Swiss Deposit Token Proof of Concept completed

22/09/2025

The Swiss Deposit Token is a regulated, blockchain-based digital representation of Swiss bank deposits, designed to bring programmability and efficiency to traditional banking without creating new forms of money or crypto assets.

- Under the umbrella of the Swiss Bankers Association (SBA), PostFinance, Sygnum Bank, and UBS have conducted a Deposit Token feasibility study.

- The results report published today forms the basis for a standardised infrastructure for blockchain-based financial services in Switzerland.

- For the first time, banks have carried out a legally binding payment across institutions using bank deposits and a public blockchain – a milestone for the entire financial sector.

- Switzerland’s domestic payment system is already very efficient and cost-effective.

- However, it reaches its limits in new applications: traditional payments cannot be programmed, are not available around the clock for larger amounts, and can only be integrated into blockchain-based ecosystems to a limited extent.

- By representing bank deposits on the blockchain, payments could in the future not only be processed immediately and definitively on a shared infrastructure but also be integrated directly into automated business processes.

- Programmable rules (smart contracts) on this infrastructure enable payments to be executed only when certain conditions are met. This minimises risks, increases efficiency, and streamlines complex transactions.

- Such automation unlocks potential for new digital services: in future, customers could benefit from fast, secure, and transparent payment processes – whether in securities trading, the automatic settlement of insurance claims, or machine-to-machine transactions without human interaction.

The token offers

- Universal usability and choice,

- Deployment on a public chain with permissioned access, and

- Legally binding settlement.

Each of the above principles points to inevitable structural requirements for tokenised infrastructure in capital markets:

- Avoiding fragmentation (otherwise, what’s the point?),

- Preserving counterparty choice,

- Balancing transparency with compliance, and

- Giving the market confidence that settlement is legally binding, definitive, and final.

Here’s a summary of the Swiss banking proposal for the Deposit Token:

What is the Deposit Token?

- The Deposit Token is a digital representation of a commercial bank deposit—not a new form of money, but a tokenised version of an existing liability (i.e., Swiss bank deposits).

- It is designed to be a blockchain-based payment instruction under Swiss law, avoiding the complexity of creating new money or crypto assets.

- The token acts as a standardised instruction to debit and credit traditional bank accounts, rather than a claim on a new digital asset.

How Does It Work?

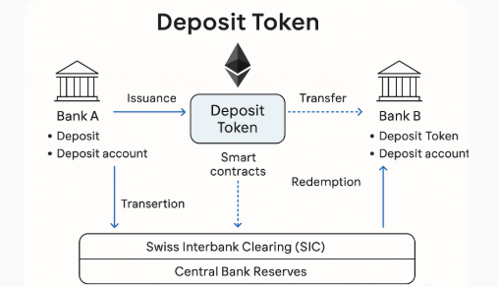

- The Deposit Token is issued and redeemed by banks, with each token fully backed by a corresponding deposit in a traditional bank account.

- Transactions are executed on a public blockchain (with permissioned access), but settlement occurs off-chain via the Swiss Interbank Clearing (SIC) system.

- Smart contracts are used to automate and verify payment processes, enabling programmable, conditional, and cross-bank transactions.

- All transactions are subject to AML, CTF, and sanctions screening, ensuring compliance with Swiss regulations.

Key Features

- Not a stablecoin: Unlike stablecoins, which often represent new digital money or assets, the Deposit Token is a direct digital mirror of existing bank deposits.

- Programmable payments: Enables automated, conditional payments (e.g., escrow, settlement of tokenised assets, machine-to-machine payments).

- Interoperability: Supports transactions across multiple banks using a shared smart contract infrastructure.

- Legal clarity: Structured as a payment instruction, not a security or crypto asset, simplifying legal and regulatory treatment.

Benefits

- Faster, programmable payments: Real-time, automated settlement for complex transactions.

- Transparency and auditability: All transactions are recorded on-chain, with full audit trails.

- Integration with digital assets: Can be used to settle tokenised securities or other digital assets.

- Maintains traditional banking integrity: Does not disrupt the existing banking model, but enhances it with blockchain capabilities.

Limitations & Next Steps

- The current model relies on off-chain banking infrastructure and does not yet integrate fully with core banking systems.

- Future development aims to create native deposit tokens with on-chain master records for greater transparency and efficiency.

In summary:The Swiss Deposit Token is a regulated, blockchain-based digital representation of Swiss bank deposits, designed to bring programmability and efficiency to traditional banking without creating new forms of money or crypto assets.

References

- The Deposit Token https://www.swissbanking.ch/_Resources/Persistent/7/9/e/a/79ea024daa9834c99fc299db5d5f69c4317525a2/20250916_Ergebnisbericht%20PoC%20Deposit%20Token_EN_FINAL.pdf

- Milestone for the Swiss financial centre: Deposit Token Proof of ...https://www.sygnum.com/news/milestone-for-the-swiss-financial-center-deposit-token-proof-of-concept-successfully-completed/

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.