MAT SAYS:- Investor protection in Jersey VASPs needs a TWIN PEAK supervision model, not what we have now.

06/11/2025

MAT SAYS:- Investor protection in Jersey VASPs needs a TWIN PEAK supervision model, not what we have now.

Introduction

- ON the 2nd of October 2025, I sat on a panel at the Jersey Annual Digital Asset Summit 2025. On the panel, I made the case for TWIN PEAK supervision of Jersey VASPs.

- My panel ideas advocated for a Twin Peaks Supervisory Model for Jersey's VASPs; I highlighted

- Current Framework Falls Short: Jersey's supervision of Virtual Asset Service Providers (VASPs) primarily emphasises anti-money laundering (AML), countering the financing of terrorism (CFT), and counter-proliferation financing (CPF) under Schedule 2 of the Proceeds of Crime (Jersey) Law 1999 (POCL), offering limited oversight on broader risks like financial stability or fair customer treatment. This single-peak approach may leave investors exposed in a rapidly evolving digital asset sector.

- Twin Peaks as a Solution: Integrating VASPs into the Financial Services (Jersey) Law 1998 (FS(J)L) as a defined financial service could establish a twin peaks model, separating prudential regulation (focusing on financial soundness) from conduct oversight (ensuring market integrity and consumer protection), similar to successful implementations in Mauritius, Australia and South Africa.

- Potential Benefits for Investors: This shift could enhance confidence through mandatory requirements like capital reserves, client asset segregation, and complaint handling, addressing gaps in the current AML-centric regime and aligning Jersey with global best practices.

- Balanced Perspective: While the existing model supports innovation with light-touch elements, evidence from other jurisdictions suggests twin peaks can foster growth without stifling it. However, implementation would require careful calibration to avoid over-regulation.

- Eight days later, Andrew Evans, Head of innovation at the JFSC, on 10 October 2025, wrote a BLOG “From hype to helpful: essentials for digital-asset innovation which was published on the JFSC website

- Andrew Evans BLOG

- Was part of IOSCO’s World Investor Week, which promotes investor education and protection, and it offered a practical guide to help you move from uncertainty to informed engagement.

- Made a well-made point that whether digital assets are already in your portfolio conversations or just on your radar, understanding the fundamentals and the safeguards is essential.

- Is well written and positions Jersey as a proactive jurisdiction for digital assets, emphasising education during World Investor Week and

- Demystifies concepts such as stablecoins, tokenisation, and DeFi, and outlines questions investors should ask.

- However, Andrew Evans' BLOG section "How Jersey aims to protect investors" frames AML/CFT/CPF supervision as comprehensive protection, and in my view, gives an incomplete picture of the regulatory oversight offered to VASPS in Jersey. And it is this I want to write further about

Here are my key concerns about Andrew’s BLOG

- Concerning Andrew’s BLOG: the key points I wish to highlight

- Misleading Emphasis on Investor Protection: While the BLOG highlights Jersey's AML/CFT/CPF framework as a means to protect investors through VASP supervision, this is primarily focused on preventing financial crime rather than directly safeguarding investor interests, such as through financial soundness or fair treatment standards.

- Lack of Comprehensive Regulation: Statements on principles-based tokenisation and clear routes to market suggest robust protections, but research indicates VASPs operate without mandatory prudential requirements (e.g., capital adequacy) or conduct rules (e.g., complaint handling, fee transparency), which are standard in other Jersey financial regulations.

- Omission of Key Risks: The BLOG fails to disclose that VASPs are not subject to the same regulatory codes as traditional investment businesses, potentially leaving investors without legal recourse in areas like asset segregation or suitability assessments. The evidence suggests this is a gap in the framework.

- Specific Rebuttals to the BLOG Statements

- Authorisation and Supervision Under Schedule 2: The claim that VASPs are captured under Schedule 2 of the Proceeds of Crime (Jersey) Law 1999 (POCL) for registration and supervision by the JFSC is accurate but incomplete. This framework prioritises anti-money laundering (AML), countering the financing of terrorism (CFT), and counter-proliferation financing (CPF), rather than direct investor safeguards such as capital requirements or ethical conduct. Investors can view the list of registered VASPs on the JFSC website, but registration does not imply broader regulatory oversight other than what may be agreed at authorisation stages with the JFSC behind closed doors

- Principles-Based Tokenisation and Clear Routes to Market: These approaches focus on the substance of products and clarify disclosure expectations, but they operate within the AML/CFT/CPF-centric Schedule 2, lacking enforcement on prudential or conduct elements. For instance, there's no legal mandate for client asset protection or suitability standards, unlike under the Financial Services (Jersey) Law 1998 (FS(J)L).

