MAT SAYS – low risk activity – there is a lot still to do, even with exemptions

03/09/2025

The JFSC has issued a Local lending: low-risk AML/CFT/CPF exemption FAQs.

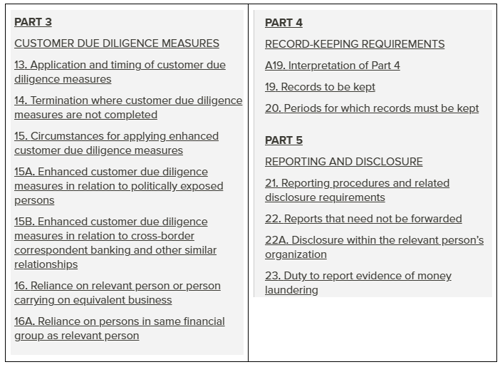

In this FAQ, the JFSC remind us that Article 4A(2) of the Proceeds of Crime (Low Risk Financial Services Business) (Jersey) Order 2024 explains that lenders meeting the conditions of the Order do not need to comply with Articles 7, 8, 9, 9A, 10, 11 and 11A of the MLO [MLO]

At this point, what must be remembered is that there are 25 articles on the MLO – so a lot still must be complied with – the key articles are here

Just so you know, the exceptions are in relation to the MLO, not additional requirements published by the JFSC.

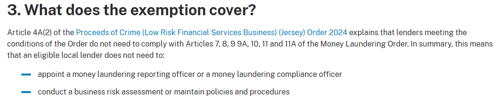

Looking at the JFSC FAQ, the standout statement in the FAQ is that a local lender does not need to conduct a business risk assessment (a BRA)

However, in stating this, the JFSC are silent on the remainder of its AML/CFT/CPF Handbook Section 2 – Corporate governance and dealing with such matters as: strategy and appetite.

- Corporate governance - the board must consider, on an ongoing basis, the supervised person’s [including LOW RISK ACTIVITY] risk appetite

Also, remember there are many JFSC codes and also guidance in the AML/CFT/CPF Handbook that you will need to apply, for example:-

- CDD sections – sections 3 and 4

- A supervised person [including LOW RISK ACTIVITY] must apply a risk-based approach to determine the extent and nature of the measures to be taken when undertaking the identification process

- If you rely on another for CDD (obliged person) – section 5

- To the extent that reliance is placed on an obliged person, a supervised person must be able to demonstrate that the conditions required by the MLO are met.

- Monitoring – section 6

- A supervised person [including LOW RISK ACTIVITY] must sign up to receive sanctions e-mail alerts from the JFSC and sanctions notices from the Government of Jersey, which are publicly available on the Jersey Gazette – see the Government of Jersey Sanctions Notices Registration (gov.je) and the JFSC Sanctions Registration (jerseyfsc.org).

- EDD – section 7

- A supervised person [including LOW RISK ACTIVITY] must apply enhanced CDD measures on a risk-sensitive basis where a person who falls within Article 3(7) of the Money Laundering Order, or who is the Beneficial owner and/or controller of a customer or is a person who must otherwise be identified under Article 3 of the Money Laundering Order, is not physically present for identification purposes.

- Exemptions and simplified measure – section 7

- A supervised person [including LOW RISK ACTIVITY] must be able to demonstrate that the exemption conditions required by the MLO and summarised in the statutory requirements above are being met.

- Reporting – section 8

- In addition to reporting procedures that must be maintained under Article 21 of the Money Laundering Order, a supervised person [including LOW RISK ACTIVITY] must maintain procedures that: highlight that internal SARs are to be made regardless of the amount involved in a transaction or relationship and regardless of whether it is thought to involve tax matters;

- Note that low-risk activities are exempt from policy and procedures under Article 11 of the MLO, but there is no exemption from Reporting procedures in Article 21

- Training – section 9 (yes, the JFSC requires going a little further than the MLO)

- A supervised person [including LOW RISK ACTIVITY] may demonstrate the provision of adequate training to board members where (in addition to training for relevant employees) it addresses: ›

conducting and recording a BRA; ›ESTABLISHING A FORMAL STRATEGY to counter money laundering, the financing of terrorism, or the financing of proliferation; - Record keeping – section 10

- A supervised person [including LOW RISK ACTIVITY] must keep its risk assessment for each customer that has still to be remediated in line with section 4.7.2 of this Handbook for a period of five years after the end of the calendar year in which it is superseded.

CONCLUSION/OBSERVATION

Why can't the low-risk community https://www.jerseylaw.je/laws/current/ro_50_2024 be provided with comprehensive guidance on what they must do?

At the moment, when looking at the published rules (the LOW-RISK Order and the JFSC FAQ) for low-risk activities, I’m reminded about what United States Secretary of Defence Donald Rumsfeld said in a news briefing on February 12, 2002, who, as we know, said:-

- “As we know, there are known knowns; there are things we know we know.

- We also know there are known unknowns; that is to say, we know there are some things we do not know.

- But there are also unknown unknowns—the ones we don't know we don't know”

IF YOU WANT TO DISCUSS THE ABOVE, PLEASE CALL

Mathew Beale - Chartered FCSI

Principal & Director - Comsure Compliance Limited, Comsure Technology Limited, Comsure Mauritius

(the "Comsure Group of Companies")

T (Jersey) +44 1534 733-588 /+44 7797 747-490

T (Mauritius) +230 214-6487 / +230 5717-6907

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.