Sanctions 50% rule – who is a direct and indirect SDN?

18/08/2025

SDN - Specially Designated National – is a term used by the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC)/UK Office of Financial Sanctions Implementation (OFSI) / and the European External Action Service (EEAS) to identify individuals, entities, and organisations that are subject to sanctions. These parties are listed on the SDN List, and U.S./UK/EU persons are generally prohibited from dealing with them.

However, SDNs hide themselves in structures, so you also need to think about the 50% rule.

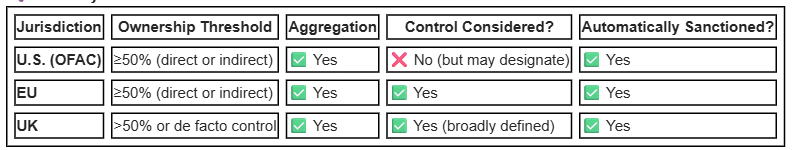

- The "50 Percent Rule" works across the U.S., UK, and EU sanctions regimes when it comes to entities owned or controlled by sanctioned individuals or entities:

United States (OFAC – SDN List)

- Rule: If one or more blocked persons (on the SDN list) own 50% or more of an entity—directly or indirectly and in aggregate—that entity is automatically considered blocked, even if it is not explicitly listed.

- Control alone (without 50% ownership) does not trigger automatic blocking, but OFAC may still designate the entity separately.

- Example: If two SDNs each own 25% of a company, that company is blocked under the rule.

European Union

- Updated Rule (2024): The EU now aligns with the U.S. by applying a "50% or more" ownership threshold for asset freezes.

- Aggregation: Ownership stakes of multiple EU-designated persons are aggregated to determine if the threshold is met.

- Control: The EU also considers control (e.g., dominant influence, board appointment rights, use of front companies) as a basis for sanctions, even if the 50% ownership threshold is not met.

- Effect: Entities meeting these criteria are treated as if they are sanctioned, even if not named in the regulation.

United Kingdom (Post-Brexit OFSI Rules)

- Rule: The UK uses an "owned or controlled" test, modelled loosely on the U.S. 50% rule.

- Ownership: More than 50% of shares or voting rights, or the right to appoint/remove a majority of the board, triggers sanctions.

- Control: The UK goes further by including de facto control, even without legal ownership, if it's reasonable to expect that a sanctioned person can direct the entity’s affairs.

- Challenge: This broader interpretation introduces ambiguity and requires careful due diligence by businesses.

🔍 Summary Table

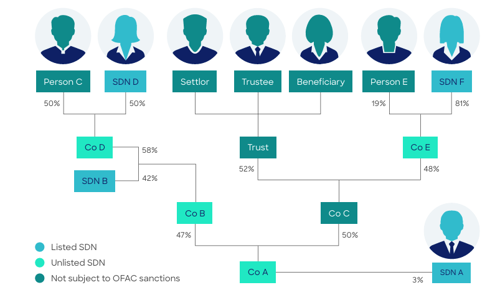

PROBLEM TO SOLVE

The problem to solve is taken from one of the ACAMS Ownership & Control infographics from 2024

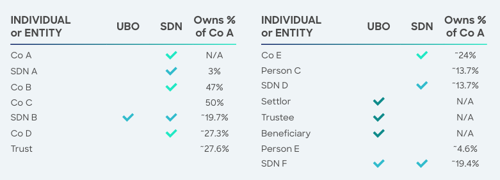

- Company A Ltd (Co A) is registered in Country X, which applies the 15% threshold for identification of beneficial ownership.

- Who are Co A’s beneficial owners?

- Is Co A subject to OFAC sanctions?

- Please note

- SDN A, SDN B, SDN D and SDN F are listed as Specially Designated Nationals List.

The answers are below the following examples that are provided to warm up your analytic skills.

OFAC Examples

- "Indirectly," as used in OFAC’s 50 Percent Rule, refers to one or more blocked persons' ownership of shares of an entity through another entity or entities that are 50 percent or more owned in the aggregate by the blocked person(s).

- OFAC urges persons considering a potential transaction to conduct appropriate due diligence on entities that are party to or involved with the transaction or with which account relationships are maintained to determine the ownership stakes.

TEST

Please take a look at the examples below for further guidance on deciding whether an entity is blocked under OFAC's 50% Rule.

Example 1:

-

- Blocked Person X owns 50 percent of Entity A, and Entity A owns 50 percent of Entity B.

