MUPPET DIRECTORS INVOLVED IN “MINI UMBRELLA COMPANY” FRAUD – case studies

13/02/2025

The following is sourced from TAX POLICY ASSOCIATES, a not-for-profit company founded to improve tax and legal policy and the public understanding of tax –

HOW CRIMINALS USE “MUPPETS” TO COMMIT CORPORATE FRAUD – AND HOW TO STOP THEM

OR READ BELOW

Many fraudulent companies at Companies House are run by entirely fake directors – non-existent people with fabricated identities. But many others are fronted by “muppet” directors: real individuals, often recruited through Facebook, who lend their names to companies they don’t control.

The true masterminds behind the fraud remain in the shadows.

From next month, we’re likely to see a surge in muppet directors. Companies House is introducing ID verification rules, making it much harder for fraudsters to register fake identities.

The fraudsters’ likely response? Recruit more muppets.

X2 EXAMPLES OF MUPPETS

Meet Donna:

Note: Donnas identifying details caught up in this scheme are masked because it would be unfair for them to attract random abuse on social media.

Donna's Facebook profile

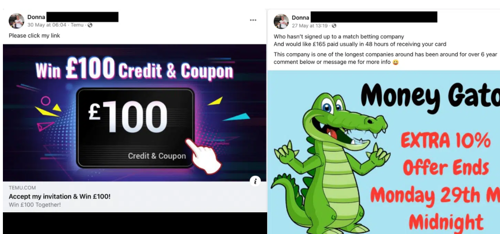

Donna seems like a nice person but tends to promote “get rich quick” internet promotions to her friends. These posts didn’t get much attention, and nobody commented.

This one is different:

Unsurprisingly, dozens of people responded, offering £1,800 of free money.

But what is this thing that you can do up to four times, but not if you’re Scottish, and if you’ve done one, then you can’t do another?

Donna’s companies

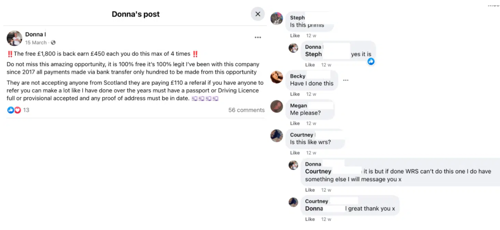

Here’s what happened to one of Donna’s companies:

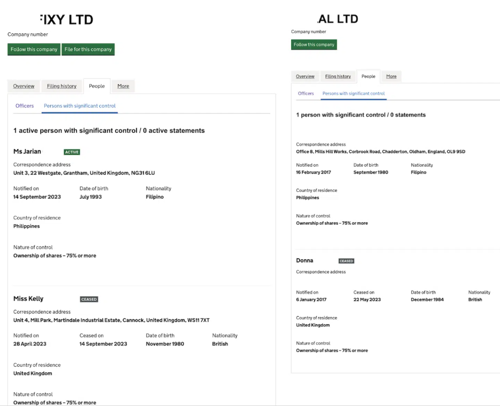

Four months after becoming a director, Donna resigned and was replaced by Josefina – a resident of the Philippines:

Not long after, the company was struck off. And this happened 23 times. Usually, Donna is a director for a few months, then replaced by a Philippine resident individual, and then the company is dissolved:

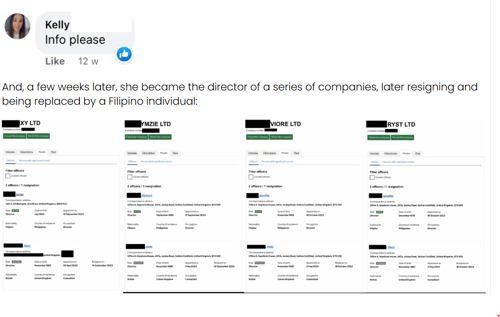

Kelly

Kelly responded to that Facebook comment thread on 15 March:

These companies are still active.

What’s going on?

Donna and Kelly’s companies were used in what’s called “mini umbrella company” fraud—thousands of small companies created to claim tax incentives they’re not entitled to.

- TAX POLICY ASSOCIATES published a four-part report into these frauds in 2023. https://taxpolicy.org.uk/2023/07/03/scheme/

- HMRC’s view of these frauds is set out here. https://www.gov.uk/guidance/mini-umbrella-company-fraud#:~:text=Arrangements%20are%20constantly%20evolving%20as%20organised%20criminals%20try%20to%20hide%20their%20fraudulent%20activities%20from%20HMRC.

HMRC's initial response to the fraud was to ensure that companies with UK directors could only claim the tax incentives. That’s why Donna and Kelly were hired.

But once the fraud has started, they’re not needed—it's better to use directors who can be paid less, which is much more challenging for HMRC to track down. The Philippines is an ideal location.

Is it a crime?

Donna and Kelly know nothing about tax fraud, which is the goal of these companies.

But they both incorporated a company and clicked a box that says they control it – that they’re the “person with significant control”:

This isn’t true.

Donna and Kelly aren’t in control of these companies—they’re doing what someone tells them.

They provided false information to Companies House, and if they did so recklessly or intentionally, that’s a criminal offence.

CONCLUSION

- DO YOUR DUE DILIGENCE AND DO MORE THAN TICK THE BOX

SOURCES

- https://taxpolicy.org.uk/2025/02/13/how-criminals-use-muppets-to-commit-corporate-fraud-and-how-to-stop-them/

- Simon Goodley at the Guardian for his original reporting on the MUC tax fraud https://www.theguardian.com/uk-news/2016/nov/15/revealed-temp-agencies-avoidance-scheme-costs-taxpayers-hundreds-of-millions

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.