The FCA Highlights the Financial Sector’s Climate Readiness Crisis

21/02/2025

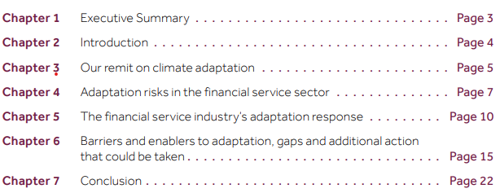

Earlier this month, the FCA published a brief report highlighting the critical challenges and opportunities for financial services, particularly banks and insurers, in the face of climate change.

https://www.fca.org.uk/publication/corporate/fca-adaptation-report-2025.pdf

FCA OVERVIEW

- The FCA suggest a key concern is the industry's struggle with the quality and completeness of data and modelling, which hampers the ability to quantify and manage climate risks effectively. This limitation affects risk assessment and decision-making processes, potentially leading to inadequate responses to emerging climate threats.

- The report identified barriers to insurance underwriting for climate risks, which, in turn, influence lending and investment decisions. These obstacles can restrict the industry's capacity to support clients in adapting to climate impacts, affecting overall financial stability.

- The FCA also emphasised the importance of allocating capital toward adaptation efforts. Financial institutions play a pivotal role in directing investments to initiatives that bolster resilience against climate change. However, current capital allocation often falls short of supporting necessary adaptation measures.

THE RISKS OF INACTION

- Failing to integrate adaptation measures into financial decision-making poses significant risks to banks and insurers. These include:

- Credit & market risk: Banks exposed to sectors vulnerable to climate impacts may face increased loan defaults, declining asset values, and higher risk-weighted capital requirements. Real estate, agriculture, and energy-intensive industries are particularly at risk.

- Underwriting & liability risk: Insurers that fail to account for climate risks correctly may see increasing claims payouts, rising reinsurance costs, and the potential uninsurability of entire markets. Mispricing risks today could result in significant financial losses tomorrow.

- Regulatory & compliance risk: With regulators intensifying their scrutiny of climate risk management, firms that do not adapt may face enforcement action, capital add-ons, or restrictions on business activities. The FCA’s findings align with broader UK and global regulatory efforts, such as the Bank of England’s climate stress tests and the Task Force on Climate-related Financial Disclosures (TCFD).

- Reputational risk: As public and investor expectations shift, firms that are perceived as failing to act on climate adaptation may suffer from brand damage, reduced customer trust, and potential legal challenges over greenwashing.

- Systemic financial risk: If financial institutions do not adequately account for climate adaptation, systemic instability could emerge, leading to cascading financial losses and undermining confidence in the broader market.

TRANSITION PLANS.

- The World Benchmarking Alliance's 2025 Financial System Benchmark parallel revealed that 3% of financial institutions have established transition plans.

- https://www.worldbenchmarkingalliance.org/publication/financial-system/#:~:text=The%202025%20benchmark%20shows%20that,processes%20to%20drive%20real%20change.

- This alarming statistic underscores a widespread lack of preparedness in navigating the shift to a low-carbon economy. Many firms struggle with clear frameworks, scope three emissions assessments, and short-term financial pressures.

KEY QUESTIONS FOR FIRMS

- Given these insights, banks and insurers must reflect on their strategies and operations. Key questions for management to consider include:

- Data and Risk Management: How robust are our current data and modelling frameworks in assessing climate-related risks? What steps can we take to enhance our capabilities in this area?

- Underwriting and Investment: Are we effectively identifying and mitigating barriers in underwriting and investment processes that hinder support for climate adaptation? How can we adjust our policies to facilitate resilience-building initiatives better?

- Capital Allocation: To what extent do we direct capital toward projects and sectors promoting climate adaptation? What criteria do we use to evaluate such investments, and how might we improve them?

- Transition Planning: Do we have a comprehensive transition plan to move toward a low-carbon economy? If not, what are the obstacles, and how can we overcome them to develop and implement such a plan?

FROM COMPLIANCE TO COMPETITIVE ADVANTAGE

- Financial institutions have a critical role in facilitating climate adaptation. Banks must integrate climate risks into lending criteria and incentivise greener investments. At the same time, insurers should price climate risks accurately and develop innovative products such as parametric insurance for extreme weather events.

- To move beyond regulatory compliance, financial institutions should view climate adaptation as a business opportunity. Leveraging existing frameworks and resources (like the

- Glasgow Financial Alliance for Net Zero (GFANZ) https://www.gfanzero.com/our-work/financial-institution-net-zero-transition-plans/

- The UK’s Transition Plan Taskforce (TPT)) https://www.ifrs.org/sustainability/knowledge-hub/transition-plan-taskforce-resources/

- Can help them build credible transition plans. Addressing these challenges today will ensure resilience and long-term success in an increasingly climate-conscious world.

Source

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.