Jersey SARS - SANCTION SARS – DATA AND TOUCHPOINTS IN 2024

09/02/2025

The JFIU have published our Suspicious Activity Report (SAR) Statistics for 2024 Q4, which can be read here:

- https://go.fiu.je/2024Q4

- https://cdn.prod.website-files.com/6464df252c82010a0d5f893f/679ce03eeb33bcc813bbe9da_20250125_1035_V1%20FIU%20SAR%20Q4%202024%20Report.pdf

KEY HIGHLIGHTS FROM THIS REPORT ARE HERE:

SUMMARY OF JFIU SANCTION COMMENTARY

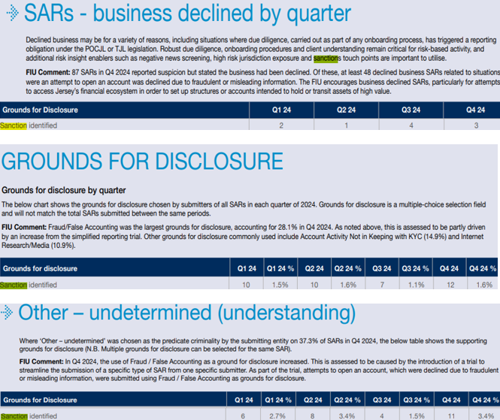

- The following is a summary of the FIU comments and “SANCTION IDENTIFIED DATA AND SANCTION TOUCH POINTS”, as reported in the latest Suspicious Activity Report (SAR) Statistics for the 2024 Q4 report.

- This COMSURE summary encapsulates the essence of SANCTION-IDENTIFIED DATA AND SANCTION TOUCH POINTS as integral components in the fight against financial crime, reflecting the necessity for vigilance and compliance in today's complex economic landscape.

JFIU OVERVIEW

- Sanction-identified data is crucial in financial crime prevention and compliance. It pertains to identifying individuals, entities, or countries subject to sanctions imposed by various regulatory bodies.

- Including sanctions touch points in Suspicious Activity Reports (SARs) assists financial institutions and designated businesses in recognising and mitigating the risks associated with these sanctions.

JFIU SANCTION IDENTIFIED DATA

- Sanction-identified data refers to information regarding:

- Individuals and Entities: Those who are directly named on sanction lists, which may include government officials, business executives, and organizations involved in illegal activities.

- Countries: Nations subject to comprehensive sanctions due to political unrest, human rights violations, or involvement in terrorism.

- Importance of Identifying Sanctions

- Risk Mitigation: Identifying individuals and entities on sanction lists helps financial institutions avoid transactions that could potentially involve illicit activities, thus protecting their operations and reputation.

- Compliance: Adhering to sanction regulations is mandatory for financial institutions to avoid penalties and legal repercussions.

- Enhanced Due Diligence: Organizations must conduct thorough checks and balances to ensure they do not engage in transactions with sanctioned entities.

JFIU SANCTION TOUCH POINTS

- Sanction touch points refer to critical junctures in the transaction process where sanctions-related data is assessed:

- Client Onboarding: During the initial stages of client interaction, institutions must verify whether the individual or entity is on any sanction lists.

- Transaction Monitoring: Continuous monitoring of transactions is crucial. Any flagged transactions that involve sanctioned entities should be reviewed and reported.

- Ongoing Due Diligence: Regular checks against updated sanction lists are necessary to ensure continuous compliance, especially as new sanctions can be imposed or existing ones can be lifted.

- Examples of Sanction Touch-Points

- Negative News Screening: Institutions may implement tools that flag negative news articles about potential clients or transactions that could indicate sanction risks.

- Jurisdictional Awareness: Awareness of high-risk jurisdictions commonly associated with sanctions can guide institutions' risk assessments and decision-making processes.

THE DATA IS HERE

COMSURE CONCLUSION

- Identifying sanctions and establishing sanction touchpoints are critical for financial institutions to combat economic crime.

- By thoroughly understanding and integrating these elements into their compliance frameworks, organisations can enhance their ability to detect and prevent illicit activities, safeguard their interests, and uphold regulatory standards.

- Sanction risk exists as shown above – beware and make sure your screening solution works properly

COMSURE SCREENING SOLUTION

- Comsure has an AML screening system that supports automatic name transposition, and it can be run every night and embedded into your Customer Risk Assessments [CRA].

WANT TO KNOW MORE – CALL MATHEW

- Mathew Beale - Chartered FCSI

- Principal & Director - Comsure Compliance Limited, Comsure Technology Limited, Comsure Mauritius (the "Comsure Group of Companies")

- mathewbeale@comsuregroup.com

- T (Jersey) +44 1534 733-588 /+44 7797 747-490

- T (Mauritius) +230 214-6487 / +230 5717-6907

Source

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.