VASP Regulation in Jersey and Mauritius – Is Mauritius leading the way?

28/09/2025

This briefing provides a comparative overview of the regulatory frameworks governing Virtual Asset Service Providers (VASPs) in Jersey and Mauritius.

It focuses on:

- Anti-Money Laundering and Counter-Terrorist Financing (AML/CFT),

- Prudential rules and,

- Conduct of business rules.

Jersey

- Regulator: Jersey Financial Services Commission (JFSC).

- Legal Framework: Proceeds of Crime (Jersey) Law 1999 and related Orders.

- Scope: VASPs must register for AML/CFT supervision. Activities include exchange, transfer, safekeeping, and ICO participation.

- Key Features:- AML/CFT supervision only:

- No prudential or conduct of business regulation unless dual-licensed.

- No capital requirements.

- Physical presence not required.

- Limited consumer protection.

- Risk Assessment: Medium-High ML/TF/PF risk; small number of registered VASPs.

Jersey has conducted a dedicated National Risk Assessment (NRA) for Virtual Asset Service Providers (VASPs), most recently updated in May 2024.

Jersey VASP National Risk Assessment (2024)

Overview:

- The NRA assesses money laundering (ML), terrorist financing (TF), and proliferation financing (PF) risks associated with virtual assets and VASPs.

- It builds on a 2022 risk overview, which was limited due to the small size of the sector at the time.

- The Proceeds of Crime (Amendment No. 6) (Jersey) Law 2022 brought VASPs fully within the scope of AML/CFT/CPF regulation, enabling the JFSC to collect relevant data[1][2].

Key Findings:

- ML/TF/PF threat and inherent vulnerability of VA/VASP activity in Jersey is assessed as Medium-High.

- Existing mitigation measures are assessed as Medium.

- The sector remains small but evolving from 3 registered VASPs in 2022 to 14 by September 2025. https://www.jerseyfsc.org/industry/vasp-entities/

- Jersey’s conservative approach has helped mitigate risk but may have limited a deeper understanding of the sector’s evolving threats[3].

Next Steps:

- Several residual risks have been identified.

- Recommended actions include:

- Enhancing sector knowledge.

- Improving oversight and control.

- Integrating actions into the National Action Plan.

- Strengthening coordination through the National Financial Crime Policy and Strategy Cooperation Structure.

Mauritius:

- Regulator: Financial Services Commission (FSC).

- Legal Framework: Virtual Asset and Initial Token Offering Services (VAITOS) Act 2021.

- Scope: Full licensing regime for VASPs and ITO issuers operating in or from Mauritius.

- Key Features:- AML/CFT supervision:

- Prudential regulation, including capital requirements.

- Conduct of business rules, including governance and consumer protection.

- Physical presence required (local office, resident directors, MLRO, Compliance Officer).

- Ongoing supervision and enforcement.

Mauritius has undertaken a dedicated National Risk Assessment (NRA) focused on Virtual Assets (VAs) and Virtual Asset Service Providers (VASPs).

Mauritius VASP NRA Overview

- Title: Mauritius Money Laundering/Terrorist Financing Risk Assessment of Virtual Assets and Virtual Asset Service Providers.

- Published: February 2022.

- Purpose: To identify, assess, and understand the money laundering (ML) and terrorist financing (TF) risks associated with VAs and VASPs.

- Drivers:

- Alignment with FATF Recommendation 15.

- Support for the enactment of the VAITOS Act 2021.

- Strengthening AML/CFT controls in response to emerging technologies[1]

Key Findings and Impacts:

- The NRA highlighted inherent vulnerabilities in the virtual asset ecosystem, including:

- Cross-border nature of transactions.

- Anonymity and speed of transfers.

- Limited awareness among traditional financial institutions.

- It provided a foundation for:

- Licensing and supervision of VASPs.

- Risk-based AML/CFT controls.

- Inter-agency coordination and capacity building.

Strategic Importance:

- The NRA was instrumental in Mauritius being delisted from the FATF “grey list” in October 2021.

- It demonstrated the jurisdiction’s commitment to proactive risk management and international compliance.

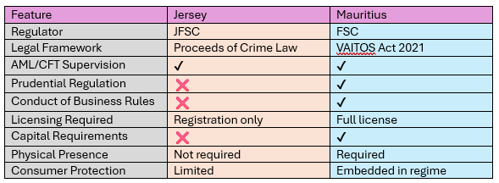

Summary Comparison:

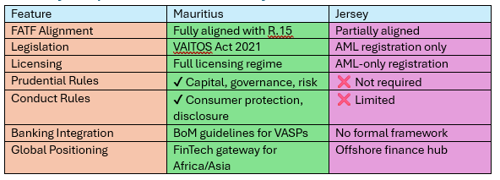

Why Mauritius has stronger VASP Regulation than Jersey?

This briefing outlines the key reasons why Mauritius has adopted a more comprehensive regulatory framework for Virtual Asset Service Providers (VASPs) compared to Jersey. It focuses on international drivers, including FATF compliance, the OECD's Crypto-Asset Reporting Framework (CARF), FinTech strategy, and banking sector integration.

- FATF Compliance and Reputation Management:

- Mauritius undertook significant reforms to exit the FATF grey list, including enacting the VAITOS Act 2021 and implementing robust AML/CFT supervision for VASPs. These reforms helped Mauritius achieve compliance or near-compliance with 39 of the 40 FATF Recommendations. Jersey, while aligned with FATF standards, has limited its VASP oversight to AML registration without full prudential or conduct regulation.

- OECD's Crypto-Asset Reporting Framework (CARF):

- Mauritius is a signatory to CARF, committing to tax transparency and cross-border reporting for crypto transactions. This includes KYC, beneficial ownership disclosure, and transaction reporting. Jersey is also a signatory but has not yet implemented a comprehensive framework to support CARF obligations.

- Strategic Positioning as a FinTech Hub:

- Mauritius aims to be a regional FinTech gateway for Africa and Asia. It has launched a regulatory sandbox, offering a business-friendly environment with legal and tax advantages. Jersey, while a well-established offshore financial centre, has not prioritised FinTech development to the same extent.

- Banking Sector Integration:

- The Bank of Mauritius has issued guidelines to support banking relationships with VASPs, including enhanced due diligence and cybersecurity standards. Jersey lacks a formal framework for banking integration with VASPs, limiting institutional trust and financial system alignment.

Summary Comparison: Mauritius vs Jersey:

References:

- MAURITIUS MONEY LAUNDERING/TERRORIST FINANCING RISK ASSESSMENT OF ...https://www.fscmauritius.org/media/123445/the-mauritius-money-launderingterrorist-financing-risk-assessment-of-virtual-assets-and-virtual-asset-service-providers-public-report.pdf

- https://mauritiusifc.mu/aml-cft/compliance-fatf-recommendations

- Virtual Asset Service Providers National Risk Assessment (2024) https://www.gov.je/Industry/Finance/FinancialCrime/NationalRiskAssesmnents/Pages/VASPNationalRiskAssessment.aspx

- Bailiwick of Jersey Virtual Asset Service Providers https://www.gov.je/SiteCollectionDocuments/Industry%20and%20finance/R%20Virtual%20Assets%20Service%20Providers%20National%20Risk%20Assessment%20Update%20May%202024.pdf

- JERSEY VASP National Risk Assessment 2024 | Comsure, Jersey https://www.comsuregroup.com/news/jersey-vasp-national-risk-assessment-2024/

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.