JFSC 2023 examination feedback on countering the financing of terrorism and proliferation financing [“TF/PF.”]

03/10/2024

The JFSC has issued its 2023 examination feedback on countering terrorist financing (TF) and counter-proliferation financing (PF), collectively referred to as “TF/PF.”

Throughout 2023, the JFSC conducted a comprehensive assessment to gauge the effectiveness of measures implemented by supervised persons in countering “TF/PF.”

The assessment was made up of:-

- A questionnaire and

- Selected on-site visits

THE VISIT QUESTIONNAIRE

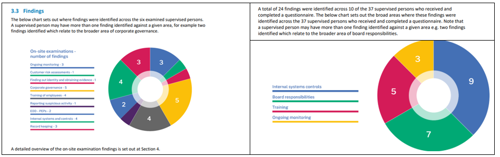

- In the first half of 2023, 43 supervised persons completed a questionnaire about their

- Corporate governance arrangements

- Internal systems and controls (including policies and procedures)

- Training related to TF/PF

- The supervised persons who received questionnaires represented a diverse cross-section of the industry, ranging from designated non-financial business professionals (DNFBPs) to banking, fund services, and trust company businesses, demonstrating the broad scope of the JFSC assessment.

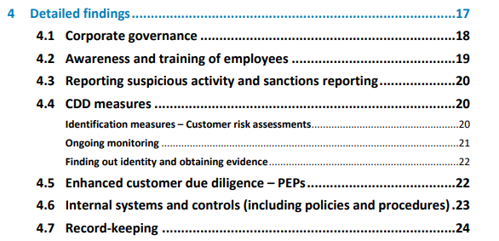

- Following the completed questionnaires, a sample of six supervised persons was selected for an on-site examination.

- The supervisory risk data available to the JFSC determined the selection process and on-site examinations took place in the third quarter of 2023

- The questionnaire responses of each supervised person informed the reviews conducted during the on-site activity, ensuring a comprehensive evaluation.

- The report's Section 4 provides a detailed overview of the comprehensive and reliable examination findings. A summary is also provided in Section 3, which ensures a thorough understanding of the findings.

DETAILED FINDINGS [4]

DEFINITION - “MONEY LAUNDERING” INCLUDES TF AND PF.

- Wherever this feedback refers to “money laundering” when quoting the requirements of the Money Laundering Order, this should be read to include TF and PF.

- The definition of “money laundering” detailed under Article 1 of the Proceeds of Crime (Jersey) Law 1999 (POCL) includes conduct which is an offence under

- The Terrorism (Jersey) Law 2002.

- Furthermore, the definition of “money laundering” detailed under Article 37 of POCL includes conduct which is an offence under any provision of

- The Sanctions and Asset-Freezing (Jersey) Law 2019 (SAFL) or

- Any provision of an order made under Article 3 of SAFL, capturing the relevant UN and UK sanctions regimes related to proliferation and proliferation financing.

- Therefore, terrorist financing and proliferation financing are deemed to be captured within the definition of “money laundering” set out within the Money Laundering Order.

BACKGROUND INFORMATION HIGHLIGHTED BY THE JFSC

MANAGEMENT AND CONTROL

- TF/PF risk and the linked risk of facilitating sanctions evasion must be identified and managed throughout a supervised person’s business operation.

- This includes, but is not limited to:

- Documenting its TF/PF risk exposure in a business risk assessment (BRA)

- Maintaining adequate and effective systems and controls which cover TF/PF at the appropriate points

- Assessing the risk of a business relationship involving TF/PF

- Monitoring for potential TF/PF activity

- Delivering adequate training to employees

LEGAL AND REGULATORY

- Legislative requirements concerning TF/PF controls are set out in

- The Money Laundering (Jersey) Order 2008 (the Money Laundering Order).

- Regulatory requirenets are captured in the JFSC

- Handbook for the prevention and detection of money laundering, the countering of terrorist financing, and the countering of proliferation financing (the handbook).

- Obligations in the relevant Codes of Practice may also apply to TF/PF controls.

SOURCES

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.