- ENTITY A + B IS CONSIDERED TO BE BLOCKED.

- This is so because

- Blocked Person X owns, indirectly, 50% of Entity B.

- Blocked Person X's 50 percent ownership of Entity A makes Entity A a blocked person.

- Entity A's 50 percent ownership of Entity B, in turn, makes Entity B a blocked person.

Example 2:

-

- Blocked Person X owns 50 percent of Entity A and 50 percent of Entity B. Entities A and B each own 25 percent of Entity C.

- Entity A+B+C is considered to be blocked.

- This is so because,

- Through its 50 percent ownership of Entity A, Blocked Person X is supposed to indirectly own 25 percent of Entity C; and

- Through its 50 percent ownership of Entity B, Blocked Person X is considered to own another 25 percent of Entity C indirectly.

- When Blocked Person X's indirect ownership of Entity C through Entity A and Entity B is totalled, it equals 50 per cent.

- Entity C is also considered to be blocked due to the 50 per cent aggregate ownership by ENTITIES A AND B, WHICH ARE THEMSELVES BLOCKED entities due to Blocked Person X's 50 per cent ownership of each.

Example 3:

-

- Blocked Person X owns 50 percent of Entity A and 10 percent of Entity B.

- Entity A also owns 40 percent of Entity B.

- ENTITY A+ B IS CONSIDERED TO BE BLOCKED.

- This is so because,

- Through its 50 percent ownership of Entity A, Blocked Person X is supposed to own 40 percent of Entity B indirectly.

- When added to Blocked Person X's direct 10 percent ownership of Entity B, Blocked Person X's total ownership (direct and indirect) of Entity B is 50 percent.

- Entity B is also blocked due to the 50 percent aggregate ownership by Blocked Person X and ENTITY A, WHICH ARE THEMSELVES BOTH BLOCKED PERSONS.

Example 4:

-

- Blocked Person X owns 50 percent of Entity A and 25 percent of Entity B. Entities A and B each own 25 percent of Entity C.

- Entity C IS NOT considered to be blocked = ENTITY A is BLOCKED

- This is so because,

- Even though Blocked Person X is supposed to indirectly own 25 percent of Entity C through its 50 percent ownership of Entity A,

- Entity B is not 50 percent or more owned by Blocked Person X, and therefore Blocked Person X is not considered to indirectly own any of Entity C through its part ownership of Entity B.

- Blocked Person X's total ownership (direct and indirect) of Entity C does not equal or exceed 50 percent.

- Entity A is itself a blocked person, but its ownership of Entity C also does not equal or exceed 50 percent.

Example 5:

-

- Blocked Person X owns 25 percent of Entity A and 25 percent of Entity B.

- Entities A and B each own 50 percent of Entity C.

- Entity C is NOT BLOCKED.

- This is so because

- Blocked Person X's 25 percent ownership of each of Entity A and Entity B falls short of 50 percent.

- Accordingly, neither Entity A nor Entity B is blocked, and Blocked Person X is not considered to indirectly own any of Entity C through its part ownership of Entities A or B.

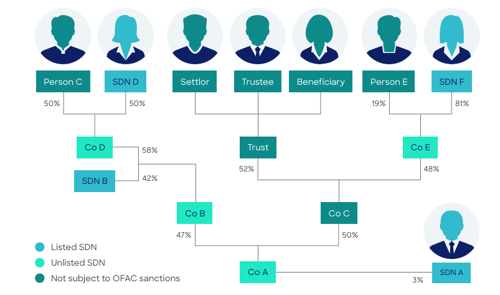

BACK TO THE QUESTION FROM THE TOP

Sources

- https://www.acams.org/en/media/document/38216)

- Date Frequently Asked Questions | Office of Foreign Assets Control https://ofac.treasury.gov/faqs/search/401 -

- https://ofac.treasury.gov/faqs/401 -

- https://ofac.treasury.gov/media/6186/download?inline

- | Office of Foreign Assets Control - https://ofac.treasury.gov/faqs/topic/1521

- EU Updates Sanctions Best Practices, Clarifying Ownership Threshold for ...https://www.skadden.com/insights/publications/2024/09/eu-updates-sanctions-best-practices

- UK Sanctions Post-Brexit: The New ‘Owned Or Controlled’ Rules – Having ...https://elbornes.com/insight/uk-sanctions-post-brexit-the-new-owned-or-controlled-rules-having-problems-interpreting-them/

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.