UK directors are exceptional—some are 123 years or older, and one is a son of God.

31/10/2024

Moody's Analytics discovered [Jan 2024] that over 2,200 shell companies have directors aged 123 years or older, even though the oldest known person lived to be 122. One of the directors mentioned is said to be 942 years old, which means he would have been born in the 11th century.

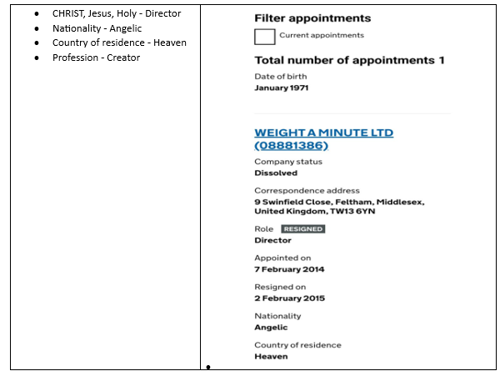

Also, we have Jesus.

Moody's Analytics report

- identified 21 million "red flags" associated with 472 million shell companies it examined.

- These "red flags" serve as a signal that a specific company may be used for financial crimes.

- Unusual individuals appointed as directors are just one of the seven key behaviours highlighted in Moody's Analytics study as typical "red flags" associated with shell companies, allowing for recognition of their involvement in suspicious activities.

Shell companies do not conduct or engage in minimal business activities. Sometimes, they can serve helpful trade functions. However, they can also be abused for aggressive tax planning or tax evasion purposes

So, with all of the above, the EU wants to Unshell-shell companies.

Unshell” Proposal:

The European Parliament has been actively working on the “Unshell” regulations, which aim to prevent the misuse of shell companies for tax evasion and aggressive tax planning. These regulations are part of a broader effort to ensure fair and effective taxation within the EU.

Key Points of the “Unshell” Proposal:

- Substance Requirements: The proposal introduces a filtering system for EU company entities. Companies must pass a series of gateways related to income, staff, and premises to prove they have sufficient economic substance

- Presumption of Shell Status: Entities that fail to meet these substance requirements are presumed to be shell companies. They must provide additional evidence to rebut this presumption by demonstrating a commercial, non-tax rationale for their structure

- Loss of Tax Advantages: Shell companies that cannot rebut the presumption will lose any tax advantages granted through bilateral tax treaties or EU directives

- Enhanced Transparency: The regulations aim to increase transparency and data sharing among EU member states to identify better and combat the use of shell companies for illicit purposes

Legislative Process:

- The European Commission presented the directive in December 2021.

- The European Parliament adopted a non-binding report in January 2023.

- Negotiations in the Council are ongoing, requiring unanimity for adoption

These measures are designed to close loopholes and ensure that companies operating within the EU contribute their fair share of taxes, thereby supporting sustainable public finances.

Source

- https://markets.businessinsider.com/news/stocks/business-fraud-moodys-red-flags-investors-ratings-outlook-economy-markets-2024-1

- https://www.moodys.com/web/en/us/about/insights/data-stories/kyc-innovation-shell-company-indicator.html

- 'Unshell': Rules to prevent the misuse of shell entities for tax .... https://www.europarl.europa.eu/thinktank/en/document/EPRS_BRI%282022%29733648.

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.