Understanding who meets the threshold of Senior management in a Jersey JFSC-regulated/supervised firm.

29/10/2024

The Jersey Financial Services Commission (JFSC) defines a “senior manager” within supervised firms in Jersey.

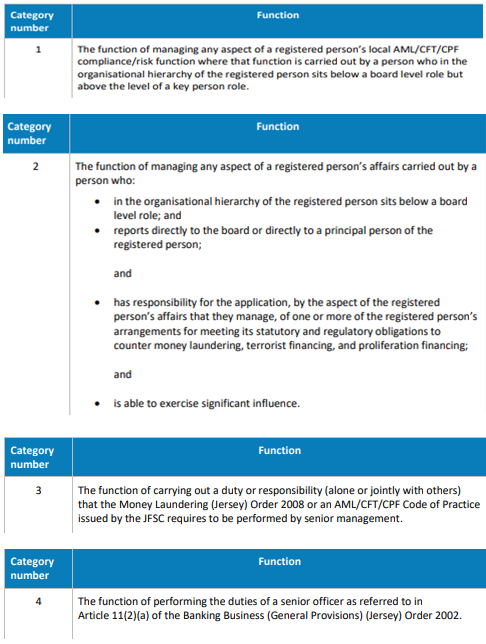

According to Article 1(1) of the Financial Services Commission (Jersey) Law 1998, a SENIOR MANAGEMENT FUNCTION requires the individual to manage one or more aspects of the registered person’s affairs. These aspects must involve, or potentially involve, a risk of severe consequences for the registered person, business, or other interests in Jersey.

This definition includes making decisions or deciding how these aspects should be carried out. The JFSC has designated specific functions as SENIOR MANAGEMENT FUNCTIONS, which include roles related to compliance with anti-money laundering (AML), countering the financing of terrorism (CFT), and countering proliferation financing (CPF), among other codes.

To assist in understanding the definition, the JFSC has issued a Notice designating “SENIOR MANAGEMENT FUNCTIONS. “This notice is issued by the Jersey Financial Services Commission (“the JFSC”) under Article 1(1) of the Financial Services Commission (Jersey) Law 1998 (“the Commission Law”).

In support of the notice, the JFSC has created four categories of senior manager

In addition to the above, there is another definition to grapple with.

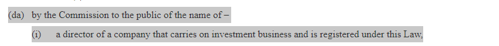

For investment businesses, “senior management” is individuals captured by Article 38(1)(da)(i) and (da)(ii) of the Financial Services (Jersey) Law 1998 [FSJL].

Source:- https://www.jerseylaw.je/laws/current/Pages/13.225.aspx

The definition is limited to those persons who are resident in Jersey or those who, though resident outside of Jersey, form part of the Registered Person’s span of control.

In support of the above, the JFSC has issued the following definition.

Source:- https://www.jerseyfsc.org/media/3604/gn-submission-ie-and-sm-details.pdf

Further to the above, the JFSC then adds to its codes of practice.

- Depending on the circumstances of the registered person, the JFSC may permit the inclusion of an individual actively involved in the day-to-day management of the business (A SENIOR MANAGER) when considering the REGULATORY SPAN OF CONTROL.

- In this scenario, the JFSC will consider the fitness and propriety of senior managers using the procedure established for considering principal persons and key persons.

https://www.jerseyfsc.org/industry/codes-of-practice/investment-business-code-of-practice/

Finally, there is the SPAN OF CONTROL.

The span of control is a term used to describe individuals with day-to-day control and oversight of regulated business operations in Jersey.

For some financial services businesses, the JFSC has detailed the minimum number of individuals that the JFSC consider necessary for the applicant to demonstrate adequate structure and organisation in the Codes of Practice.

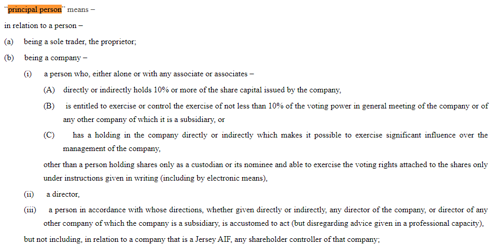

In most cases, the span of control will comprise individuals that meet the definition of a Principal Person. In the FSJL, the following is the definition in article 1-

SOURCE:- https://www.jerseylaw.je/laws/current/Pages/13.225.aspx

However, there are circumstances where this will not be the case, most notably where the regulated business operates in Jersey as a branch of a company incorporated in another jurisdiction.

In the limited circumstances where the span of control requirements will not be, or are not, met by individuals that are Principal Persons, the JFSC may assess an individual for the applicant meeting the structure and organisation element of the fit and proper test. This assessment is conducted via the no-objection process.

The JFSC has issued some guidance on these matters here:-

![]()

SOURCE- https://www.jerseyfsc.org/industry/myprofile/why-you-need-to-apply-for-a-no-objection/

CLOSE

If you are unclear about the senior management regime, let Comsure assist.

Contact:- mathew@comsuregroup.com

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.