NATIONAL RISK ASSESSMENTS & ACCOUNTANTS – Jersey =MEDIUM-LOW - the UK = HIGH

22/09/2025

As part of Jersey's ongoing work to prevent financial crime, the island has undertaken several risk assessments.

The assessments are an accumulation of work from the Government of Jersey working alongside us, other agencies, professionals across the finance industry, and stakeholders in the non-profit sector.

The assessment document outlines the potential risks, threats, and vulnerabilities that Jersey faces as an international financial centre. It is a critical exercise for any jurisdiction to undertake regularly to understand where the risks lie, so stakeholders can take action to mitigate those risks accordingly.

Find the published assessments on the Government of Jersey's website along with other regulatory publications here:

- Jersey NRA for Accountants (JFSC PDF) https://www.jerseyfsc.org/media/4170/national-risk-assessment-accountants.pdf

- Government of Jersey NRA Page

- https://www.gov.je/Industry/Finance/FinancialCrime/NationalRiskAssesmnents/Pages/NationalRiskAssessmentMoneyLaundering.aspx

- https://www.gov.je/SiteCollectionDocuments/Industry%20and%20finance/ID%20Bailiwick%20of%20Jersey%20National%20Risk%20Assessment%20of%20Money%20Laundering%20September%202020.pdf

- Update on the National Risk Assessment of Money Laundering

- Money laundering and terrorist financing risk data analysis https://www.jerseyfsc.org/media/8177/20250326-sector-data-accountancy-1.pdf

- National Risk Assessments — Jersey Financial Services Commission https://www.jerseyfsc.org/industry/risk/national-risk-assessments/

Jersey Relevant persons are reminded of their obligation under Article 11(2)(a) of the Money Laundering (Jersey) Order 2008 to consider the level of risk identified in national risk assessments when maintaining appropriate and consistent policies and procedures.

Here’s a summary of the Jersey National Risk Assessment (NRA) and its impact on the accountancy sector:

What is the Jersey NRA?

- The NRA is a comprehensive, government-led assessment of the risks of money laundering (ML) and terrorist financing (TF) in Jersey, covering all sectors, including accountancy.

- It is required by the Financial Action Task Force (FATF) and is used to inform policy, regulation, and industry practices.

Key Findings for Accountants

- Threat Level: The accountancy sector is rated as “medium-low” risk for money laundering, with most clients considered standard or lower risk.

- Dominant Activities: Tax advice is the most common service, followed by external accountancy services, audit, and insolvency services.

- Client Base: Over 90% of clients are rated as standard or lower risk, and 89% are resident in the UK or Crown Dependencies.

- Sector Structure: The sector is dominated by the “Big 4” firms, but over 50% are sole practitioners.

Obligations for Accountants

- AML/CFT Compliance: Accountants must comply with the Money Laundering (Jersey) Order 2008 and take into account the risks identified in the NRA when designing and maintaining their AML/CFT policies and procedures.

- Risk Assessment: Firms must conduct their own risk assessments, considering the NRA findings, and apply enhanced due diligence where higher risks are identified.

- Ongoing Monitoring: The NRA is updated regularly, and firms are expected to keep their risk assessments and controls up to date with the latest findings.

- Sector Guidance: The Jersey Financial Services Commission (JFSC) provides a dedicated AML/CFT Handbook for the accountancy sector.

Practical Implications

- Policies and Procedures: Accountancy firms must review and update their AML/CFT frameworks to reflect the NRA’s sector-specific risks.

- Training: Staff should be trained on the latest NRA findings and how these affect client risk assessments.

- Client Due Diligence: Enhanced CDD is required for higher-risk clients, especially those from higher-risk jurisdictions or with complex structures.

- Regulatory Scrutiny: The JFSC expects firms to demonstrate how they have considered the NRA in their risk management and compliance programs.

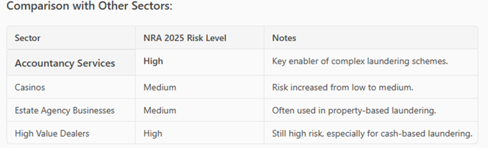

UK NRA

According to the UK National Risk Assessment 2025, the NRA identifies professional enablers—including accountants—as a high-risk sector due to their ability to facilitate complex financial transactions, create corporate structures, and conceal beneficial ownership.

- Criminals exploit accountancy services to:

- Set up shell companies and trusts.

- Provide legitimacy to illicit funds.

- Assist in tax evasion and layering of transactions.

UK NRA

Jersey

- Jersey NRA for Accountants (JFSC PDF) https://www.jerseyfsc.org/media/4170/national-risk-assessment-accountants.pdf

- Government of Jersey NRA Page

- https://www.gov.je/Industry/Finance/FinancialCrime/NationalRiskAssesmnents/Pages/NationalRiskAssessmentMoneyLaundering.aspx

- https://www.gov.je/SiteCollectionDocuments/Industry%20and%20finance/ID%20Bailiwick%20of%20Jersey%20National%20Risk%20Assessment%20of%20Money%20Laundering%20September%202020.pdf

- Update on the National Risk Assessment of Money Laundering

- Money laundering and terrorist financing risk data analysis https://www.jerseyfsc.org/media/8177/20250326-sector-data-accountancy-1.pdf

- National Risk Assessments — Jersey Financial Services Commission https://www.jerseyfsc.org/industry/risk/national-risk-assessments/

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.