MAT SAYS:- I’m advocating for a Twin Peaks Supervisory Model for Jersey's VASPs [blog 2]

06/11/2025

ON the 2nd of October 2025, I sat on a panel at the Jersey Annual Digital Asset Summit 2025. On the panel, I made the case for TWIN PEAK supervision of Jersey VASPs.

This is my second blog on the matter of TWIN PEAK supervision of Jersey VASPs.

In this second blog, I want to expand on my thinking about the Twin Peaks Supervisory Model.

Twin Peaks Supervisory Model Executive Summary

- Current Framework Falls Short: Jersey's supervision of Virtual Asset Service Providers (VASPs) primarily emphasises anti-money laundering (AML), countering the financing of terrorism (CFT), and counter-proliferation financing (CPF) under Schedule 2 of the Proceeds of Crime (Jersey) Law 1999 (POCL), offering limited oversight on broader risks like financial stability or fair customer treatment. This single-peak approach may leave investors exposed in a rapidly evolving digital asset sector.

- Twin Peaks as a Solution: Integrating VASPs into the Financial Services (Jersey) Law 1998 (FS(J)L) as a defined financial service could establish a twin peaks model, separating prudential regulation (focusing on financial soundness) from conduct oversight (ensuring market integrity and consumer protection), similar to successful implementations in Australia and South Africa.

- Potential Benefits for Investors: This shift could enhance confidence through mandatory requirements like capital reserves, client asset segregation, and complaint handling, addressing gaps in the current AML/CTF/CPF-centric regime and aligning Jersey with global best practices.

- Balanced Perspective: While the existing model supports innovation with light-touch elements, evidence from other jurisdictions suggests twin peaks can foster growth without stifling it. However, implementation would require careful calibration to avoid over-regulation.

Understanding the Current Single-Peak Model

Jersey's VASP regulation, managed by the Jersey Financial Services Commission (JFSC), centres on AML/CFT/CPF compliance.

As of September 2025, there are 13 registered VASPs, up from just 3 in 2022, reflecting sector growth but under a framework that prioritises crime prevention over comprehensive investor safeguards. Key obligations include customer due diligence (CDD), ongoing monitoring, and the appointment of compliance officers, but there are no enforced prudential standards, such as minimum capital or insurance.

The Case for Twin Peaks Integration

A twin peaks model would add VASPs to FS(J)L, creating dual oversight: one peak for stability (e.g., ensuring firms can withstand shocks) and another for conduct (e.g., fair treatment and transparency). This could build on Jersey's proactive stance, as seen in recent 2025 AML/CTF/CPF handbook enhancements, while also filling gaps. Investors might gain remedies such as asset protection in the event of firm failure, which the current regime lacks.

Why Now?

With digital assets booming, Jersey's VASP sector is evolving amid global scrutiny; the island risks lagging if it doesn't keep pace. Adopting twin peaks could position Jersey as a secure hub, attracting ethical innovation without compromising its reputation for robust finance.

In the dynamic world of digital assets, Jersey has positioned itself as a forward-thinking jurisdiction, blending innovation with regulatory prudence. Yet, as highlighted in BLOG 1, the current supervisory model for Virtual Asset Service Providers (VASPs) may not fully equip investors with the protections they deserve in this high-stakes arena.

This blog explores the case for transitioning from Jersey's existing single-peak AML/CFT/CPF-focused oversight to a twin-peak supervisory model by incorporating VASPs into the Financial Services (Jersey) Law 1998 (FS(J)L).

Drawing on global examples, regulatory comparisons, and sector insights, we'll examine why this shift could enhance investor confidence, promote market integrity, and sustain Jersey's competitive edge in digital finance.

The Foundations of Jersey's Current VASP Regulation

Jersey's approach to VASPs is rooted in anti-financial crime measures, primarily under Schedule 2 of the Proceeds of Crime (Jersey) Law 1999 (POCL). This framework, aligned with the Financial Action Task Force (FATF) standards, requires VASP entities that conduct exchanges, transfers, safekeeping, or related services for virtual assets to register with the JFSC and comply with stringent AML/CFT/CPF obligations. As detailed in the JFSC's Guidelines on Interpretation of Schedule 2 Business (updated October 2023), these include maintaining policies for customer due diligence (CDD), ongoing transaction monitoring, filing Suspicious Activity Reports (SARs), and appointing a Money Laundering Reporting Officer (MLRO) and Money Laundering Compliance Officer (MLCO).

This single-peak model, in which the JFSC oversees all aspects through an AML/CTF/CPF lens, has been effective in mitigating money laundering risks. The 2024 Virtual Asset Service Providers National Risk Assessment rated the sector as medium-high risk due to its growth and transnational nature, but commended Jersey's registration system for enhancing traceability. By September 2025, the number of registered VASPs had grown to 14, indicating increasing adoption while maintaining compliance focus, according to the JFSC's public registry.

