Know your Russian sanction red flags

10/03/2022

It is less than two weeks since sanctions and export control against the Russian government for its invasion of Ukraine, “all financial institutions” are on notice to “be vigilant” against potential sanctions evasion activity

To help all employees spot a sanction risk, they should be aware of “Red Flag indicators” that Russia, and related parties, may use to evade sanctions,

- These red flags can include:

- Use of corporate vehicles and shell companies to obscure ownership, source of funds, or for international wire transfers

- Use of third parties to shield the identity of sanctioned persons or to hide the origin or ownership of funds

- Opening or misuse of accounts in jurisdictions or with financial institutions experiencing a sudden rise in the value of transfers

- Opening of new accounts that attempt to send or receive funds from a sanctioned Russian bank or those removed from the Society for Worldwide Interbank Financial Telecommunication (SWIFT)

- Non-routine foreign exchange transactions that may involve sanctioned Russian banks

- Transactions connected to virtual currency addresses listed by OFAC and other sanction bodies, e.g. UK/EU/UN

- Use of virtual currency exchanges or MSBs in high-risk jurisdictions

Why This Matters:

- Russian sanctioned persons may seek to evade western sanctions through various means, including facilitating trade and anonymizing their activities through non-sanctioned financial institutions, front companies, and non-sanctioned businesses and associates outside of Russia.

- The U.S. advisory also calls on financial institutions to “consider how the use of innovative tools and solutions may assist in identifying hidden Russian and Belarusian assets.”

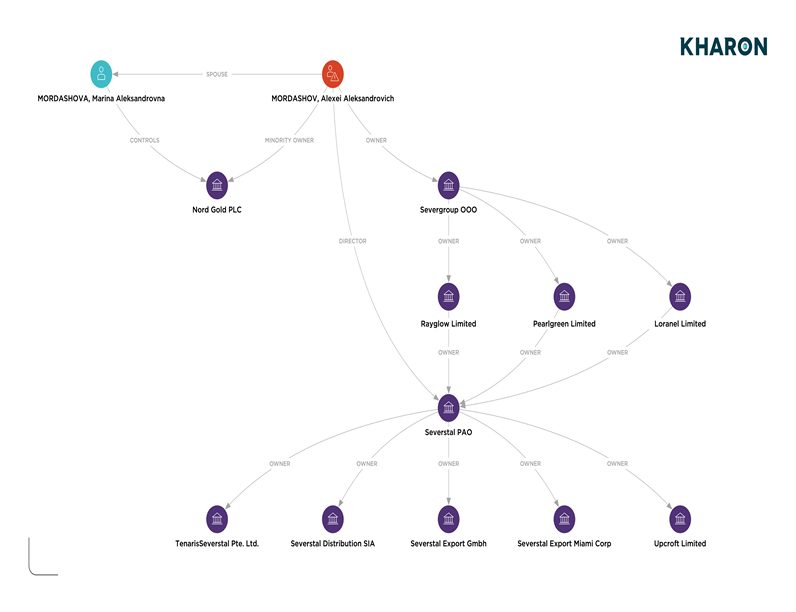

50% Expanded Risk In Focus: Alexei Aleksandrovich Mordashov hiding behind 50% rule

- Recently sanctioned Russian oligarch Alexei Aleksandrovich Mordashov holds a majority stake in export companies based in Europe, Asia, and the U.S. through his ownership of Severstal PAO in Russia, according to corporate records and publicly available financial disclosures reviewed by Kharon. On February 28th, Mordashov was sanctioned by the European Union for “benefiting from his links with Russian decision-makers” responsible for the annexation of Crimea and the destabilization of Ukraine.

- Mordashov owns more than a 50 per cent stake in

- Holding companies registered in Cyprus that, in the aggregate, own a majority of Severstal PAO.

- None of these companies is sanctioned.

But we cannot ignore the sanctioned by extension rules

Check out the ownership as shown by KHARON

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.