MONEYVAL….JERSEY SCORES AND DEFINITIONS

26/07/2024

HERE ARE THE JERSEY SCORES

THE BAD RESULT WAS 18 ………………

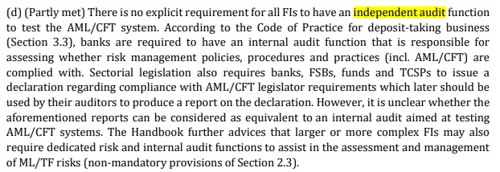

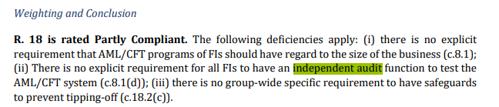

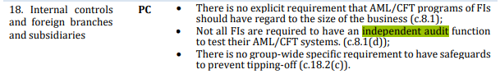

18 IS AS FOLLOWS:-

SOURCES

- https://www.fatf-gafi.org/content/dam/fatf-gafi/methodology/FATF%20Methodology%2022%20Feb%202013.pdf.coredownload.pdf

- https://mail.financialcrime.gov.je/cr/AQjgtBUQgqIUGKP28zsNgbf64F4v-84_GjhfwRjju1MTnxjL_VMWgNjsBhLEKA

READ MORE ABOUT THE REPORT

2024 MONEYVAL Report: Jersey among T op ten jurisdictions worldwide for FATF Compliance (but Stuff Still to do)

Jersey’s MONEYVAL Mutual Evaluation report has just been published. The report represents Jersey's commitment to building a responsible and sustainable international finance centre.

THE HIGHLIGHTS INCLUDE

- The latest MONEYVAL report praises Jersey for its robust AML/CFT framework,

- Jersey is placed among the top ten jurisdictions worldwide in compliance with FATF standards.

- Jersey joins only three countries worldwide with a rating of HIGH for risk understanding and national cooperation.

- The regimes for transparency of beneficial ownership and international cooperation are specifically commended

- fundamental improvements need to be identified.

- Strong Legal Framework & Cooperation:

- Jersey's legal framework and proactive international cooperation reinforce its position as an AML/CFT/CPF compliance leader.

- Outstanding Risk Understanding:

- Jersey demonstrates a comprehensive and well-coordinated understanding of money laundering and terrorist financing risks, setting a high benchmark for risk assessment practices.

- Effective Use of Financial Intelligence:

- The jurisdiction is commended for its increased utilisation of financial intelligence in investigations. Continued efforts to enhance strategic analysis capabilities are encouraged.

WATCH OUT FOR THE NEED TO IMPROVE

- Having significantly strengthened its legal framework since the last mutual evaluation, Jersey has most elements of an effective AML/CFT,

- BUT STILL NEEDS TO IMPROVE THE IMPLEMENTATION OF MEASURES IN CERTAIN AREAS.

JFSC AREAS TO FOCUS ON INCLUDE:

- Enhancing background checks for principals and key persons

- Undertaking a review of how the JFSC assess supervisory findings, which will help boards and compliance functions further their understanding of seriousness

- Ensuring the right enforcement action is taken at the right time and

- Ensure that enforcement actions continue to be carefully considered based on the severity of the breaches identified and associated risks.

RECOMMENDATIONS FOR THE BOARD, MLROS AND COMPLIANCE TEAMS:

- Enhance Strategic Analysis:

- Develop and utilise advanced analytical tools to better anticipate and mitigate emerging risks.

- Focus on Complex Structures:

- Ensure rigorous oversight and due diligence for clients using complex legal structures, particularly in the trust and company service provider sectors.

- Strengthen Reporting Protocols:

- Improve the quality and timeliness of suspicious activity reports (SARs) to align with Jersey’s risk profile.

- Prioritise Training & Resources:

- Invest in specialised training for compliance staff to effectively handle sophisticated financial products and services.

MONEYVAL concludes that,

- Having significantly strengthened its legal framework since the last mutual evaluation, Jersey has most elements of an effective AML/CFT,

- BUT STILL NEEDS TO IMPROVE THE IMPLEMENTATION OF MEASURES IN CERTAIN AREAS.

- On the operational side, Jersey has achieved high effectiveness in understanding ML/TF risks and implementing adequate AML/CFT policies and mitigation strategies.

- The report commends the authorities for concluding multiple high-quality, comprehensive, and detailed risk assessment products informed by various sources. National coordination and cooperation between agencies and private sector awareness of risks are also strengths of the system.

- Jersey’s Financial Intelligence Unit (FIU) 's operational independence and resources have significantly improved since the last MONEYVAL assessment.

- Although the trend is relatively recent, financial intelligence is regularly used to develop evidence and trace proceeds in ML, TF, and predicate offence investigations. Authorities are encouraged to make increased use of these resources.

- While ML cases are routinely investigated and proceeds of crime are pursued as a policy objective,

- the modest number of ML prosecutions, including those for third-party and autonomous ML, CALL FOR A MORE PROACTIVE APPROACH BY THE COMPETENT AUTHORITIES.

- However, MONEYVAL recognises

- the positive results of alternative measures such as civil forfeiture mechanisms, deferred prosecution agreements, and introducing a criminal offence of failure to prevent ML.

- Jersey has appropriate mechanisms to identify, investigate and prosecute TF.

- The low number of investigations and the absence of prosecutions and convictions have been assessed as consistent with the jurisdiction’s low TF risk profile.

- Mechanisms to implement, without delay, targeted financial sanctions (TFS) on terrorism financing and proliferation financing are equally in place.

- Notwithstanding, the assessment detects room for improvement regarding the supervision of TFS requirements and the risk-based oversight of the non-profit sector.

- Steps have been undertaken to reinforce the AML/CFT supervisory framework, which concentrates on the higher-risk entities and sectors, in line with supervisors’ good understanding of risks.

- However, the approach to ensure compliance with AML/CFT obligations greatly relies on remedial actions, with a modest imposition of sanctions, which is not considered sufficiently in line with the number and types of breaches detected.

- Measures to prevent criminals from entering the market are in place for all sectors, but the report calls for a more robust process for conducting criminality checks.

- The private sector demonstrated a good understanding of the risks and compliance with AML/CFT obligations.

- However, the report makes clear that the private sector’s implementation of the following measures would merit further improvements

- complex structures,

- assessment of the risks for the application of exemptions,

- application of enhanced due diligence measures (EDD) to politically exposed persons (PEPs) and

- the detection and prompt reporting of suspicious transactions

- However, the report makes clear that the private sector’s implementation of the following measures would merit further improvements

- MONEYVAL finds that Jersey authorities demonstrated a good understanding of the extent to which legal persons and arrangements can be misused for ML purposes.

- Jersey ensures the availability of adequate, accurate and up-to-date essential and beneficial ownership (BO) information of legal persons and arrangements through a fully populated Registry and trust and company service providers (TCSPs), as well as conducting comprehensive checks, risk assessments and vetting processes on an ongoing basis.

- Jersey authorities demonstrated commendable efficiency in actively seeking and providing mutual legal assistance (MLA) and other forms of international cooperation, particularly in the later years of the assessed period.

- Similar conclusions were drawn regarding the process of BO information sharing.

- Nevertheless, authorities are encouraged to seek informal cooperation more frequently and increase their outreach to foreign counterparts via MLAs.

- Jersey is expected to report to MONEYVAL under its regular follow-up reporting process in December 2026.

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.