The Jersey Government launches a 10-year plan in its Financial Services Competitiveness Programme.

22/04/2025

On 22 April 2025, the Government of Jersey published its Financial Services Competitiveness Programme on its website. This major strategic initiative aims to strengthen Jersey's position as a globally attractive and forward-looking International Finance Centre (IFC).

The programme aims to strengthen Jersey's position as a leading International Finance Centre (IFC) and improve the competitiveness of Jersey's FRPS sector by maintaining the existing base and enhancing growth prospects over the next 10 years.

This comprehensive programme

- Is designed to support and enhance Jersey's financial and related professional services (FRPS) sector, which is the Island's largest employer and the most significant contributor to tax revenues that fund public services.

- It brings together several government departments, the Jersey Financial Services Commission (JFSC), Jersey Finance, Digital Jersey, and representatives from across the financial and professional services industry.

The Financial Services Competitiveness Programme

- Will deliver clear, actionable recommendations to improve Jersey's regulatory and business environment, enhance its global positioning, and prepare the sector for future opportunities and challenges.

- Is governed by a Ministerial Working Group, chaired by the Minister for External Relations, responsible for Financial Services, Deputy Ian Gorst. The Chief Executive Officer, Dr Andrew McLaughlin, acts as the Senior Responsible Officer. A cross-government team of officials will support them.

Programme structure and key workstreams

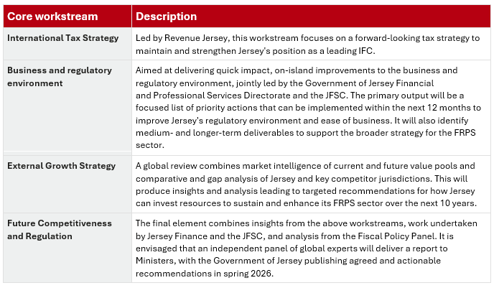

The programme is built around four core workstreams, which will be managed in a phased approach.

- International Tax Strategy—Led by Revenue Jersey, this strategy will focus on maintaining Jersey's strong position through a forward-looking tax policy.

- Business & Regulatory Environment – Led jointly by the Government and the JFSC, this aims to improve the ease of doing business, delivering quick-win reforms and medium- and long-term changes to enhance the Island's appeal to global investors.

- External Growth Strategy – A global market analysis to inform Jersey's external engagement strategy, identifying future value pools and Jersey's competitive positioning, led by the Government with expert support from Jersey Finance Ltd.

- Future Competitiveness & Regulation—This phase will combine insights from all workstreams and culminate in a report by an independent panel of global experts.

The first phase, already underway, will focus on improvements to Jersey's business and regulatory environment.

- This will involve making positive changes to improve the ease of doing business and to help maintain and grow the Island's FRPS sector as it competes in the market today.

- < UNK> Recent global economic volatility has demonstrated that it is more important than ever that Jersey invests in optimising its business and regulatory environment to increase its competitive edge.

In spring 2026, the government will publish a report on progress in delivering the programme and an action plan on the next steps.

Industry engagement

The Government will engage regularly with stakeholders through:

- Industry events and “roundtable" discussions

- Updates at Financial Services Advisory Board meetings

- Briefings for State Members and Scrutiny Panels

- Ongoing consultation and feedback channels

More information is available on the Government of Jersey website: Financial services competitiveness programme, and is also shown below.

Financial Services Competitiveness Programme

The programme aims to strengthen Jersey's position as a leading International Finance Centre (IFC) and improve the competitiveness of Jersey's FRPS sector by maintaining the existing base and enhancing growth prospects over the next 10 years.

Jersey's financial and related professional services (FRPS) sector is a key growth engine of the Island's economy. It employs the largest number of Islanders and makes the biggest contribution to the tax revenues that fund our public services. Protecting and promoting our FRPS sector is, therefore, of vital importance.

The focus will be on government, industry, and the regulator working together, supported by expert analysis, to produce clear and implementable recommendations and actions to optimise Jersey's regulatory and business environment and position the Island's FRPS sector for long-term growth.

The programme is a collaborative effort involving teams across the Government of Jersey departments, including Revenue Jersey, Financial and Professional Services, Economy, and External Relations, together with Jersey Finance, the Jersey Financial Services Commission (JFSC), Digital Jersey, and industry representatives.

The programme is overseen by a ministerial working group, chaired by the Minister for External Relations. The Chief Executive Officer is the Senior Responsible Officer for the programme, supported by a cross-government team of officials.

By engaging with a broad range of stakeholders on and off the Island, the programme's actionable recommendations will help maintain and grow Jersey's valuable financial and related professional services sector as it competes in the market today, and invest in the industry's future growth. In turn, the programme should galvanise stakeholders on and off the Island, with renewed confidence in the future, enhanced clarity on how to position for success, and stronger relationships at all levels between government, industry and regulator.

The outputs of this programme will determine future activities and guide any future investment, including funding allocated in the agreed 2025 to 2028 Budget to boost the productivity, digital capacity, and skills of the financial services sector and the broader economy.