- Failure to Highlight Regulatory Gaps: Evans does not address that Jersey does not impose codes regulating VASP operating behaviour, such as treating customers fairly, fee transparency, complaint handling, or insurance. This contrasts with FS(J)L-regulated entities, which must adhere to Codes of Practice covering these areas.

How Jersey Aims to Protect Investors in VASPS – My Fuller Critique and Rebuttal

An introduction to Jersey VASP risk and Implications for Investors

- Evidence suggests that while Jersey's regime aligns with FATF standards for AML/CFT/CPF, it may not provide the full suite of protections investors expect from traditional finance. Potential investors should seek independent advice and verify whether a VASP holds additional registrations under FS(J)L to enhance safeguards.

- Andrew Evans' BLOG, "From Hype to Helpful: Essentials for Digital-Asset Innovation," published by the Jersey Financial Services Commission (JFSC),

- Serves as an educational piece during IOSCO’s World Investor Week.

- It aims to demystify digital assets such as Bitcoin, stablecoins, tokenisation, DeFi, and staking, while guiding investors on the risks, benefits, and due diligence.

- Evans, as Head of Innovation at the JFSC, emphasises Jersey's role in fostering innovation with safeguards, but the piece has drawn criticism for potentially misleading portrayals of investor protections.

Critique and rebuttal

- The following critique and rebuttal focus on three key statements in the "How Jersey Aims to Protect Investors" section, as highlighted in the query, and examine their accuracy, omissions, and implications under Jersey's regulatory framework.

- To provide a balanced view, this analysis draws from

- Relevant Jersey laws, JFSC guidance, and third-party legal insights. Jersey's approach to virtual assets evolved significantly with amendments to the Proceeds of Crime (Jersey) Law 1999 (POCL) in 2022-2023, aligning with Financial Action Task Force (FATF) standards.

- Virtual Asset Service Providers (VASPs) that exchange, transfer, safeguard, or administer virtual assets are required to register with the JFSC under Schedule 2 of POCL.

- This registration subjects them to Jersey's complete anti-money laundering (AML), countering the financing of terrorism (CFT), and counter-proliferation financing (CPF) regime, including the Money Laundering (Jersey) Order 2008.

- Key obligations include maintaining AML/CFT/CPF policies, conducting customer due diligence (CDD), ongoing monitoring, filing Suspicious Activity Reports (SARs), and appointing a Money Laundering Reporting Officer (MLRO) and Money Laundering Compliance Officer (MLCO).

- However,

- The above Schedule 2 of the POCL regime is narrowly focused on financial crime prevention, protecting the jurisdiction and businesses from illicit activities rather than directly shielding investors from risks such as insolvency, unfair practices, or asset mismanagement.

- In contrast, the Financial Services (Jersey) Law 1998 (FS(J)L) provides a broader regulatory umbrella for traditional financial services, such as “investment business”, with requirements for prudential soundness, conduct standards, and client protections.

- The distinction is critical:

- VASPs under pure Schedule 2 supervision lack these additional layers unless they also engage in FS(J)L defined activities, such as dealing in investments or trust company business.

Rebuttal to the First Statement: Authorisation and Supervision

- Evans states: "Authorisation and supervision: Virtual Asset Service Providers (VASPs) are captured under Schedule 2 of Jersey’s AML/CFT/CPF framework, with registration and ongoing supervision by the JFSC. You can see a full list of registered VASPs on our website."

- This is factually correct. VASPs must register under the Proceeds of Crime (Supervisory Bodies) (Jersey) Law 2008 (SBJL), which enforces Schedule 2 of POCL. The JFSC maintains a public registry of VASPs, updated since May 2024, to promote transparency. Supervision is risk-based, involving inspections, data collection, and enforcement for AML/CFT/CPF breaches, with penalties including fines or imprisonment for non-compliance.