However, this regime's scope is narrow. It prioritises preventing illicit flows over ensuring financial soundness or fair conduct. For instance, there's no mandatory requirement for VASPs to hold capital reserves against operational risks or segregate client assets to protect them in insolvency scenarios. Recent updates, such as the June 2025 consultation on AML/CFT/CPF handbook enhancements, have strengthened risk-based supervision but still operate within this limited framework.

Critics argue that this "light-touch" oversight of non-AML/CTF/CPF matters leaves investors vulnerable, especially as digital assets like stablecoins and tokenised real-world assets (RWAs) blur the lines with traditional finance.

Demystifying the Twin Peaks Model

The twin peaks regulatory model, first proposed by economist Michael Taylor in 1995, divides supervision into two distinct "peaks":

- One for prudential regulation (ensuring financial stability and resilience) and

- Another for conduct of business (protecting consumers and maintaining market integrity).

Unlike institutional models that regulate based on entity type (e.g., banks vs. insurers) or integrated models with a single regulator, twin peaks allow specialised focus, reduce conflicts of interest, and enable proactive interventions.

- Australia pioneered this in 1998, with the Australian Prudential Regulation Authority (APRA) handling stability and the Australian Securities and Investments Commission (ASIC) overseeing conduct.

- South Africa adopted it in 2018 through the Financial Sector Regulation Act, creating the Prudential Authority (PA) and the Financial Sector Conduct Authority (FSCA), and emphasising outcomes-based regulation to foster fair, efficient markets.

- The Netherlands follows a similar structure, with the Dutch Central Bank for prudential matters and the Authority for Financial Markets for conduct, addressing coordination through joint protocols.

In the context of VASPs, Twin Peaks offers tailored benefits. It allows regulators to address crypto-specific risks such as smart contract vulnerabilities and liquidity shocks while applying proven standards from traditional finance. For example, South Africa's model has integrated crypto under the FSCA's conduct rules, requiring VASPs to adhere to licensing, disclosure, and consumer protection standards beyond mere AML/CTF/CPF.

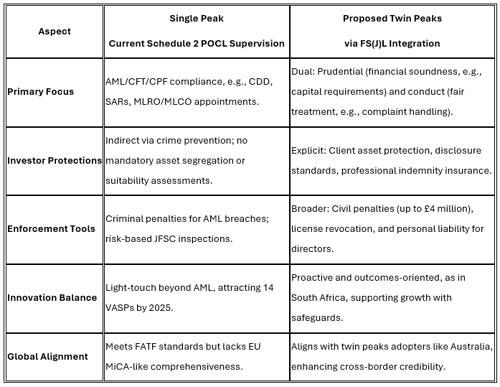

Comparing Current vs. Proposed Models: A Tabular Overview

To illustrate the gaps and potential gains, consider this comparison between Jersey's current single-peak AML/CTF/CPF-focused supervision and a proposed twin peaks integration under FS(J)L:

This table underscores how FS(J)L's existing codes for investment business, including fit-and-proper tests, governance, and financial resources, could extend to VASPs, creating a more robust regime without reinventing the wheel.

Arguments for Adoption in Jersey

Proponents argue that Jersey's VASP sector, while compliant with FATF as reflected in the 2023 Mutual Evaluation Report, could benefit from twin peaks to address emerging risks identified in the 2024 NRA update. Benefits include:

- Enhanced Investor Security: Twin Peaks would mandate prudential elements like liquidity buffers and insurance, protecting against firm failures, which are crucial in volatile crypto markets. As seen in Australia, this separation enables targeted consumer remedies, such as dispute-resolution mechanisms.

- Market Integrity and Growth: By clarifying conduct rules (e.g., fee transparency, treating customers fairly), the model could reduce fraud risks while attracting reputable players. Jersey's 2025 emphasis on digital asset adoption, as noted in industry insights, aligns with this, potentially boosting capital flows.

- Global Competitiveness: Jurisdictions like Hong Kong and Kenya have integrated VASPs into broader frameworks in 2023-2025, offering licensing regimes that balance innovation and protection. Jersey, with its zero-tolerance for misconduct, could lead offshore centres by adopting twin peaks, as suggested by comparisons with Mauritius.

- Proactive Risk Management: The model's outcomes focus, as in South Africa's FSCA, enables forward-looking supervision, addressing VASP-specific issues like oracle manipulation or governance capture.

Counterarguments exist:

- Some view the current model as sufficiently agile, avoiding burdensome rules that might deter startups.

- However, the FATF's emphasis on comprehensive VASP oversight, combined with Jersey's 2022-2023 regime expansions (e.g., Travel Rule guidance), suggests room for evolution without stifling growth.

