JFSC Enforcement – you can NOW choose your reporting professional consultant

29/10/2025

The JFSC will continue to name up to three pre-approved consultants in enforcement notices issued under the Financial Services (Jersey) Law 1998 (FSJL).

However, the GOOD NEWS is that Firms may now propose their own appointee, provided they demonstrate:

- Equivalent expertise to JFSC-nominated consultants.

- No material conflicts of interest.

- Prompt submission of the proposal.

The JFSC says

Source:

- JFSC Regulatory Consultants Seminar – Strengthening Collaboration (2024)

- https://www.jerseyfsc.org/news-and-events/strengthening-collaboration-insights-from-the-regulatory-CONSULTANTS-seminar/

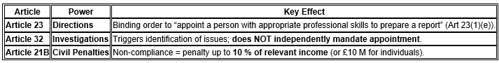

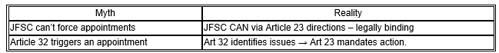

Legal Basis

- The JFSC’s power to require appointment of an external professional at the firm’s expense derives from supervisory and investigative powers under the FSJL.

- Source: Consolidated FSJL (26 Feb 2024) https://www.jerseylaw.je/laws/current/PDFs/L_32_1998_20240226.pdf

- Clarification: JFSC cannot compel appointment under Article 32 alone; it does so via legally enforceable directions under Article 23.

JFSC ENFORCEMENT POLICY

Source: JFSC – Our Approach to Enforcement (2023) https://www.jerseyfsc.org/media/8105/our-approach-to-enforcement.pdf

- External reviews ensure independent assurance.

- JFSC prefers collaboration but imposes when required.

- Consultants are named publicly for transparency and deterrence.

JFSC sector-specific Codes (e.g., Trust Company Business, Investment Business) mandate:

- Full cooperation with investigations.

- Facilitation of independent reviews when directed.

- Prompt remediation under oversight.

Practical Triggers for External Appointment - JFSC typically mandates external reviewers when:

- Breach of Codes = breach of registration → enforcement trigger.

- Board/management conflict undermines internal credibility.

- Compliance team lacks capacity or independence.

- Complex forensic, AML/CFT, or governance issues require specialist skills.

- Independent verification of remediation is needed before lifting restrictions.

Executive Summary

BOTTOM LINE:

- Material compliance gaps = mandatory independent review at your cost.

Your options:

- Accept one of JFSC’s three named consultants, OR

- Propose your own (with evidence of expertise + no conflicts). e.g. COMSURE WWW.COMSUREGROUP.COM

Non-compliance consequences:

- Civil penalties (up to 10 % revenue)

- Public censure

- Licence restrictions/revocation

KEY SOURCES

- FS(J)L Article 23 (Directions): https://www.jerseylaw.je/laws/current/Pages/13.225.aspx#Art23

- Commission Law Article 21B (Penalties): https://www.jerseylaw.je/laws/current/l_11_1998#Art21B

- https://www.jerseyfsc.org/about-us/our-teams/enforcement/

- https://www.jerseyfsc.org/news-and-events/strengthening-collaboration-insights-from-the-regulatory-CONSULTANTS-seminar/

Related guidance and policy

- Decision-making process https://www.jerseyfsc.org/industry/guidance-and-policy/decision-making-process/

- Regulatory Settlements https://www.jerseyfsc.org/industry/guidance-and-policy/regulatory-settlements/

- Integrity and competence https://www.jerseyfsc.org/industry/guidance-and-policy/integrity-and-competence/

- Making a referral to the police and/or the Attorney General https://www.jerseyfsc.org/industry/guidance-and-policy/making-a-referral-to-the-police-and-or-the-attorney-general/

- Handbook on international co-operation and information exchange https://www.jerseyfsc.org/industry/international-co-operation/handbook-on-international-co-operation-and-information-exchange/

- Our approach to Enforcement https://www.jerseyfsc.org/industry/guidance-and-policy/our-approach-to-enforcement/

Civil financial penalties methodology - natural persons

- Civil financial penalties on natural persons - methods for determining the amount https://www.jerseyfsc.org/industry/guidance-and-policy/civil-financial-penalties-on-natural-persons/

Civil financial penalties methodology- registered persons

- Civil financial penalties on Registered Persons - methods for determining the amount https://www.jerseyfsc.org/industry/guidance-and-policy/civil-financial-penalties-on-registered-persons/

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.