Jersey's position as an International Finance Centre (IFC)

Jersey has been a leading IFC for over 60 years, built on political and economic stability, robust regulation, and proactive industry development.

With deep pools of talent from our expert financial services workforce, a robust and reliable legal framework, and an attractive and stable tax environment, Jersey is at the forefront of banking, corporate services, funds, investment management, private wealth, and the specialist areas of Islamic finance and philanthropy.

Today's financial and related professional services sector is the cornerstone of Jersey's economy, directly employing almost 14,000 people and accounting for 40% of economic activity. It plays a pivotal role in fostering economic prosperity, generating employment, and enhancing the quality of life for all Islanders.

Measuring Jersey's economy GDP and GVA https://www.gov.je/SiteCollectionDocuments/Government and administration/GDP and GVA 2023.pdf

Keeping Jersey's financial services competitive.

Jersey's FRPS sector operates in a highly competitive, global environment. Jersey has a long track record of being agile and adapting to new trends and innovations in products and services. All financial centres must continuously invest in the future to remain competitive. Recent global shifts, including:

- Economic changes

- The evolving tax policy landscape

- Regulatory developments

- Technological advancements

- Brexit

- Post-pandemic recovery

This requires a refreshed strategy demonstrating Jersey's commitment to increasing its competitive edge and creating an environment for new opportunities.

Key Objectives

- Strengthen Jersey's position as a leading IFC

- Provide insights to sustain and expand the industry

- Improve collaboration between the government, the regulator, and the industry

- Implement clear, measurable actions for long-term success

The programme is structured around four core workstreams:

The programme is closely linked to complementary activities undertaken by Jersey Finance (Vision2050) and the JFSC (registry review and strategic review).

Representatives from Jersey Finance and the JFSC are integral to the Competitiveness Programme Team and will ensure alignment.

Programme updates

Industry workshops with industry representatives under workstream two have already begun. Initial feedback from the industry has been very positive, and an initial report is expected by early summer.

Activity under workstream three will begin imminently.

A series of stakeholder engagements will facilitate transparent communication and foster informed discussions. These engagements will take place through various platforms, including:

- Industry events to provide insights and updates

- Regular updates at the Financial Services Advisory Board (FSAB) meetings

- Ministerial speeches highlighting key developments and strategic direction

Dedicated briefings for State Members and private Scrutiny briefings will also be scheduled to keep policymakers informed.

The programme team welcomes any engagement from stakeholders. Contact growthfs@gov.je.

RELATED WORK UNDERTAKEN BY JERSEY FINANCE AND THE JERSEY FINANCIAL SERVICES COMMISSION

Jersey Finance - Vision2050

Through its Vision2050 workstream, Jersey Finance is working closely with industry leaders and stakeholders to drive key priorities that will ensure the continued success of Jersey as a thriving International Finance Centre. Focused on talent development, innovation in our toolkit, leveraging technology, and enhancing collaboration, these efforts are crucial to ensuring a flourishing and sustainable financial services ecosystem.

- Talent: become a talent magnet: Jersey will be a talent magnet, attracting from outside and within skilled future generations, which is essential for its success as a global finance hub. We will put people at the heart of our strategy; retain, attract and close gaps. Where the next generation chooses to live, work and thrive

- Toolkit: keep proposition fresh and relevant: Jersey will deliver products and services that address market and societal needs, keeping the proposition fresh and relevant. This will include evolving current regulation and legislation, and innovating in new areas

- Technology: leverage tech as a force multiplier: Jersey will have a technology-enabled global finance industry, utilising best-in-class digital infrastructure to deliver exceptional client service safely and securely. We will embrace technology to create ideas that reduce the cost of doing business, increase process efficiency and workforce capacity

- Together: inspire Jersey to embrace its finance industry. Jersey's reputation will be unquestioned by those we want as clients and users of our industry, as well as our home community, which will feel proud of Jersey's status as a global IFC and appreciate its benefits in the local economy.

Jersey Financial Services Commission (JFSC)

- Registry Strategic Review

- On 17 March 2025, the JFSC appointed an independent third party to conduct a strategic review of the Registry.

- This review is a strategic priority and considers the effectiveness of the JFSC's current approach to the Registry's operational procedures and the longer-term scope of the Registry function to ensure it is future-ready regarding technology, innovation and integration. The JFSC commenced its strategic review with stakeholder engagement, including relevant trade bodies.

- The Board of Commissioners will consider the independent third-party report in late June 2025.

- JFSC Strategic Review

- With the JFSC approaching the end of its current strategy period, work has commenced on developing a new strategy for 2026+.

- The JFSC is aligned with Jersey's growth and competitiveness aims and ambitions, working closely with the Government of Jersey and other key stakeholders.

- The Board of Commissioners will consider a draft JFSC 2026+ strategy in late June 2025.

Source

- https://www.gov.je/News/2025/Pages/FinancialServicesCompetitivenessProgramme.aspx

- https://www.gov.je/Industry/Finance/Pages/FinancialServicesCompetitivenessProgramme.aspx

Stakeholders are encouraged to engage with the programme team via growthfs@gov.je.

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.