- However, the statement is misleading in the context of "protecting investors." Schedule 2 focuses exclusively on AML/CFT/CPF compliance, not investor-centric protections. For example, there are no requirements for financial soundness (e.g., minimum capital reserves to withstand losses) or client asset protection (e.g., segregation of funds to prevent commingling). Breaches under this regime typically result in criminal liability for money laundering failures, rather than in civil remedies for investors harmed by poor business practices. This contrasts sharply with FS(J)L, where registered entities face licence revocation, public censure, or personal liability for directors if they violate conduct rules. By framing this as investor protection without clarifying its limited scope, the BLOG may foster overconfidence among readers new to digital assets.

Rebuttal to the Second and Third Statements: Principles-Based Tokenisation and Clear Routes to Market

- Evans claims:

- "Principles-based tokenisation: our RWA approach focuses on the true nature of the product and activity so innovators and supervisors speak the same language (and investors can see the protection in place).

- Clear routes to market: guidance for issuers and applicants clarifies expectations on disclosure, governance, and controls (so you can compare like-for-like offerings)."

- These elements are part of JFSC's guidance on real-world asset (RWA) tokenisation, which adopts a "substance-over-form" approach to ensure activities align with existing regulations.

- The guidance clarifies disclosure requirements and promotes traceability via the Travel Rule for cross-border transfers. This is proactive and aligns with international standards, but again, it's embedded within the AML/CFT/CPF framework.

- The misleading aspect lies in implying comprehensive investor visibility into protections. Under Schedule 2, there are no enforced

- Prudential regulations (e.g., liquidity buffers) or

- Conduct standards (e.g., suitability assessments ensuring products match investor risk profiles).

- Further JFSC guidance for VASPs emphasises AML/CFT/CPF policies, but does not mandate

- Insurance,

- Complaint procedures, or

- Fee transparency.

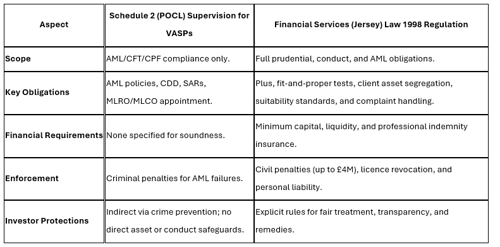

This table illustrates the gap:

- VASPs are not automatically subject to the Code of Practice for Investment Business, issued under FS(J)L ARTICLE 19, which mandates integrity, competence, and organisational standards for investment firms. Only entities registered under FS(J)L Article 9 must comply, and pure VASPs typically fall outside this unless their activities overlap with the defined "investment business" (e.g., managing crypto as securities).

- Evans' omission of these gaps is notable, especially in an educational context. For instance, if a VASP fails, investors may lack protections like segregated assets or compensation schemes available under FS(J)L.

- The BLOG's "smart investor checklist" touches on risks but does not flag this regulatory asymmetry, potentially understating vulnerabilities in DeFi or tokenisation.

Broader Critique: Context and Implications

- The BLOG's tone is promotional, highlighting Jersey's collaborations (e.g., the Digital Assets Working Group) and "trust rails" enabled by the Travel Rule, which requires VASPs to transmit originator/beneficiary information for transfers. While this enhances traceability, it does not address systemic risks such as smart contract vulnerabilities or liquidity shocks, as mentioned elsewhere in the piece. Counterarguments from legal sources suggest that Jersey's light-touch approach attracts innovation but may expose investors to higher risks than in jurisdictions with dedicated crypto laws (e.g., the EU's MiCA).

- In rebuttal, while Evans disclaims the BLOG as non-advice, its placement under JFSC branding is the one who has authority.

- A more balanced view would acknowledge that VASPs operate without FS(J)L-equivalent codes and advise investors to check for dual registrations. Jersey's regime is evolving, e.g., the 2024 VASP National Risk Assessment rates the sector as medium-high risk due to rapid growth, but current protections remain AML/CFT/CPF-focused.

- Overall, the BLOG provides value in demystifying crypto but falls short in transparency about regulatory limitations, potentially misleading novice investors.

- For thorough due diligence, consult primary sources like Jersey Law or seek professional advice.

