The Jersey government's “Civil Financial Penalties Regime” consultation is open

18/12/2025

Following the Minister for External Relations and Financial Services announcement of their intention to consult on potential changes to the civil financial penalties regime, under the Financial Services Commission (Jersey) Law 1998, the JFSC stated on 25 November:-

- To ensure fairness for parties currently undergoing a sanction process where civil financial penalties are being considered, the JFSC will pause progressing these cases until there is clarity on any proposed changes and

- The JFSC will also consult on updates to our published methodology, reflecting our experience of applying the current approach over the past three years.

Following this JFSC update, the Jersey government issued its consultation yesterday.

- The Jersey government wants your views on proposed changes to the maximum penalties that may be imposed on a registered person in Jersey under a Financial Services Commission (Financial Penalties) (Jersey) Order 2015.

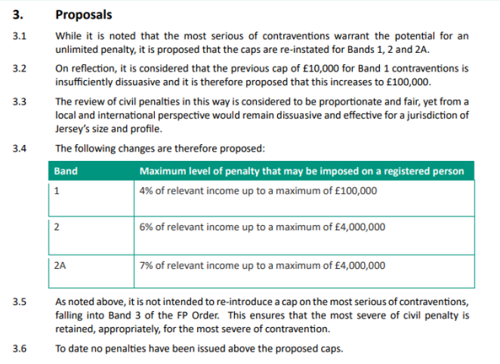

Feedback is sought on three proposals:

- To increase the cap of £100,000 for Band 1 contraventions

- To restore a cap of £4m for Band 2 and 2A contraventions

- To retain the current position of there being no cap for the most serious contraventions, which fall under Band 3

Key extracts from the consultation follow:-

These proposals aim to ensure Jersey remains compliant with the Financial Action Task Force's recommendations, which require implementing a range of effective, dissuasive, and proportionate sanctions.

How to submit comments to the consultation –

- You can respond to this consultation by email to growthfs@gov.je, or by post, to:

FAO Miguel Zaragoza, Department for the Economy

Government of Jersey

Union Street

St Helier

JE2 3DN

Sources

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.