Trade-Based Money Laundering Trends and Developments

15/08/2024

In 2020 the Egmont Group and the Financial Action Task Force (FATF) have published a report on this topic titled "FATF/Egmont Trade-based Money Laundering: Trends and Developments”.

The report

- Discusses how international trade networks can attract criminals and terrorist financiers who exploit the interconnected supply chains to launder the proceeds of crime or finance terrorism.

- It explains how criminals exploit trade transactions to move money rather than goods.

- Highlights recommendations to address the risks of trade-based money laundering. These include using national risk assessments and other risk-focused material to raise awareness among the public and private sector entities involved in international trade.

Given the diversity of tradable goods, the involvement of multiple parties, and the speed of trade transactions, trade-based money laundering remains a significant risk. This report aims to help the public and private sectors understand these risks so that they can take action when they occur.

Egmont also highlights cases in its case study [2014-2020] publication https://egmontgroup.org/wp-content/uploads/2022/01/2021-Financial.Analysis.Cases_.2014-2020-3.pdf

The report

- Discusses how international trade networks can attract criminals and terrorist financiers who exploit the interconnected supply chains to launder the proceeds of crime or finance terrorism.

- It explains how criminals exploit trade transactions to move money rather than goods.

- Highlights recommendations to address the risks of trade-based money laundering. These include using national risk assessments and other risk-focused material to raise awareness among the public and private sector entities involved in international trade.

Given the diversity of tradable goods, the involvement of multiple parties, and the speed of trade transactions, trade-based money laundering remains a significant risk. This report aims to help the public and private sectors understand these risks so that they can take action when they occur.

Egmont also highlights cases in its case study [2014-2020] publication https://egmontgroup.org/wp-content/uploads/2022/01/2021-Financial.Analysis.Cases_.2014-2020-3.pdf

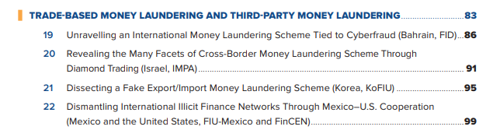

Also as shown in the attached key feature document are the following examples

SOURCE

(1) FATF/Egmont Trade-based Money Laundering: Trends and Developments. https://www.fatf-gafi.org/en/publications/Methodsandtrends/Trade-based-money-laundering-trends-and-developments.html

(2) BEST EGMONT CASES - Egmont Group of Financial Intelligence Units. https://egmontgroup.org/wp-content/uploads/2022/01/2021-Financial.Analysis.Cases_.2014-2020-3.pdf

(3) Publication of the Joint EG-FATF Trade-Based Money Laundering Report .... https://egmontgroup.org/news/publication-of-the-joint-eg-fatf-trade-based-money-laundering-report/

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.