Proliferation Financing (WMD)Typologies - TCSP Sector case study

16/01/2026

The JFIU has published nine Proliferation Financing Typologies that examine different aspects of how PF could occur and potential links to Jersey.(all eight are linked below)

The following Proliferation Financing Typologies issued by the JFIU is numbered 19. - go.fiu.je/typo19

This PF typology looks

- At the hypothetical case of how the services of a Trust and Company Service Provider (TCSP) could be used to obscure the true Ultimate Beneficial Owner (UBO), especially through Shell Companies, thereby making it harder to identify Illicit Funds.

- At how certain red flags, such as High Value Transactions, which don't always have a clear financial explanation, and those from high-risk overseas jurisdictions, can indicate links to PF.

The following is extracted from the JFIU - go.fiu.je/typo19 with some additional content added by the Comsure team of experts

The case study:

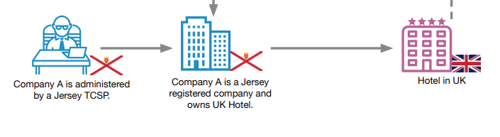

- A Jersey-regulated Trust Company Services Provider (TCSP) provides administration services for a Jersey-registered company, Company A, which in turn owns a hotel in the UK.

- A recently incorporated UK entity, Company X, offers to purchase the hotel for a significant sum through an independent (FCA-regulated) investment firm who are being represented by a magic circle London based global firm

- THE London law firm is SRA AML regulated and is required to comply with

- UK Money Laundering Regulations (MLRs) – statutory AML framework

- FCA AML/CTF supervisory requirements – more rigorous, data-led compliance

- CTF, CPF & Sanctions obligations – full compliance required

- Sector AML guidance – transitioning from SRA/LSAG to potentially FCA-issued guidance

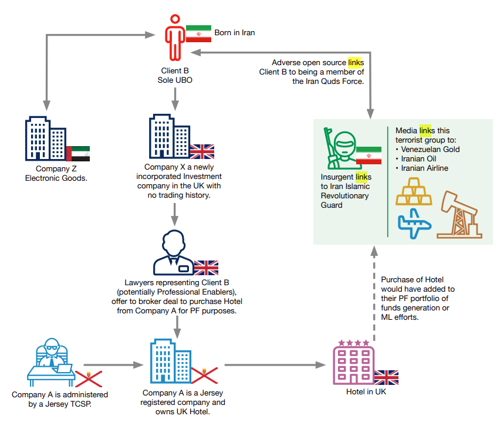

- The Ultimate Beneficial Owner (UBO) of Company X, who was identified as Client B,

- Who was born in Iran and

- Who was confirmed as operating a company in Dubai known as Company Z, which forms part of a larger entity involved as a wholesaler in electronics goods.

- As a EDD customer controller (EDD triggers - outside of Jersey/linked to a higher risk country, asset holding vehicle), Client B was unable to provide a sufficient Source of Wealth (SoW),

- As part of the client acceptance process, the TCSP STARTED ITS due diligence exercise, which included Open-source checks that revealed adverse media –

- That Client B matched (and was suspected of being an undercover agent of Iran's Islamic Revolutionary Guard Corps – “Quds Force”).

- That Client B WAS linked as a secret operative of a sanctioned IRGC and responsible for smuggling supplies and logistics, particularly military equipment, to Iran's proxies in Syria and Lebanon.

- That Client B has, through business and political contacts, been running a clandestine operation involving the purchase of dozens of kilograms of gold in Venezuela in exchange for Iranian oil, which was then smuggled on a privately owned Iranian airline, which is subject to US sanctions, from Venezuela to Tehran.

- After the gold reached Iran, it was transferred to Turkey, Syria and potentially other countries in Eastern Europe.

- The funds were then suspected of being used to support the proliferation of WMDs and their means of delivery.

- There is a realistic possibility that if the hotel were to be purchased by Client B, the income derived from the hotel may, in turn, be used for Proliferation Financing (PF) / Terrorist Financing (TF) / Money Laundering (ML) purposes.

Suspicious Activity:

- This is an offer to purchase a hotel in the UK for a significant sum of money through a recently incorporated UK company with no trading history.

- Client B was unable to provide a sufficient Source of Wealth (SoW), and open-source checks were unable to independently corroborate his wealth.

- Checks on Companies House in the UK revealed that Client B was linked to a number of recently incorporated companies, of which he was the sole director, most of which had slight misspellings of his name; the FIU assess that this was done intentionally to obscure his identity.