Potential Implementation Pathways

To enact this, Jersey could amend FS(J)L to define VASPs as an "investment business" subcategory, leveraging existing codes of practice. The JFSC could maintain unified administration, but with internal peaks for prudential and conduct teams, similar to the Netherlands. A phased rollout, starting with larger VASPs, could minimise disruption, informed by stakeholder consultations such as the 2025 AML/CTF/CPF enhancements.

In conclusion

While Jersey's single-peak model has served well, integrating VASPs into FS(J)L to achieve a twin-peak approach could provide the full confidence investors seek.

As global regulations tighten, this evolution would safeguard users, bolster resilience, and cement Jersey's role in ethical digital finance.

KEY SOURCES

- VASP Regulation in Jersey and Mauritius https://www.comsuregroup.com/news/vasp-regulation-in-jersey-and-mauritius-is-mauritius-leading-the-way/

- Virtual Asset Service Providers National Risk Assessment (2024) https://www.gov.je/Industry/Finance/FinancialCrime/NationalRiskAssesmnents/pages/vaspnationalriskassessment.aspx

- Crypto Corner: Capital flows are the lifeblood of Jersey https://jerseyeveningpost.com/business/2025/11/05/crypto-corner-capital-flows-are-the-lifeblood-of-jersey/

- Consultation on proposed enhancements to the AML/CFT/CPF Handbook https://www.jerseyfsc.org/media/rbynfdur/consultation-on-proposed-enhancements-to-the-aml-cft-cpf-handbook.pdf

- Doing it the Australian Way, 'Twin Peaks' and the Pitfalls in Between https://clsbluesky.law.columbia.edu/2016/03/31/doing-it-the-australian-way-twin-peaks-and-the-pitfalls-in-between-2/

- The twin peaks model of financial regulation and reform in South Africa https://www.tandfonline.com/doi/full/10.1080/17521440.2017.1447777

- Financial regulation: Is Australia's 'twin peaks' model a successful export? https://www.lowyinstitute.org/the-interpreter/financial-regulation-australia-s-twin-peaks-model-successful-export

- Twin Peaks model of financial regulation https://bowmanslaw.com/insights/twin-peaks-model-financial-regulation/

- The Philosophy behind Twin Peaks https://www.fsca.co.za/TPNL/1/FSB/thephilosophy.html

- Is "Twin Peaks" the future of financial supervision? https://www.youtube.com/watch?v=cVxJDfC75NQ video

- Financial supervisory architecture: what has changed after the crisis? https://www.bis.org/fsi/publ/insights8.pdf

- Implementing a twin peaks model of financial regulation in South Africa https://www.treasury.gov.za/default.aspx

- Digital Asset Growth and Regulation https://www.jerseyfinance.com/insights/digital-asset-growth-and-regulation/

- Virtual Assets – Industry Update https://www.jerseyfsc.org/media/5971/presentation-virtual-assets-digital-jersey-13102022.pdf

- An overview of the regulation of virtual assets in Jersey https://charltonsquantum.com/wp-content/uploads/docs/jersey-crypto-guide.pdf [a few errors in this document]

- Global Legal Insights Fintech 2024: Jersey chapter https://www.walkersglobal.com/en/Insights/2024/09/Global-Legal-Insights-Jersey-Chapter

- Read our Travel Rule guidance for virtual asset service providers https://www.jerseyfsc.org/news-and-events/read-our-travel-rule-guidance-for-virtual-asset-service-providers-vasps/

- A tale of two jurisdictions: Contrasting cryptocurrency regulations https://www.sciencedirect.com/science/article/pii/S2949791425000260

- The COFI Bill: What Financial Institutions Need to Know https://www.afriwise.com/blog/the-cofi-bill-what-financial-institutions-need-to-know

- The future of New Zealand's financial services regulatory regime https://www.minterellison.co.nz/insights/financial-services-the-case-for-reform

- The Philosophy behind Twin Peaks https://www.fsca.co.za/TPNL/1/FSB/thephilosophy.html

- Cryptocurrency & Blockchain: When Do the Benefits Outweigh the Risks https://www.lexisnexis.com/community/insights/legal/practical-guidance-journal/b/pa/posts/cryptocurrency-blockchain-when-do-the-benefits-outweigh-the-risks

- Consultation paper on policy proposals for crypto assets https://www.sars.gov.za/wp-content/uploads/Legal/DiscPapers/LAPD-LPrep-DP-2019-01-CAR-WG-Consultation-paper-on-crypto-assets_final.pdf

- Guidelines on the Interpretation of Schedule 2 Business https://www.jerseyfsc.org/media/7104/guidelines-on-interpretation-031023.pdf

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.