their operations. The offence aligns Jersey with jurisdictions like the UK, which have similar "failure to prevent" models (e.g., bribery or tax evasion). It shifts the burden onto organisations to demonstrate proactive compliance, with potential penalties for non-compliance, including fines or reputational damage.

Implications: Businesses must review and strengthen their AML policies to mitigate liability risks under this strict liability framework.

2. Criminal Justice (Deferred Prosecution Agreements) (Jersey) Law 2023

Effective Date: 3 March 2023

Legislation: Criminal Justice (Deferred Prosecution Agreements) (Jersey) Law 2023 (DPA Law), supplemented by Attorney General’s Guidance

Overview: The DPA Law introduces Deferred Prosecution Agreements (DPAs) as an alternative to traditional prosecution for corporate entities involved in financial misconduct. Under a DPA, prosecution is suspended for a defined period, contingent on the entity meeting specific conditions—such as paying penalties, implementing compliance reforms, or cooperating with authorities. The Attorney General’s Guidance clarifies the application and negotiation of DPAs.

Implications: DPAs offer a balanced approach, encouraging self-reporting and remediation while avoiding the collateral consequences of full prosecution. Entities should assess their exposure to financial crime risks and consider DPAs a strategic resolution tool.

3. JFSC Statutory Notice on Senior Management Functions

Effective Date: 13 March 2023

Legislation: Statutory Notice issued by the Jersey Financial Services Commission (JFSC)

Overview: The JFSC has designated certain "senior management functions" within registered persons (e.g., financial institutions) as falling under the civil monetary penalties regime. This notice identifies which senior managers may be personally liable for significant and material contraventions of the Money Laundering Order or a JFSC Code of Practice, provided they are deemed culpable. Penalties could include fines or restrictions on holding senior roles.

Implications: This enhances individual accountability, compelling senior managers to prioritise compliance oversight. Firms should ensure a clear delineation of responsibilities and robust training for those in designated roles.

Conclusion

These updates reflect Jersey’s ongoing commitment to maintaining a robust financial regulatory environment. The "Failure to Prevent" offence increases corporate accountability, DPAs provide a flexible enforcement mechanism, and the JFSC notice reinforces personal responsibility among senior managers. Affected entities should promptly align their compliance frameworks with these changes to mitigate risks and ensure adherence to Jersey’s evolving standards.

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.