JFSC SUPERVISION UPDATE FOR FEB/MARCH 2025

06/03/2025

In FEBRUARY, the JFSC actioned the following :

- 2025 business plan = https://www.jerseyfsc.org/publications/business-plans/business-plan-2025/

- consumer credit working groups industry update = https://www.jerseyfsc.org/news-and-events/join-our-next-round-of-consumer-credit-working-groups/

- Non-profit organisations newsletter = https://preview.mailerlite.com/j7v0t0f4f8

Also, in other FEBRUARY news (FOR ALL NEWS GO HERE https://www.jerseyfsc.org/#updates_news)

- 24 February 2025 = Countries and territories in AML/CFT/CPF Handbook appendices updated – 21 February 2025

- Industry update | 21 February 2025 = Jersey introduces director disqualification sanctions

- Industry update | 20 February 2025 = Accessing the Obliged Entity Beneficial Owner register

- Industry update | 10 February 2025 = Submit your 2025 regulatory fee information by Friday 14 February

- Industry update | 07 February 2025 = Obliged Entity Beneficial Owner register – legislation and access overview sessions

Looking ahead into MARCH

- The JFSC will be publishing

- Bitesize feedback on diversion risk for non-profit organisations.

- The JFSC will also continue the JFSC thematic assessment work for:

- Investment business – fees charges and commissions

- Trust company service providers and fund services businesses – ongoing monitoring

- The JFSC are conducting a short, voluntary survey on corporate sustainability,

- https://www.jerseyfsc.org/news-and-events/our-corporate-sustainability-disclosure-usage-survey/

- Which is open until 6 March and the JFSC

- JFSC will be finalising discussions with subsidiary banks regarding Basel 3.1 as the JFSC assess the impact of UK delays on the JFSC own roadmap.

- On 25 March, the JFSC will be hosting an NPO drop-in session, an opportunity to ask questions and receive guidance.

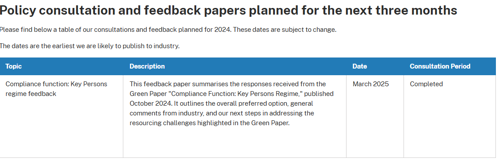

- Also, an update on the Green Paper "Compliance Function: Key Persons Regime," published October 2024 is expected in March

SOURCES

https://www.jerseyfsc.org/news-and-events/watch-supervision-monthly-update-march-2025/

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.