MAURITIAN PROLIFERATION RISKS in two laws – ensure you follow both definitions of Proliferation and Proliferation Financing

04/11/2025

In Mauritius, there are two key pieces of legislation addressing anti-money laundering, counter-terrorism financing, and counter-proliferation financing (C-PF).

- The United Nations (Financial Prohibitions, Arms Embargo and Travel Ban) Sanctions Act 2019 (UNSA 2019)

- The Financial Intelligence and Anti-Money Laundering Act 2002 (FIAMLA)

Both acts incorporate definitions related to proliferation that are aligned with international standards from

- The United Nations Security Council (UNSC) resolutions and

- The Financial Action Task Force (FATF) Recommendations, particularly FATF Recommendation 7 on targeted financial sanctions (TFS)

These definitions are not the same—they are distinct but complementary:

- (UNSA 2019-FIAMLA) Proliferation focuses on the physical or technical acts related to weapons of mass destruction (WMD).

- (FIAMLA ONLY) - Proliferation financing addresses the financial mechanisms enabling those acts.

Mauritius' framework ensures TFS under UNSA 2019 directly supports FIAMLA's broader preventive measures, but the terms are not conflated in either act.

Definition in UNSA 2019

UNSA 2019 primarily implements UNSC resolutions under Chapter VII of the UN Charter to counter threats like WMD proliferation.

It provides a specific definition of proliferation (but not a standalone definition of "proliferation financing," which is addressed through prohibitions on financial support).

- Proliferation: Defined to include "not only the movement of WMDs but also related technical training, advice, service, brokering or assistance." This encompasses the development, acquisition, production, sale, transport, transfer, or use of nuclear, chemical, or biological weapons and their means of delivery, including dual-use goods and technologies for non-legitimate purposes.

- Proliferation Financing (PF): Implied as the provision of funds, financial services, or other assets to carry out proliferation activities. The act mandates freezing of assets, arms embargoes, and travel bans on designated persons/entities involved in PF, aligning with UNSC resolutions (e.g., 1718/2006 on North Korea, 2231/2015 on Iran).

UNSA 2019's guidelines (issued by the National Sanctions Secretariat) emphasise a risk-based implementation of TFS to disrupt PF, treating it as a financial enabler of proliferation.

Definition in FIAMLA

FIAMLA (as amended by the Anti-Money Laundering and Combating the Financing of Terrorism and Proliferation (Miscellaneous Provisions) Act 2019) establishes the Financial Intelligence Unit (FIU) and imposes obligations on reporting persons (e.g., financial institutions, DNFBPs) for customer due diligence (CDD), suspicious transaction reporting (STR), and risk assessments.

FIAMLA explicitly includes PF in its scope, but does not redefine "proliferation" Instead, it cross-references UNSA 2019 and UNSC standards.

- Proliferation: Not explicitly defined in isolation; it adopts the UNSA 2019/UNSC [see above] understanding of WMD-related activities (e.g., manufacture, export, or transfer of nuclear/chemical/biological weapons and related materials).

- Proliferation Financing (PF): Explicitly defined as "the financing of the proliferation of weapons of mass destruction," covering the raising, moving, or making available of funds, assets, or economic resources to persons/entities for WMD proliferation purposes, including means of delivery and dual-use items. This includes evasion of TFS under UNSA 2019.

FIAMLA's 2018 Regulations and related guidelines (e.g., from the Bank of Mauritius and Financial Services Commission) require institutions to assess and mitigate PF risks alongside money laundering (ML) and terrorist financing (TF), with STRs submitted to the FIU for analysis.

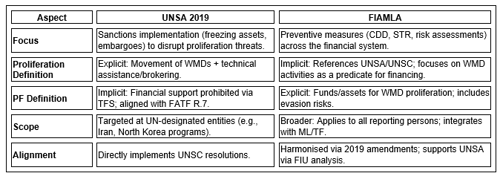

Key Similarities and Differences

Conclusion

The definitions in UNSA 2019 and FIAMLA are aligned but not identical.

UNSA 2019 defines "proliferation" more granularly to support sanctions, while FIAMLA emphasises "proliferation financing" as a financial crime predicate, building on UNSA's framework.

This separation ensures comprehensive coverage: UNSA targets immediate threats, and FIAMLA enables systemic prevention.

Mauritius' 2022 National Risk Assessment rates PF risk as "medium" overall, with higher vulnerabilities in trade finance and non-profits, underscoring the integrated approach.

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.