- It was highly likely that Company X was incorporated as a shell company in a well-regulated jurisdiction to give it a veneer of legitimacy.

Suspicious Indicators:

- High-risk jurisdictions.

- Electronic dual-use goods.

- terrorist links

- The IRGC has been known to use complex financial networks to fund its activities.

Outcomes:

JERSEY

- The Jersey TCSP declined the offer to purchase the hotel, and the sale did not proceed and reported to the JFIU

- ADDED CONTENT:-

- The Jersey-regulated Trust Company Services Provider (TCSP) would report a suspicion to the Jersey Financial Intelligence Unit (JFIU) via a Suspicious Activity Report (SAR), as it is a regulated entity under Jersey's anti-money laundering (AML), counter-terrorist financing (CTF), and counter-proliferation financing (CPF) framework.

- This obligation arises from suspicions identified during due diligence, as detailed in the case study.

- The suspicion encompasses potential

- Proliferation financing (PF)—the primary focus of the typology—which involves

- Sanctions evasion (e.g., links to the sanctioned IRGC Quds Force, Iranian airline, and related activities, including electronics).

- It also includes elements of terrorist financing (TF), due to Client B's alleged role in supporting

- IRGC proxies in Syria and Lebanon, and

- Money laundering (ML),

- Through the use of shell companies, obscured identities, and high-value transactions without a verifiable source of wealth that could legitimise illicit funds for proliferation purposes.

- There was no concern regarding the management of the asset (hotel), with the sellers unaware of the potential source of funding or Client B's background.

LONDON

- Lawyers in the UK acting on behalf of the seller would also have had an obligation to file a SAR with the UK FIU requesting a defence against ML in the UK.

JERSEY TIPPING OFF RISK [added content]

- Unless the JERSEY TCSP and London law firm share a financial group or network structure the Jersey-regulated TCSP CANNOT DIRECTLY TALK to the London law firm about its suspicions under the standard tipping-off exemptions in Jersey law without risking a tipping-off offence, as the London law firm is an entity outside Jersey and does not qualify under the key exemptions for disclosures between relevant persons (Regulation 5 of the Proceeds of Crime and Terrorism (Tipping Off – Exceptions) (Jersey) Regulations 2014)

- However, there are two potential pathways:

- If the disclosure is made specifically to obtain legal advice from the law firm (e.g., as the seller's legal adviser in the transaction) and not to further any criminal purpose, it may be protected under statutory exemptions in Articles 35(2) and (4) of the Proceeds of Crime (Jersey) Law 1999 and Terrorism (Jersey) Law 2002.

- The TCSP can request written permission from the Jersey Financial Crimes Unit (JFCU) under Regulation 2(1)(c) of the Tipping Off Regulations to make the disclosure, which would provide protection if granted [PROTECTED DISCLOSURE]. This is separate from any consent related to proceeding with the transaction.

- All protected disclosures must be made in good faith for the purpose of preventing or detecting money laundering, terrorist financing, or proliferation financing, and must not reveal the identity of the original reporter (e.g., the employee who filed the internal report).

FIU Actions:

- The FIU reviews all submissions and grades and prioritises them as appropriate.

- All FIU staff have a clear understanding and training in proliferation and proliferation financing.

- The FIU conducted further detailed research, assessment, and analysis of the adverse open-source information and engaged with its international partners.

- The FIU will assess the risks associated with PF, identifying potential breaches, non-implementation, or evasion of targeted financial sanctions.

- Enhanced shares have been made to international partner agencies.

- Requests were sent to the TCSP to obtain further information for further analysis.

FIU Comment:

- The lack of transparency in ownership—i.e., property purchases via shell companies obscure the UBO, making it harder to identify illicit funds.

- High-value transactions without a clear financial explanation can indicate links to PF.

- Overseas purchasers: Transactions involving buyers from high-risk jurisdictions subject to sanctions require additional scrutiny to the standard Client Due Diligence (CDD), such as Enhanced Due Diligence (EDD).

- Had the transaction proceeded, the hotel would have potentially generated legitimate income to support Client B's proliferation activities.

Full case study

The full suite of JFIU PF typologies can be accessed from the links below:

▶︎ go.fiu.je/typo19 = ABOVE

▶︎ go.fiu.je/typo18

▶︎ go.fiu.je/typo17

▶︎ go.fiu.je/typo16

▶︎ go.fiu.je/typo15

▶︎ go.fiu.je/typo14

▶︎ go.fiu.je/typo13

▶︎ go.fiu.je/typo12

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.