My closing thoughts on my Twin Peaks arguments for adoption in Jersey

- Proponents argue that Jersey's VASP sector, while compliant with FATF via the 2023 Mutual Evaluation Report, could benefit from twin peaks to address emerging risks identified in the 2024 NRA update. Benefits include:

- Enhanced Investor Security: Twin peaks would mandate prudential elements like liquidity buffers and insurance, protecting against firm failures, which are crucial in volatile crypto markets. As seen in Australia, this separation enables targeted consumer remedies, such as dispute-resolution mechanisms.

- Market Integrity and Growth: By clarifying conduct rules (e.g., fee transparency, treating customers fairly), the model could reduce fraud risks while attracting reputable players. Jersey's 2025 emphasis on digital asset adoption, as noted in industry insights, aligns with this, potentially boosting capital flows.

- Global Competitiveness: Jurisdictions like Hong Kong and Kenya have integrated VASPs into broader frameworks in 2023-2025, offering licensing regimes that balance innovation and protection. Jersey, with its zero-tolerance for misconduct, could lead among offshore centres by adopting twin peaks, as suggested in comparisons with Mauritius.

- Proactive Risk Management: The model's outcomes focus, as in South Africa's FSCA, enables forward-looking supervision, addressing VASP-specific issues like oracle manipulation or governance capture.

2. Potential Implementation Pathways

- To enact this, Jersey could amend FS(J)L to define VASPs as an "investment business" subcategory, leveraging existing codes of practice.

- The JFSC could maintain unified administration, but with internal peaks for prudential, conduct teams, and AML.

- A phased rollout starting with larger VASPs could minimise disruption, informed by stakeholder consultations such as the 2025 AML enhancements.

In conclusion

- While Jersey's single-peak model has served well, integrating VASPs into FS(J)L for a twin peaks approach could provide the full confidence investors seek.

- As global regulations tighten, this evolution would safeguard users, bolster resilience, and cement Jersey's role in ethical digital finance.

Key Citations

- Virtual Asset Service Providers (VASPs) https://www.jerseyfsc.org/news-and-events/virtual-asset-service-providers/

- List of Jersey-registered virtual asset service providers published https://www.jerseyfsc.org/news-and-events/list-of-jersey-registered-virtual-asset-service-providers-published/.

- Virtual Asset Service Providers National Risk Assessment (2024) https://www.gov.je/Industry/Finance/FinancialCrime/NationalRiskAssesmnents/pages/vaspnationalriskassessment.aspx

- Virtual Asset Service Providers (VASPs) under Jersey's revised AML... AML...https://www.mourant.com/news-and-views/updates/updates-2023/virtual-asset-service-providers-%28vasps%29-under-jersey-s-revised-aml-cft-cpf-regime-%28vasps%29-.aspx

- Jersey: Regulation Of The Virtual Assets Industry https://www.ifcreview.com/2024/02/jersey-regulation-of-the-virtual-assets-industry/

- VASP Regulation in Jersey and Mauritius https://www.comsuregroup.com/news/vasp-regulation-in-jersey-and-mauritius-is-mauritius-leading-the-way/

- Jersey - ARCHIVED CHAPTER | Fintech Laws and Regulations 2024 https://www.globallegalinsights.com/practice-areas/fintech-laws-and-regulations/jersey/

- JFSC Guidance: Understanding the Travel Rule for VASPs https://www.walkersglobal.com/en/Insights/2024/02/Jersey-Financial-Services-Commission-guidance-outlining-what-Virtual-Asset-Service-Providers

- Proceeds of Crime Law - Jersey AML CFT and CPF Regime https://www.walkersglobal.com/en/Insights/2024/10/Proceeds-of-Crime-Law---Jerseys-AML-CFT-and-CPF-regime

- Guidelines on the interpretation of Schedule 2 business https://www.jerseyfsc.org/media/7104/guidelines-on-interpretation-031023.pdf [SEPT 2023]

- AML supervision under Jersey's Proceeds of Crime legislation https://www.ogier.com/news-and-insights/insights/registering-for-aml-supervision-under-jerseys-proceeds-of-crime-legislation/

- Global Legal Insights Fintech 2024: Jersey chapter https://www.walkersglobal.com/en/Insights/2024/09/Global-Legal-Insights-Jersey-Chapter

- Financial Services (Jersey) Law 1998 https://www.jerseylaw.je/laws/current/l_32_1998

- Banking Business (Jersey) Law 1991 https://www.jerseylaw.je/laws/current/l_19_1991

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.